137

The carrying amounts of trade receivables, trade payables, other receivables, short-term security deposits, bank deposits with

more than 12 months maturity, capital creditors, dividend receivable, other liabilities (including discount payable) and cash

and cash equivalents including bank balances other than cash and cash equivalents are considered to be the same as their fair

values due to the current and short-term nature of such balances.

The fair values for loans and investment in Preference shares were calculated based on cash flows discounted using a current

lending rate.

The fair values of non-current borrowings are based on discounted cash flows using a current borrowing rate. They are

classified as level 3 fair values in the fair value hierarchy due to the use of unobservable inputs, including own credit risk.

For financial assets and liabilities that are measured at fair value, the carrying amounts are equal to the fair values.

Note 27.8 Financial Risk Management

Risk Management is an integral part of the business practices of the Company. The framework of Risk Management

concentrates on formalising a system to deal with the most relevant risks, building on existing Management practices,

knowledge and structures. With the help of a reputed international consultancy firm, the Company has developed and

implemented a comprehensive Risk Management System to ensure that risks to the continued existence of the Company as a

going concern and to its growth are identified and remedied on a timely basis. While defining and developing the formalised

Risk Management System, leading standards and practices have been considered. The Risk Management System is relevant to

business reality, pragmatic and simple and involves the following:

i) Risk identification and definition: Focused on identifying relevant risks, creating | updating clear definitions to ensure

undisputed understanding along with details of the underlying root causes | contributing factors.

ii) Risk classification: Focused on understanding the various impacts of risks and the level of influence on its root causes. This

involves identifying various processes generating the root causes and clear understanding of risk interrelationships.

iii) Risk assessment and prioritisation: Focused on determining risk priority and risk ownership for critical risks. This involves

assessment of the various impacts taking into consideration risk appetite and existing mitigation controls.

iv) Risk mitigation: Focused on addressing critical risks to restrict their impact(s) to an acceptable level (within the defined risk

appetite). This involves a clear definition of actions, responsibilities and milestones.

v) Risk reporting and monitoring: Focused on providing to the Board and the Audit Committee periodic information on risk

profile evolution and mitigation plans.

a) Management of liquidity risk

The principal sources of liquidity of the Company are cash and cash equivalents, borrowings and the cash flow that is

generated from operations. The Company believes that current cash and cash equivalents, tied up borrowing lines and cash

flow that is generated from operations is sufficient to meet requirements. Accordingly, liquidity risk is perceived to be low.

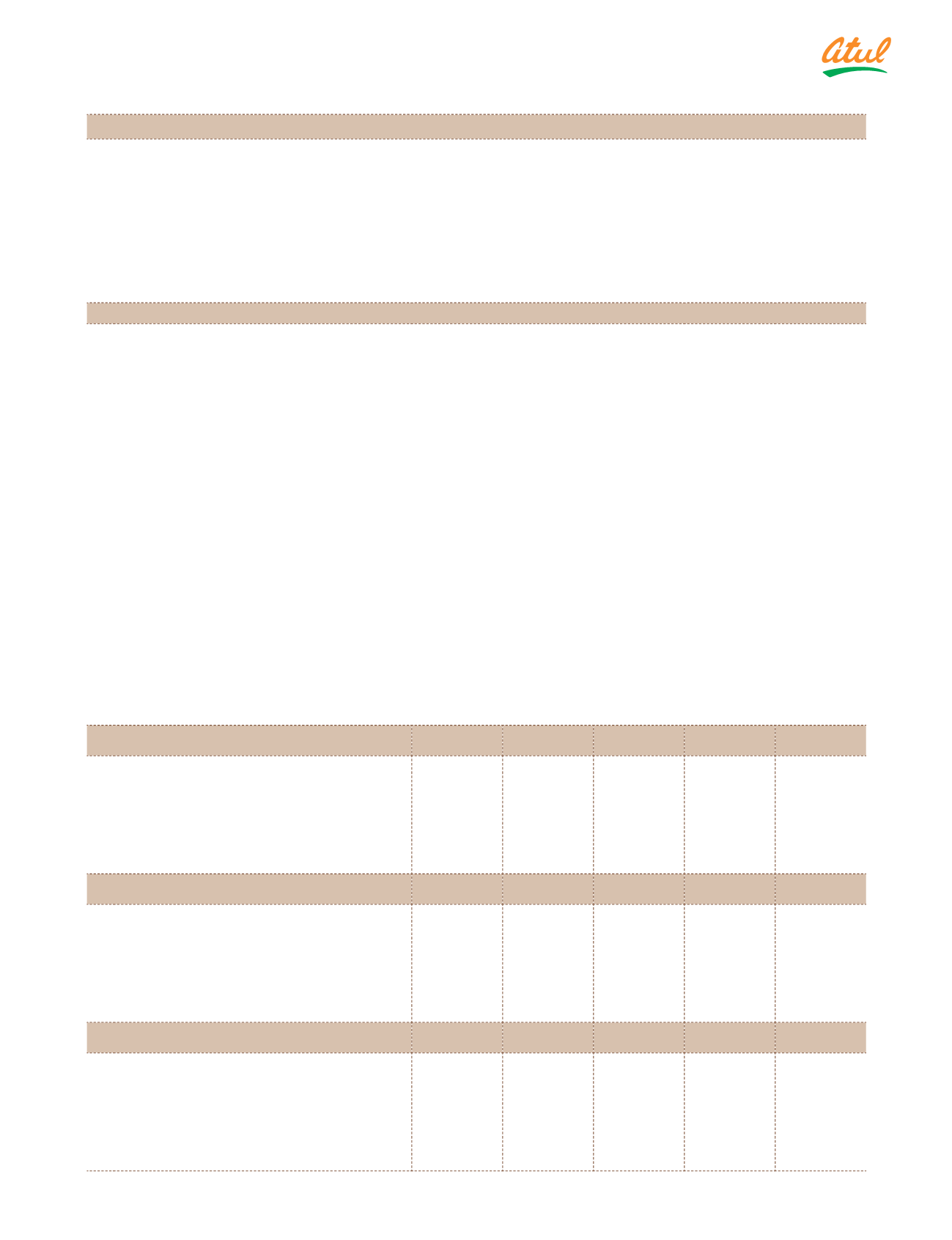

The following table shows the maturity analysis of financial liabilities of the Company based on contractually agreed

undiscounted cash flows as at the Balance Sheet date:

(

`

cr)

As at March 31, 2017

Note

Carrying

amount

Less than

12 months

More than

12 months

Total

Borrowings

15

155.23

155.23

–

155.23

Interest on non-current borrowings

0.46

–

0.46

Trade payables

19

329.06

329.06

–

329.06

Security and other deposits

16

19.30

19.30

–

19.30

Capital creditors

16

18.38

18.38

–

18.38

Other liabilities

16

8.79

8.40

0.39

8.79

Derivatives (settlement on net basis)

2.43

2.43

–

2.43

As at March 31, 2016

Note

Carrying

amount

Less than

12 months

More than

12 months

Total

Borrowings

15

301.67

280.20

21.47

301.67

Interest on non-current borrowings

1.26

0.45

1.71

Trade payables

19

294.19

294.19

–

294.19

Security and other deposits

16

18.51

18.51

–

18.51

Capital creditors

16

17.95

17.95

–

17.95

Other liabilities

16

12.56

11.80

0.76

12.56

Derivatives (settlement on net basis)

1.34

1.34

–

1.34

As at April 01, 2015

Note

Carrying

amount

Less than

12 months

More than

12 months

Total

Borrowings

15

278.66

224.58

54.08

278.66

Interest on non-current borrowings

2.27

1.61

3.88

Trade payables

19

264.89

264.89

–

264.89

Security and other deposits

16

14.93

14.93

–

14.93

Capital creditors

16

8.82

8.82

–

8.82

Other liabilities

16

14.15

13.62

0.53

14.15

Derivatives (settlement on net basis)

0.56

0.56

–

0.56

Notes

to the Financial Statements

Note 27.7 Fair value measurements

(continued)