147

Transition to Ind AS

(continued)

ii)

Estimates

Estimates in accordance with Ind AS at the transition date will be consistent with estimates made for the same

date in accordance with IGAAP (after adjustments to reflect any difference in Accounting Policies) unless there is

objective evidence that those estimates were in error.

Ind AS estimates as at April 01, 2015 are consistent with the estimates as at the same date made in conformity

with IGAAP. The Company made estimates for following items in accordance with Ind AS at the date of transition

as these were not required under IGAAP:

1) Investment in equity instruments carried at FVPL or FVOCI

2) Fair value of investment properties

iii)

Classification and measurement of financial assets

Ind AS 101 requires an entity to assess classification and measurement of financial assets (investment in debt

instruments) on the basis of the facts and circumstances that exist at the date of transition to Ind AS.

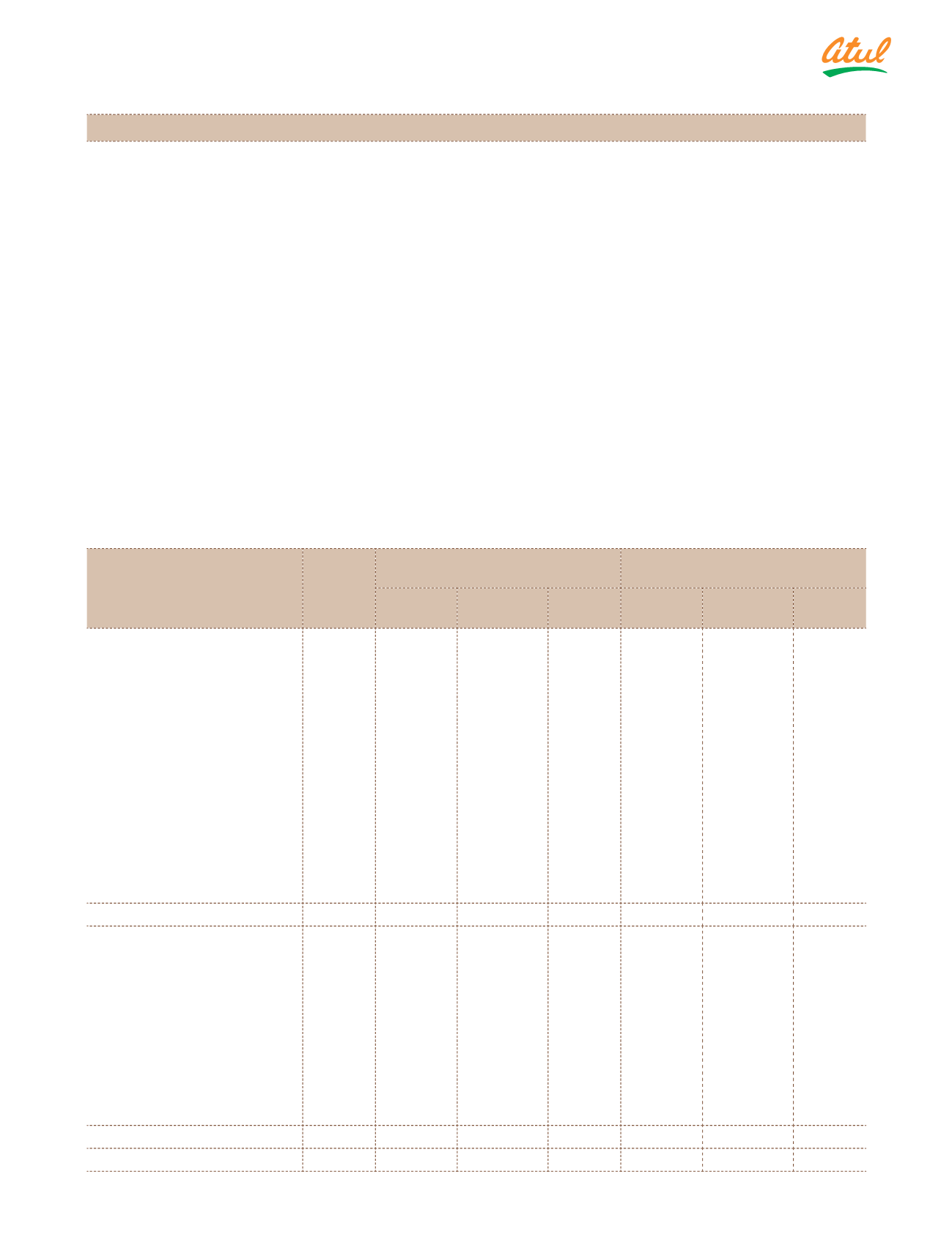

B) Reconciliations between IGAAP and Ind AS

Ind AS 101 requires an entity to reconcile equity, Total Comprehensive Income and cash flows for prior periods.

The following tables represent the reconciliations from IGAAP to Ind AS:

a)

Reconciliation of equity as at March 31, 2016 and April 01, 2015

(

`

cr)

Particulars

Note

to first

time

adoption

As at

March 31, 2016

As at

April 01, 2015

Regrouped

IGAAP*

Adjustments Ind AS Regrouped

IGAAP*

Adjustments Ind AS

ASSETS

Non-current assets

Property, plant and equipment

a, b, h

713.79

(0.96)

712.83

474.84

(3.28)

471.56

Capital work-in-progress

169.66

– 169.66

104.08

– 104.08

Investment properties

a

–

3.22

3.22

–

3.22

3.22

Intangible assets

0.12

–

0.12

0.21

–

0.21

Financial assets

–

–

i)

Investments

c, g

143.77

302.04

445.81

148.03

339.83

487.86

ii)

Loans

g

19.18

(5.51)

13.67

19.18

(7.00)

12.18

iii)

Other financial assets

b

5.22

1.30

6.52

8.25

1.42

9.67

Income tax assets (net)

3.11

–

3.11

–

–

–

Other non-current assets

71.72

–

71.72

71.52

–

71.52

Total non-current assets

1,126.57

300.09 1,426.66

826.11

334.19 1,160.30

Current assets

Inventories

374.17

– 374.17

349.65

– 349.65

Financial assets

i)

Trade receivables

420.12

– 420.12

439.19

– 439.19

ii)

Cash and cash equivalents

3.40

–

3.40

4.70

–

4.70

iii)

Bank balances other than cash

and cash equivalents above

1.92

–

1.92

1.70

–

1.70

v)

Other financial assets

10.91

–

10.91

11.69

–

11.69

Other current assets

k

147.10

0.08

147.18

128.77

0.21

128.98

Total current assets

957.62

0.08

957.70

935.70

0.21

935.91

Total assets

2,084.19

300.17 2,384.36

1,761.81

334.40 2,096.21

Notes

to the Financial Statements