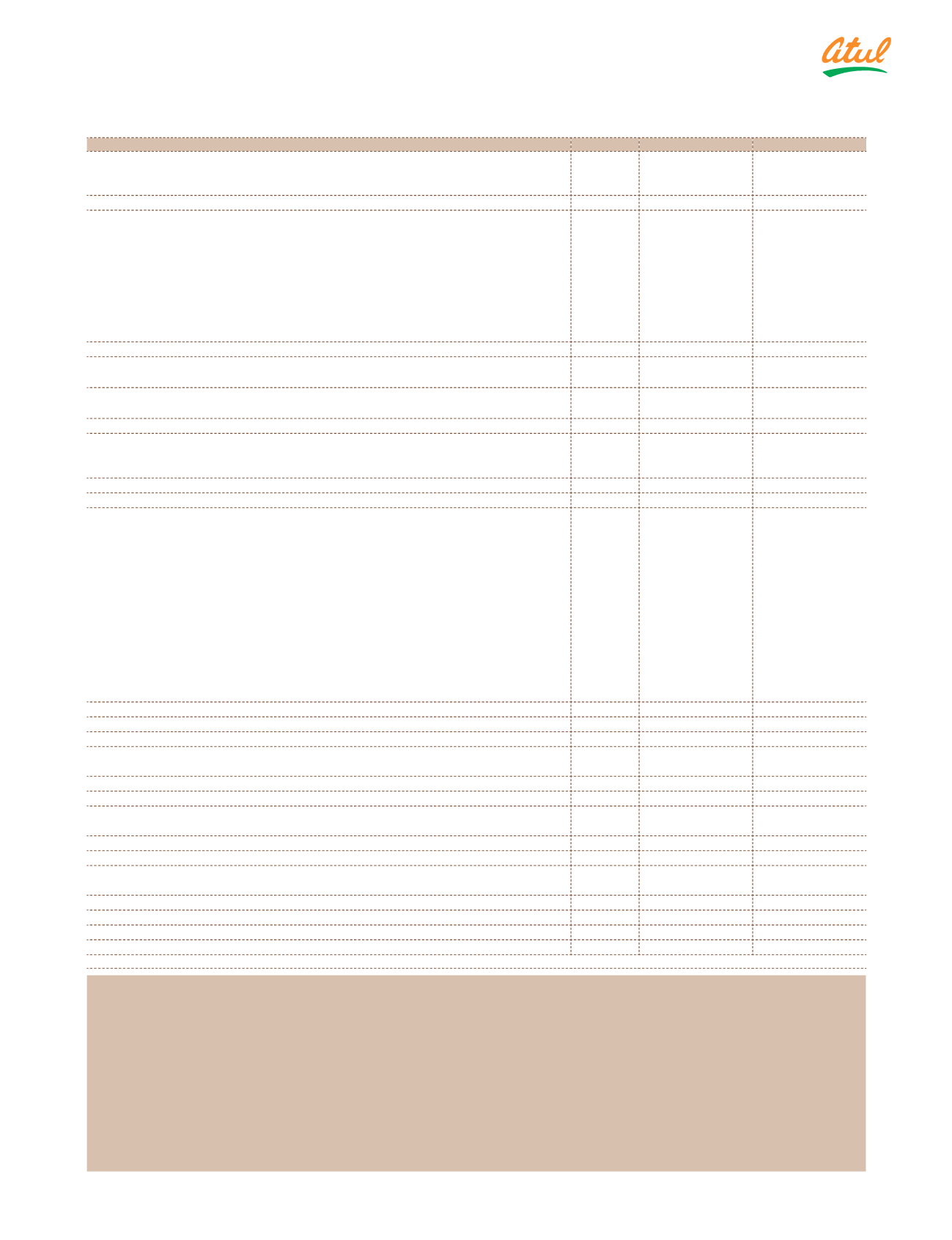

157

Consolidated Statement of Profit and Loss

for the year ended March 31, 2017

(

`

cr)

Particulars

Note

2016-17

2015-16

Income

Revenue from operations

22

2,996.05

2,755.01

Other income

23

52.55

34.40

Total income

3,048.60

2,789.41

Expenses

Cost of materials consumed

24

1,397.03

1,323.94

Purchase of stock-in-trade

27.40

23.45

Changes in inventories of finished goods, stock-in-trade and work-in-progress

25

11.05

(20.70)

Excise duty

162.11

160.42

Employee benefit expenses

26

200.14

190.91

Finance costs

27

25.17

27.53

Depreciation and amortisation expenses

2, 4

95.44

66.07

Other expenses

28

688.87

617.76

Total expenses

2,607.21

2,389.38

Profit before exceptional items, share of net profit of investments

accounted for using equity method and tax

441.39

400.03

Share of net profit of associate company and joint venture company

accounted for using the equity method

4.67

4.46

Profit before tax

446.06

404.49

Tax expense

Current tax

29.5

87.11

108.03

Deferred tax

29.5

35.60

22.19

Total tax expense

122.71

130.22

Profit for the year

323.35

274.27

Other Comprehensive Income

a) Items that will not be reclassified to profit and loss

i)

Fair value of equity instruments through Other Comprehensive

Income (FVOCI)

77.36

(38.37)

ii)

Remeasurement gain | (loss) on defined benefit plans

2.44

(2.98)

iii) Income tax related to item no (ii) above

(0.84)

1.06

iv) Share of Other Comprehensive Income of associate company

and joint venture company accounted for using the equity

method (net of tax)

(0.02)

–

b) Items that will be reclassified to profit and loss

i)

Effective portion of gain | (loss) on cash flow hedges

(0.73)

(0.90)

i)

Income tax related to item no (i) above

0.25

0.31

iii) Exchange differences on translation of foreign operations

4.45

9.35

Other Comprehensive Income, net of tax

82.91

(31.53)

Total Comprehensive income for the year

406.26

242.74

Profit is attributable to:

Owners of the Company

322.97

274.18

Non-controlling interests

0.38

0.09

323.35

274.27

Other Comprehensive Income is attributable to:

Owners of the Company

82.90

(31.53)

Non-controlling interests

0.01

–

82.91

(31.53)

Total Comprehensive Income is attributable to:

Owners of the Company

405.87

242.65

Non-controlling interests

0.39

0.09

406.26

242.74

Earnings per Equity share attributable to owners of the Company

No. of shares

29,661,733

29,661,733

Basic and diluted earning

`

per Equity share of

`

10 each

29.11

109.01

92.47

The accompanying Notes from an integral part of the Consolidated Financial Statements

As per our attached report of even date

For Dalal & Shah Chartered Accountants LLP

Firm Registration Number: 102020W | W-100040

R A Shah

S S Baijal

B S Mehta

H S Shah

S M Datta

V S Rangan

M M Chitale

S A Panse

B R Arora

Directors

For and on behalf of the Board of Directors

S S Lalbhai

Chairman and Managing Director

S A Lalbhai

Managing Director

Mumbai

May 05, 2017

S Venkatesh

Partner

Membership Number: 037942

Mumbai

May 05, 2017

T R Gopi Kannan

Whole-time Director and CFO

L P Patni

Company Secretary

B N Mohanan

Whole-time Director

and President - U&S