183

ii) Others

Effluent disposal

The Group has provided for expenses it estimates to be incurred for safe disposal of waste in line with the regulatory

framework it operates in. The provision represents the unpaid amount the entity expects to incur for which the

obligating event has already arisen as on the reporting date.

Wealth tax

The Group has provided for payments expected pertaining to wealth tax in line with the provisions of the erstwhile

Wealth Tax Act, 1957. The application of the act was discontinued from April 01, 2016.

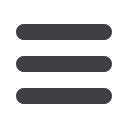

b) Movement of provision for effluent disposal

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Balance as at the beginning of the year

1.65

1.29

0.90

Less: Utilised

(1.65)

(1.29)

(0.90)

Provision made during the year

1.54

1.65

1.29

1.54

1.65

1.29

(

`

cr)

Note 20 Other liabilities

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Current

Non-

current

Current

Non-

current

Current

Non-

current

a) Deferred income on account of Government

grant received

–

9.67

–

11.05

–

12.46

b) Employee benefits payable

21.71

–

36.70

–

32.79

–

c) Statutory dues

12.37

–

14.59

–

17.95

–

d) Advances received from customers

5.53

–

9.42

–

10.26

–

39.61

9.67

60.71

11.05

61.00

12.46

(

`

cr)

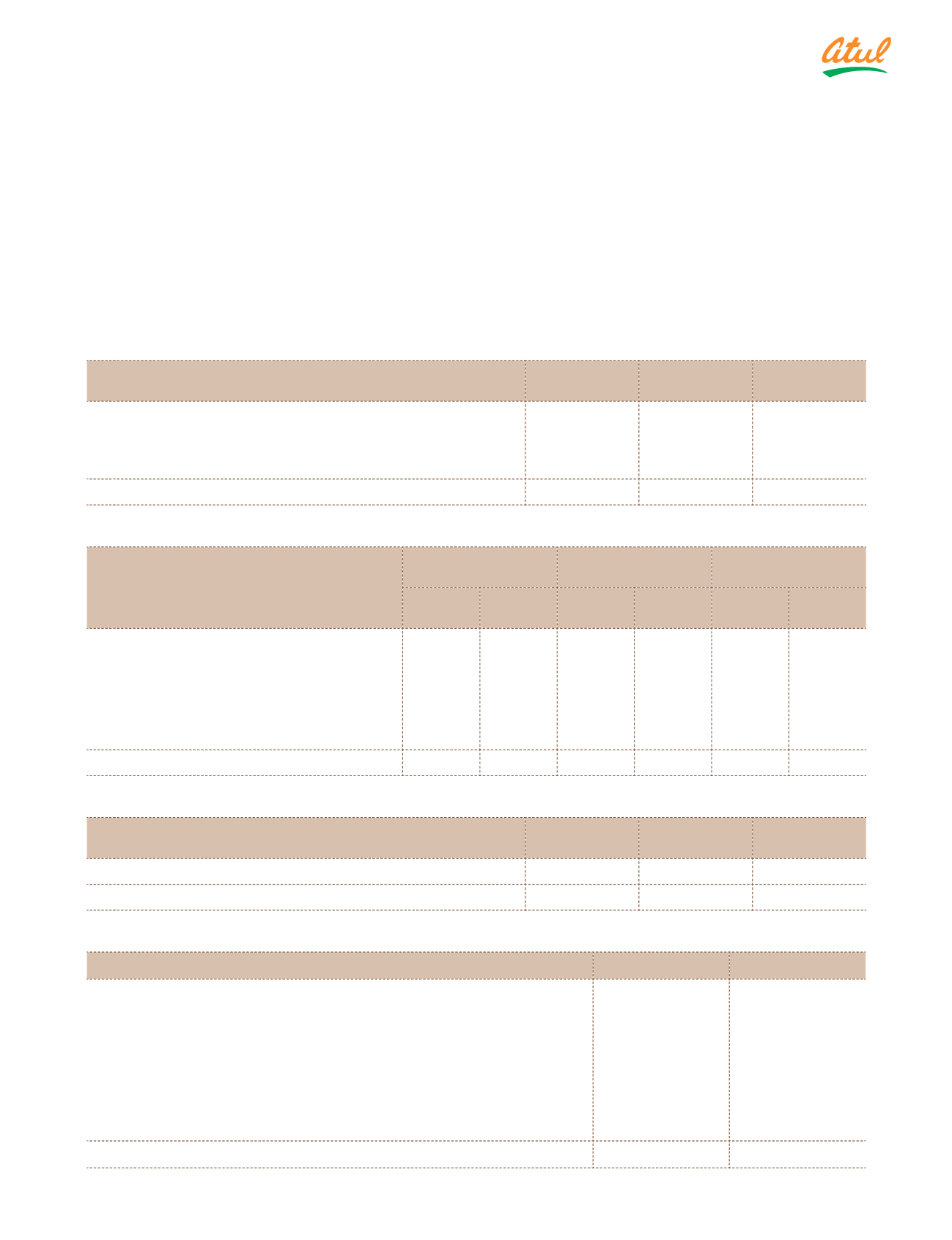

Note 21 Trade payables

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

a) Trade payables

337.49

315.12

278.21

337.49

315.12

278.21

(

`

cr)

Note 22 Revenue from operations

2016-17

2015-16

Sale of products (including excise duty)

2,932.91

2,698.01

Sale of services

7.10

4.71

Other operating revenues:

Export incentives

44.90

38.08

Scrap sales

7.92

5.61

Processing charges

3.22

8.60

2,996.05

2,755.01

Notes

to the Consolidated Financial Statements