Atul Ltd | Annual Report 2016-17

(

`

cr)

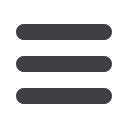

Note 29.4 (G) Outstanding balances at the year end

a) With entity over which control exercised by Key

Management Personnel

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

1 Loan Payable

–

7.00

9.00

Aagam Holdings Pvt Ltd

–

7.00

9.00

2 Payable

–

3.98

–

Aagam Holdings Pvt Ltd ¹

–

3.98

–

b) With entity over which control exercised by Joint

Venturer

1 Payable

1.34

1.62

1.35

Rudolf GmbH

1.34

1.62

1.06

Rudolf Duraner

–

–

0.29

c) With Key Management Personnel

1 Payable

0.01

0.01

0.01

Directors deposit payable

0.01

0.01

0.01

d) With entities over which KMP or their close family

members have significant influence

1 Receivables

0.03

0.12

0.07

Atul Kelavani Mandal (Current year:

`

35,655)

0.09

0.06

Atul Rural Development Fund

0.01

0.01

–

Atul Vidyalaya

0.02

0.02

0.01

Urmi Mandal (Current year:

`

1,864)

–

–

2 Payables

0.03

–

–

Atul Rural Development Fund

0.03

–

–

¹ Includes acceptances for bills discounted by third parties.

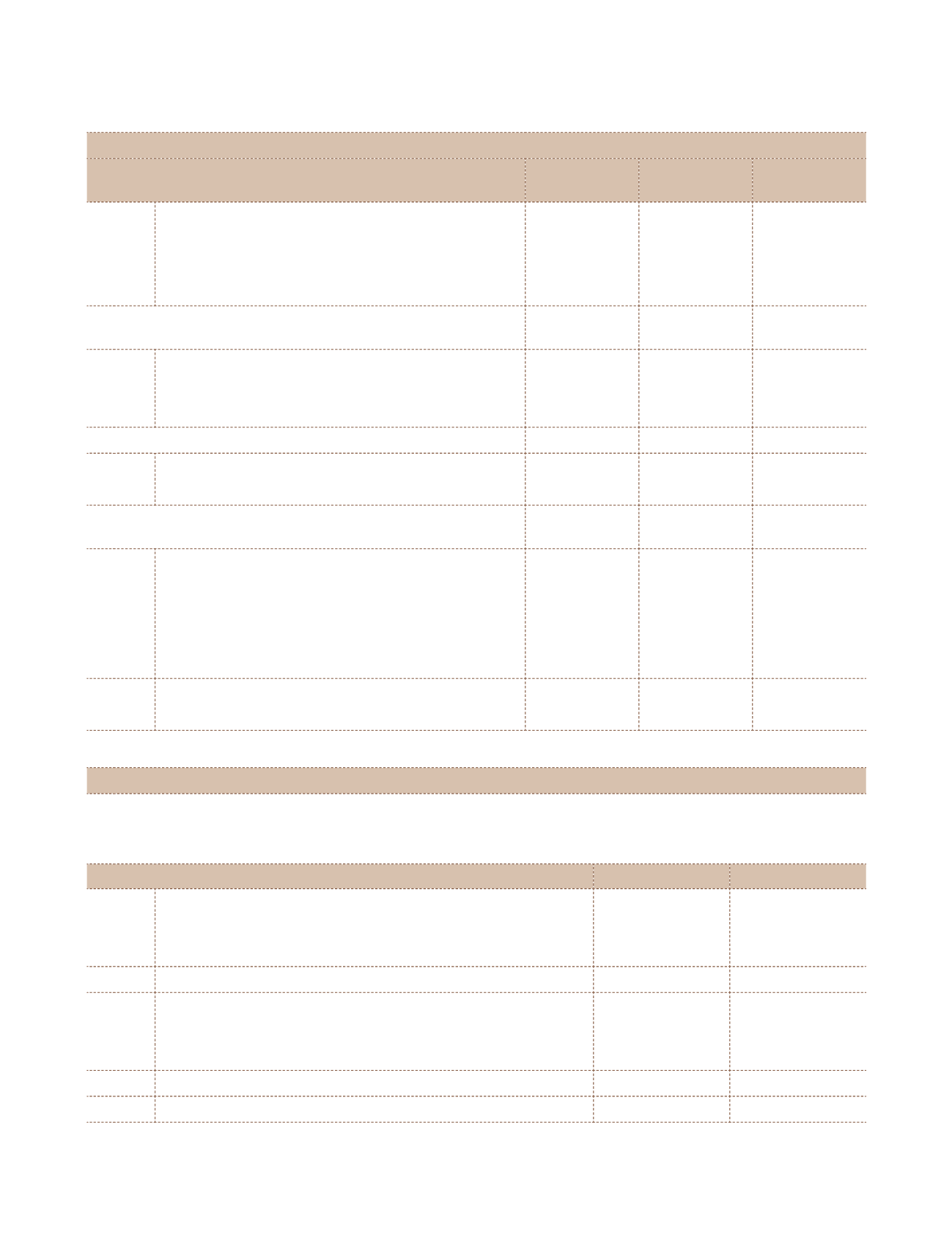

Note 29.5 Current and Deferred tax

The major components of income tax expense for the years ended March 31, 2017 and March 31, 2016 are:

a) Income tax expense

(

`

cr)

Particulars

2016-17

2015-16

i)

Current tax

Current tax on profit for the year

89.22

107.96

Adjustments for current tax of prior periods

(2.11)

0.07

Total current tax expense

87.11

108.03

ii)

Deferred tax

(Decrease) | Increase in deferred tax liabilities

63.73

22.60

Decrease | (Increase) in deferred tax assets

(28.13)

(0.41)

Total deferred tax expense | (benefit)

35.60

22.19

Income tax expense

122.71

130.22

b) No deferred tax has been recorded or recognised in Other Comprehensive Income (OCI) during the reporting

period.

Notes

to the Consolidated Financial Statements