197

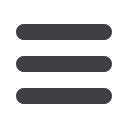

Note 29.7 Fair value measurements

(continued)

a) Fair value hierarchy

This section explains the judgements and estimates made in determining the fair values of the financial instruments that

are (a) recognised and measured at fair value and (b) measured at amortised cost and for which fair values are disclosed

in the Consolidated Financial Statements. To provide an indication about the reliability of the inputs used in determining

fair value, the Group has classified its financial instruments into the 3 levels prescribed under the Accounting Standard.

An explanation of each level is given below the table:

(

`

cr)

i)

Assets and liabilities measured

at fair value - recurring fair value

measurements at March 31, 2017

Note

Level 1

Level 2

Level 3

Total

Financial assets

Financial investment at FVPL:

Mutual funds

11

2.92

–

–

2.92

Financial investments at FVOCI:

Quoted Equity shares

6

415.10

–

–

415.10

Derivatives designated as hedges:

Currency options

–

1.70

–

1.70

Total financial assets

418.02

1.70

–

419.72

Financial liabilities

Derivatives designated as hedges:

Foreign exchange forward contracts

–

2.43

–

2.43

Derivatives not designated as hedges:

Currency swaps

–

5.07

–

5.07

Total financial liabilities

–

7.50

–

7.50

Biological assets

Tissue culture raised date palms

–

10.27

–

10.27

Total biological assets

–

10.27

–

10.27

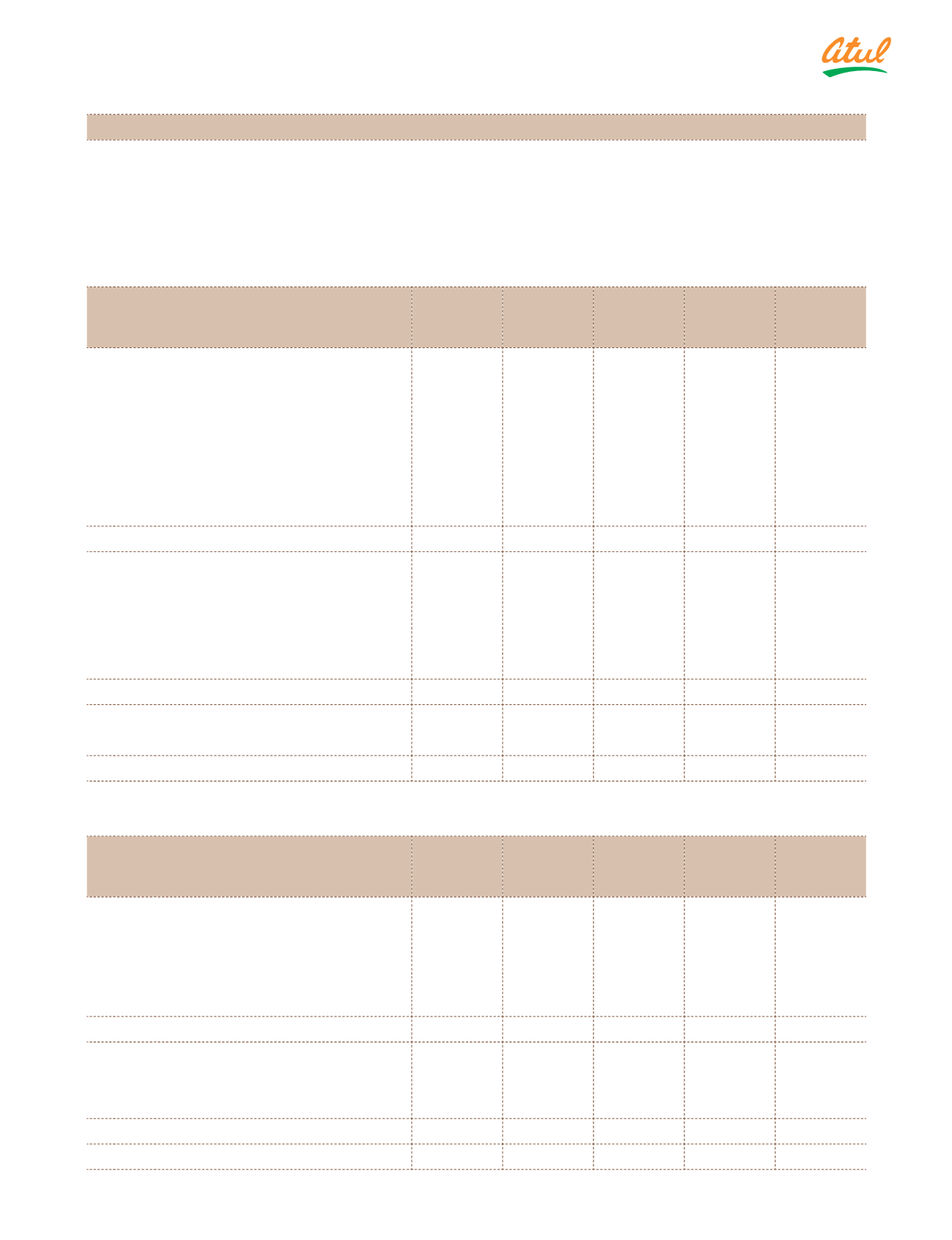

(

`

cr)

ii)

Assets and liabilities for which fair

values are disclosed at March 31,

2017

Note

Level 1

Level 2

Level 3

Total

Financial assets

Investments:

Government securities

6

0.11

–

–

0.11

Security deposits for utilities and

premises

9

–

–

1.59

1.59

Total financial assets

0.11

–

1.59

1.70

Financial liabilities

Borrowings

17

–

–

167.26

167.26

Security deposits

18

–

–

21.92

21.92

Total financial liabilities

–

–

189.18

189.18

Investment properties

3

–

–

134.00

134.00

Notes

to the Consolidated Financial Statements