Atul Ltd | Annual Report 2016-17

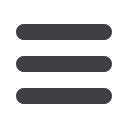

Movements in cash flow hedging reserve

(

`

cr)

Risk category

Foreign currency risk

Derivative instruments

As at

March 31, 2017

As at

March 31, 2016

Balance at the beginning of the period

(0.59)

(0.28)

Gain | (Loss) recognised in Other Comprehensive Income during the year

(0.73)

(0.90)

Amount reclassified to revenue during the year

0.59

0.28

Tax impact on above

0.25

0.31

Balance at the end of the period

(0.48)

(0.59)

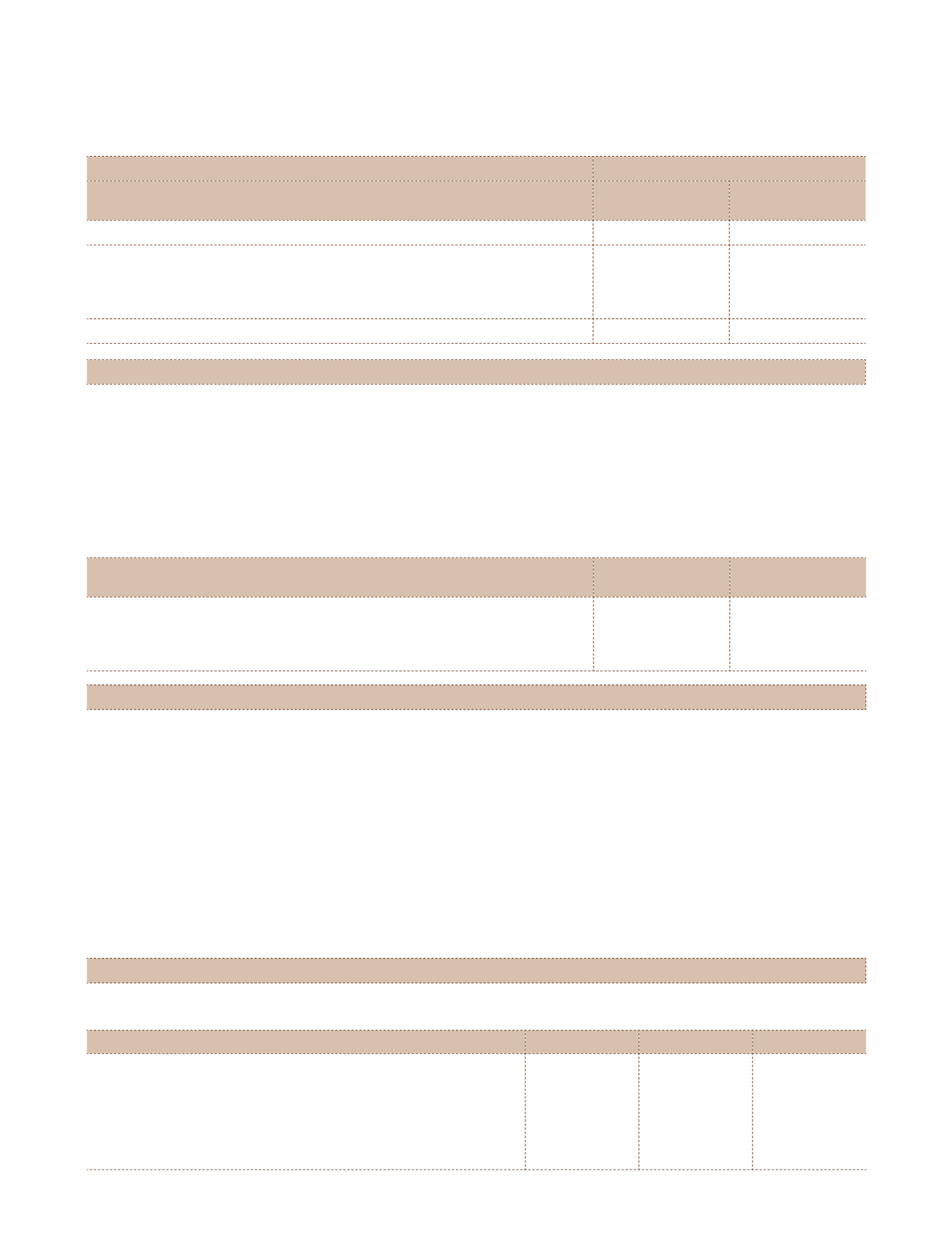

Note 29.9 Capital management

Risk Management

The primary objective of capital management of the Group is to maximise Shareholder value. The Group monitors capital using

Debt-Equity ratio which is total debt divided by total equity.

For the purposes of capital management, the Group considers the following components of its Balance Sheet to manage capital:

Total equity includes General reserve, Retained earnings, Share capital and Security premium. Total debt includes current debt

plus non-current debt.

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

Total debt

167.69

315.82

Total equity

1,936.26

1,585.11

Debt-Equity ratio

0.09

0.20

Note 29.10 Offsetting financial assets and liabilities

The below Note presents the recognised financial instruments that are offset or subject to enforceable master netting

arrangements and other similar agreements, but not offset as at March 31, 2017, March 31, 2016 and April 01, 2015.

a) Collateral against borrowings

The Group has hypothecated | mortgaged financial instruments as collateral against a number of its borrowings. Refer

to Note 17 for further information on financial and non-financial collateral hypothecated | mortgaged as security against

borrowings.

b) Master netting arrangements – not currently enforceable

Agreements with derivative counterparties are based on an ISDA Master Agreement. Under the terms of these

arrangements, only where certain credit events occur (such as default), the net position owing | receivable to a single

counterparty in the same currency will be taken as owing and all the relevant arrangements terminated. As the Group

does not presently have a legally enforceable right of set-off, these amounts have not been offset in the Balance Sheet.

Note 29.11 Earnings per share

Earnings per share (EPS) – The numerators and denominators used to calculate basic and diluted EPS:

Particulars

2016-17

2015-16

Profit for the year attributable to the Equity Shareholders

`

cr

323.35

274.27

Basic | Weighted average number of Equity shares outstanding during

the year

Number

2,96,61,733 2,96,61,733

Nominal value of Equity share

`

10

10

Basic and diluted EPS

`

109.01

92.47

Notes

to the Consolidated Financial Statements