91

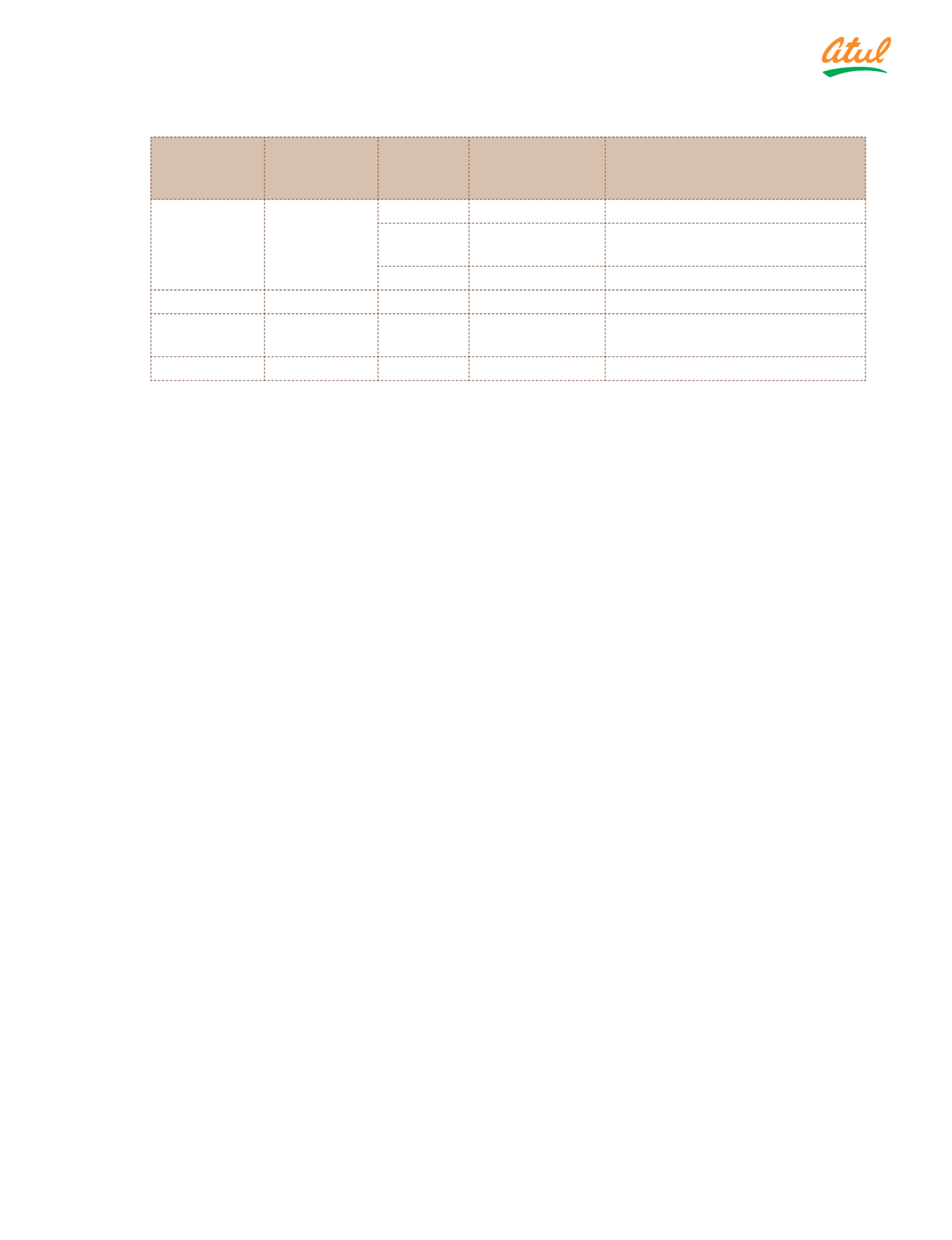

Name of the

statute

Nature of

dues

Amount

(

`

in cr)

(a)

Period to which

the amount

relates

Forum where the dispute is

pending

(b)

Central Excise

Act, 1944

Excise and

service tax

0.94 1986 to 2016

Commissioner (Appeals)

4.07 1992 to 2011

Customs, Excise and Service Tax

Appellate Tribunal

3.53 1994-95

High Court

Total

8.54

Income Tax Act,

1961

Income tax

0.19 2009-11

Commissioner of Income Tax (Appeals)

Total

0.19

(a)

Net of amounts deposited. |

(b)

Necessary stay received from respective authorities.

08. According to the records of the Company examined by

us and the information and explanations given to us,

the Company has not defaulted in repayment of loans

or borrowings to any financial institution or bank or

Government or dues to debenture holders as at the

Balance Sheet date.

09. The Company has not raised any monies by way of

initial public offer, further public offer (including debt

instruments) and term loans. Accordingly, the provisions

of Clause 3(ix) of the Order are not applicable to the

Company.

10. During the course of our examination of the books and

records of the Company, carried out in accordance with

the Generally Accepted Auditing Practices in India, and

according to the information and explanations given

to us, we have neither come across any instance of

material fraud by the Company or on the Company by

its officers or employees, noticed or reported during the

year, nor have we been informed of any such case by the

Management.

11. The Company has paid | provided for managerial

remuneration in accordance with the requisite approvals

mandated by the provisions of Section 197 read with

Schedule V to the Act.

12. As the Company is not a Nidhi Company and the Nidhi

Rules, 2014 are not applicable to it, the provisions

of Clause 3(xii) of the Order are not applicable to the

Company.

13. The Company has entered into transactions with Related

Parties in compliance with the provisions of Sections

177 and 188 of the Act, where applicable. The details

of such Related Party Transactions have been disclosed

in the Ind AS Financial Statements as required under

Indian Accounting Standard (Ind AS) 24, Related Party

Disclosures specified under Section 133 of the Act, read

with Rule 7 of the Companies (Accounts) Rules, 2014.

14. The Company has not made any preferential allotment or

private placement of shares or fully or partly convertible

debentures during the year under review. Accordingly, the

provisions of Clause 3(xiv) of the Order are not applicable

to the Company.

15. The Company has not entered into any non-cash

transactions with its Directors or persons connected with

him. Accordingly, the provisions of Clause 3(xv) of the

Order are not applicable to the Company.

16. The Company is not required to be registered under

Section 45-IA of the Reserve Bank of India Act, 1934.

Accordingly, the provisions of Clause 3(xvi) of the Order

are not applicable to the Company.

For Dalal & Shah Chartered Accountants LLP

Firm Registration Number: 102020W | W-100040

S Venkatesh

Mumbai

Partner

May 05, 2017

Membership Number: 037942