119

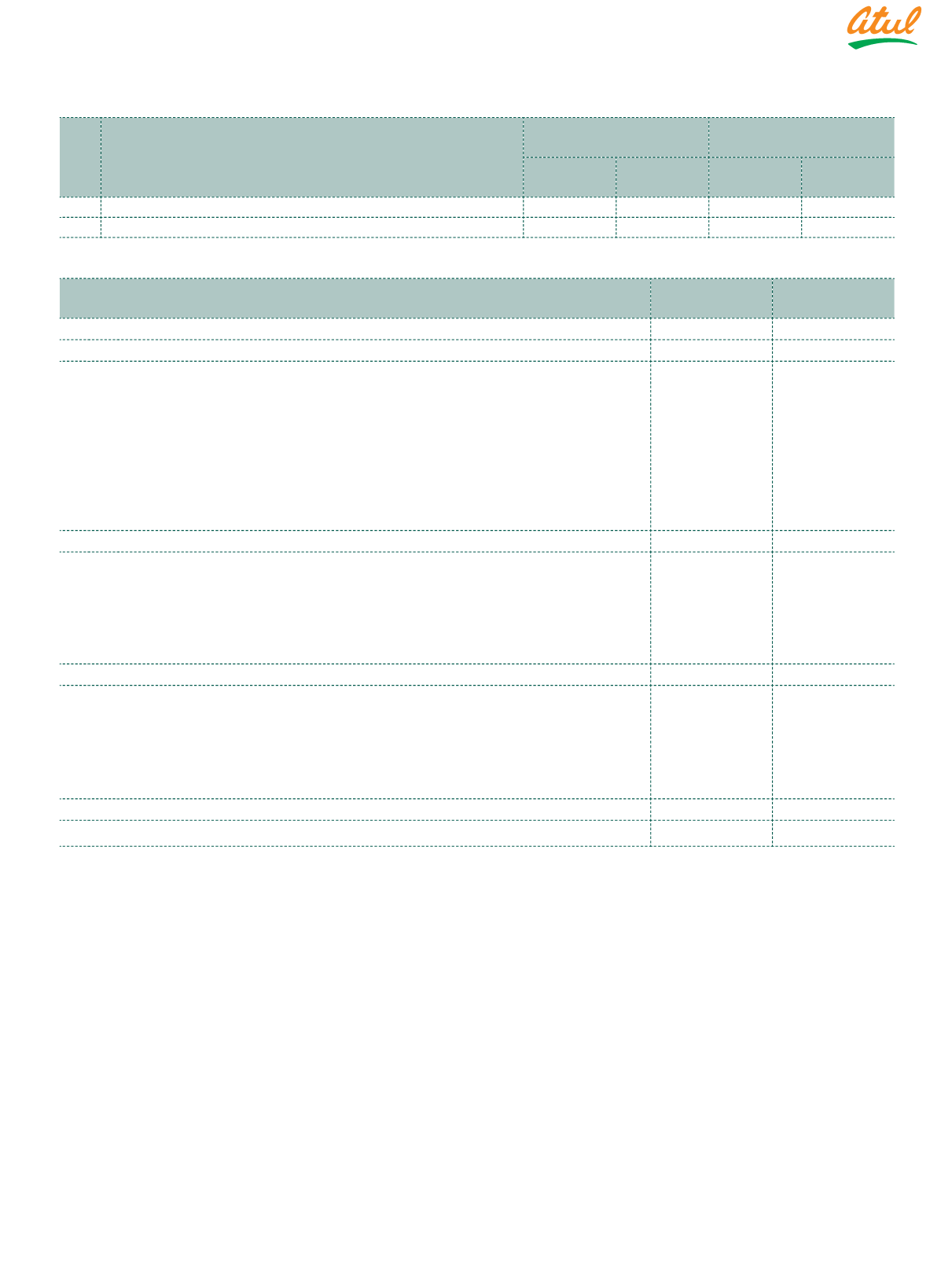

c) Details of Shareholders holding more than 5% of equity shares:

No. Name of the Shareholder

As at

March 31, 2018

As at

March 31, 2017

Holding % Number of

Shares

Holding % Number of

Shares

1 Aagam Holdings Pvt Ltd

22.41% 66,50,000

22.41% 66,50,000

2 Aeon Investments Pvt Ltd

6.94% 20,60,817

6.79% 20,14,383

(

`

cr)

Note 14 Other equity

As at

March 31, 2018

As at

March 31, 2017

a) Securities premium reserve

34.66

34.66

b) General reserve

95.80

95.80

c) Retained earnings

Balance as at the beginning of the year

1,397.04

1,145.10

Add: Profit for the year

270.41

285.30

Add: Remeasurement gain | (loss) on defined benefit plans

1.78

1.62

Add: Transfer from OCI on disposal of FVOCI equity instruments

1.54

0.73

Less: Dividend on equity shares for the year {2016-17:

`

10 per share, (2015-16:

`

10 per share)}

(29.66)

(29.66)

Less: Dividend distribution tax on dividend

(3.63)

(6.05)

Balance as at the end of the year

1,637.48

1,397.04

d) Other reserves

i) FVOCI equity instruments

Balance as at the beginning of the year

364.11

287.50

Add: Equity instruments through Other Comprehensive Income (FVOCI)

37.32

77.34

Less: Transfer to retained earnings on disposal of FVOCI equity instruments

(1.54)

(0.73)

Balance as at the end of the year

399.89

364.11

ii) Effective portion of cash flow hedges

Balance as at the beginning of the year

(0.47)

(0.59)

Add: Effective portion of gain | (loss) on cash flow hedges

0.05

(0.72)

Add: Deferred tax liability

(0.02)

0.25

Less: Hedging gain | (loss) reclassified to Statement of Profit and Loss

0.47

0.59

Balance as at the end of the year

0.03

(0.47)

2,167.86

1,891.14

Nature and purpose of other reserves

a) Securities premium reserve

Securities premium is used to record the premium on issue of shares. The reserve is utilised in accordance with the

provisions of the Companies Act, 2013.

b) FVOCI - equity instruments

The Company has elected to recognise changes in the fair value of certain investments in equity securities in Other

Comprehensive Income. These changes are accumulated within the FVOCI equity instruments reserve within equity. The

Company transfers amounts from this reserve to retained earnings when the relevant equity securities are de-recognised.

c) Cash flow hedging reserve

The Company uses hedging instruments as part of its management of foreign currency risk associated with its highly probable

forecast sale and inventory purchases and interest rate risk associated with variable interest rate borrowings. For hedging

foreign currency risk, the Company uses foreign currency forward contracts, foreign currency option contracts and Interest

rate swaps. They are designated as cash flow hedges to the extent these hedges are effective, the change in fair value of the

hedging instrument is recognised in the cash flow hedging reserve. Amounts recognised in the cash flow hedging reserve is

reclassified to profit or loss when the hedged item affects profit or loss (for example, sales and interest payments). When the

forecast transaction results in the recognition of a non-financial asset (for example, inventory), the amount recognised in the

cash flow hedging reserve is adjusted against the carrying amount of the non-financial asset.

Notes

to the Financial Statements