Atul Ltd | Annual Report 2017-18

As at March 31, 2017

(

`

cr)

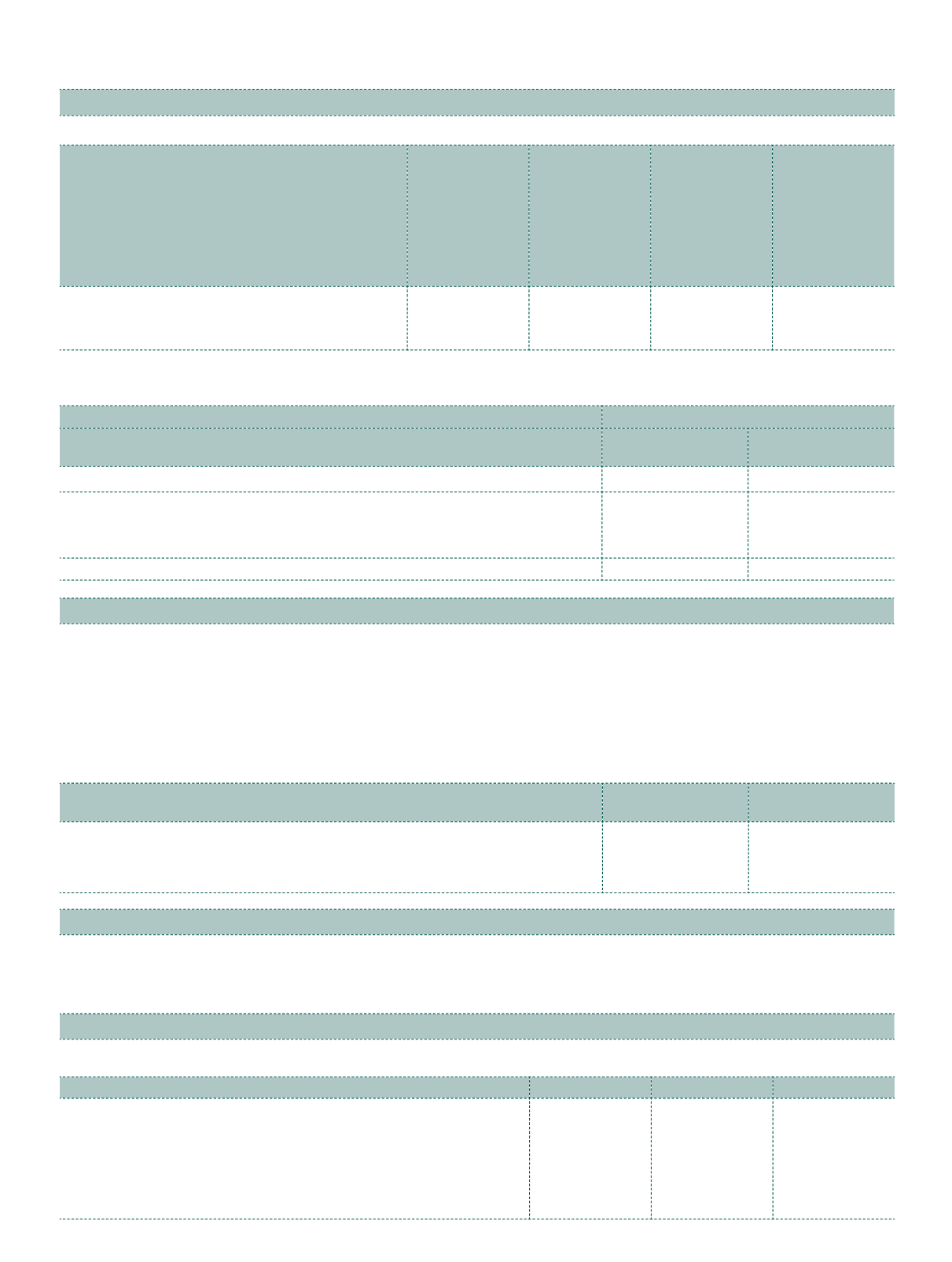

Type of hedge

Change in

the value of

the hedging

instrument

recognised

in Other

Comprehensive

Income

Hedge

ineffectiveness

recognised in

profit or loss

Amount

reclassified

from cash flow

hedging reserve

to profit or loss

Financial

Statement line

item affected

Cash flow hedge

Foreign exchange risk

(0.73)

–

(0.89) Revenue and

inventories

Movements in cash flow hedging reserve

(

`

cr)

Risk category

Foreign currency risk

Derivative instruments

As at

March 31, 2018

As at

March 31, 2017

Balance at the beginning of the year

(0.48)

(0.59)

Gain | (Loss) recognised in Other Comprehensive Income during the year

0.05

(0.73)

Amount reclassified to revenue during the year

0.48

0.59

Tax impact on above

(0.02)

0.25

Balance at the end of the year

0.03

(0.48)

Note 27.9 Capital Management

The primary objective of Capital Management of the Company is to maximise Shareholder value. The Company monitors

capital using Debt-Equity ratio which is total debt divided by total equity.

For the purpose of Capital Management, the Company considers the following components of its Balance Sheet to manage

capital:

Total equity includes General reserve, Retained earnings, Share capital and Security premium. Total debt includes current debt

plus non-current debt.

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Total debt

0.01

155.23

Total equity

2,197.54

1,920.82

Debt-Equity ratio

–

0.08

Note 27.10 Segment information

In accordance with Ind AS 108 'Operating Segments‘, segment information has been given in the Consolidated Financial

Statements of Atul Ltd, and therefore no separate disclosure on segment information is given in the Standalone Financial

Statements.

Note 27.11 Earnings per share

Earnings per share (EPS) - The numerators and denominators used to calculate basic and diluted EPS:

Particulars

2017-18

2016-17

Profit for the year attributable to the Equity Shareholders

`

cr

270.41

285.30

Basic | Weighted average number of equity shares outstanding during

the year

Number

2,96,61,733

2,96,61,733

Nominal value of equity share

`

10

10

Basic and diluted EPS

`

91.16

96.18

Notes

to the Financial Statements

Note 27.8 Financial Risk Management

(continued)