201

Note 29.8 Financial Risk Management

(continued)

c) Management of credit risk

Credit risk is the risk of financial loss to the Group if a customer or counterparty fails to meet its contractual obligations.

Trade receivables

Concentrations of credit risk with respect to trade receivables are limited due to the customer base being

large, diverse and across sectors and countries. All trade receivables are reviewed and assessed for default on a

monthly basis.

Historical experience of collecting receivables of the Group is supported by low level of past default, and hence the

credit risk is perceived to be low.

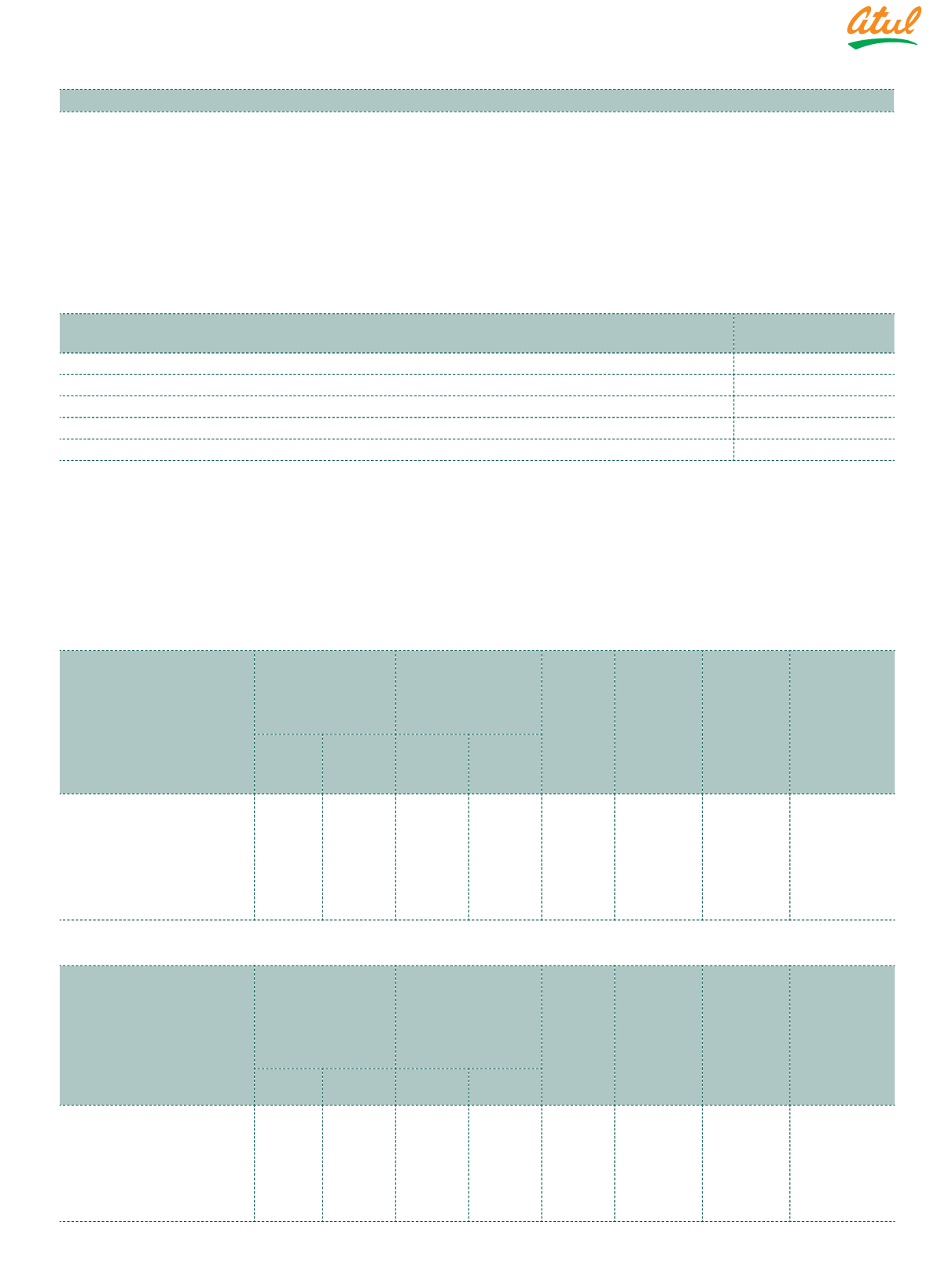

Reconciliation of loss allowance provision – Trade receivables

(

`

cr)

Particulars

As at

March 31, 2018

Loss allowance as on March 31, 2016

3.80

Changes in loss allowance

(0.64)

Loss allowance as on March 31, 2017

3.16

Changes in loss allowance

(0.56)

Loss allowance as on March 31, 2018

2.60

Other financial assets

The Group maintains exposure in cash and cash equivalents, term deposits with banks, investments in Government securities,

preference shares and loans to subsidiary companies. The Group has diversified portfolio of investment with various number

of counterparties which have secure credit ratings; hence the risk is reduced. Individual risk limits are set for each counter-

party based on financial position, credit rating and past experience. Credit limits and concentration of exposures are actively

monitored by the treasury department of the Group.

Impact of hedging activities

a) Disclosure of effects of hedge accounting on financial position:

As at March 31, 2018

(

`

cr)

Type of hedge and risks

Notional value Carrying amount of

hedging instrument

Maturity

(months)

Weighted

average

strike price |

interest rate

Changes in

fair value

of hedging

instrument

Change in the

value of hedged

item used as

the basis for

recognising

hedge

effectiveness

Assets Liabilities Assets Liabilities

Cash flow hedge

` :

US $

Foreign exchange risk

Foreign exchange forward

contracts

6.01

–

0.07

–

1-12

66.18

0.07

(0.07)

Currency range options

–

24.22

–

(0.02)

1-12 64.90-68.90

(0.02)

0.02

As at March 31, 2017

(

`

cr)

Type of hedge and risks

Notional value Carrying amount of

hedging instrument

Maturity

(months)

Weighted

average

strike price |

interest rate

Changes in

fair value

of hedging

instrument

Change in the

value of hedged

item used as

the basis for

recognising

hedge

effectivenes

Assets Liabilities Assets Liabilities

Cash flow hedge

` :

US $

Foreign exchange risk

Foreign exchange forward

contracts

–

58.35

–

(2.43)

1-12

68.06

(2.43)

2.43

Currency range options

49.60

–

1.70

–

1-12 67.98-73.20

1.70

(1.70)

Notes

to the Consolidated Financial Statements