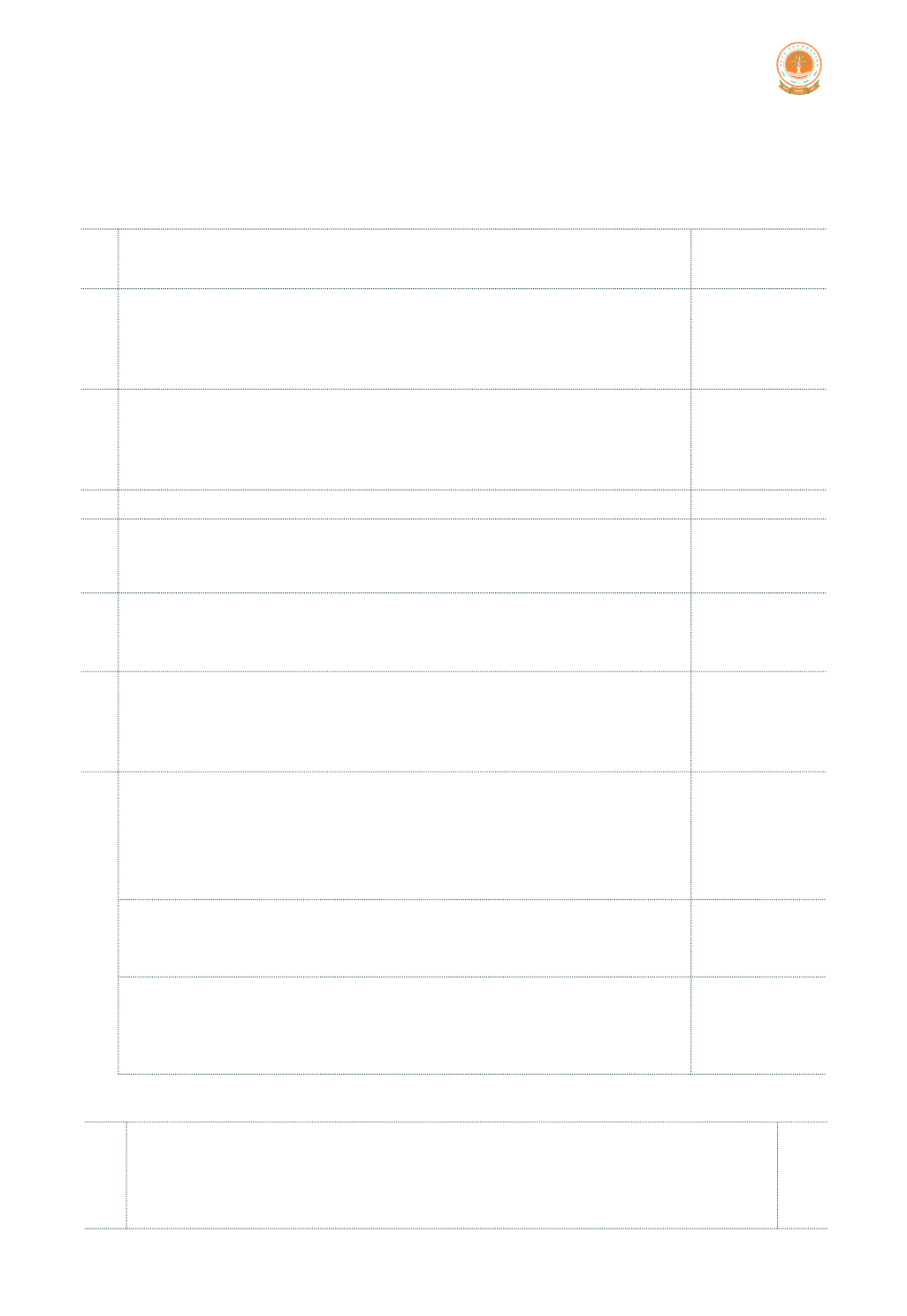

Annexure

Statement of particulars

1. Application of income for charitable or religious purposes

Amount of income of previous year applied to charitable or religious

purpose in India during that year

Whether the Trust has exercised the option under Clause (2) of the

explanation to Section 11(1)? If so, the details of the amount of income

deemed to have been applied to charitable or religious purpose in India

during the previous year

Amount of income accumulated or set apart for application to

charitable or religious purposes, to the extent it does not exceed 15%

of the income derived from property held under the Trust wholly for

purpose

Amount of income eligible for exemption under Section 11(1)(c)

Amount of income, in addition to the amount referred to in item 3

above, accumulated or set apart for specified purpose under Section

11(2)

Whether the amount of income mentioned in item 5 above has been

invested or deposited in the manner laid down in Section 11(2)(b)? If

so, the details thereof

Whether any part of the income in respect of which an option was

exercised under Clause (2) of the explanation to Section 11(1) in any

earlier year is deemed to be income of the previous year under Section

11(1B) ? If so, the details thereof

Whether during the previous year, any part of income accumulated or

set apart for specified purposes under Section 11(2) in any earlier year

i) has been applied for purposes other than charitable or religious

purposes or has ceased to be accumulated or set apart for application

thereto, or

ii) has ceased to remain invested in any security referred to in Section

11(2)(b)(I) or deposited in any account referred to in Section 11(2)(b)(ii)

or Section 11(2)(b)(iii), or

iii) has not been utilised for purposes for which it was accumulated or

set apart during the period for which it was to be accumulated or set

apart, or in the year immediately following the expiry thereof? If so, the

details thereof

1.

2.

3.

4.

5.

6.

7.

8.

6,42,05,796

Nil

13,80,161

Nil

Nil

No

NA

No

No

No

2. Application or use of income or property for the benefit of persons referred to in Section 13(3)

Whether any part of the income or property of the Trust was lent, or continues to

be lent, in the previous year to any person referred to in Section 13(3) (hereinafter

referred to in this Annexure as such person)? If so, give details of the amount, rate

of interest charged and the nature of security, if any

1.

No

Annual Report 2018-19 I Atul Foundation

26