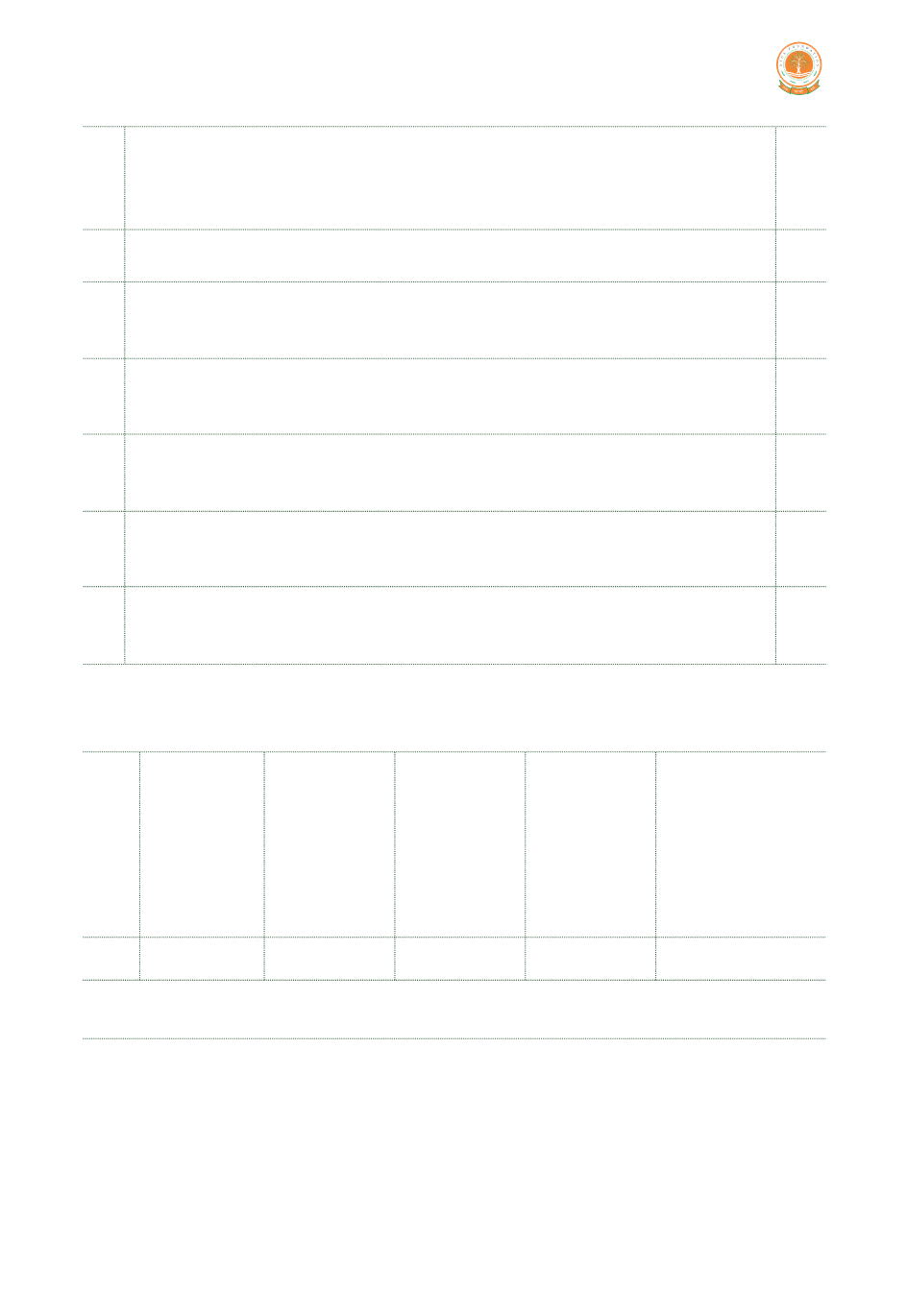

Whether any part of the income or property of the Trust was made, or continued

to be made, available for the use of any such person during the previous year? If

so, give details of the property and the amount of rent or compensation charged, if

any

Whether any payment was made to any such person during the previous year by

way of salary, allowance or otherwise? If so, give details

Whether the services of the Trust were made available to any such person during

the previous year? If so, give details thereof together with remuneration or

compensation received, if any

Whether any share, security or other property was purchased by or on behalf of

the Trust during the previous year from any such person? If so, give details thereof

togetherwith the consideration paid

Whether any share, security or other property was purchased by or on behalf of

the Trust during the previous year to any such person? If so, give details thereof

togetherwith the consideration received

Whether any income or property of the Trust was diverted during the previous

year in favour of any such person? If so, give details thereof together with the

amount of income or value of property so diverted

Whether the income or property of the Trust was used or applied during the

previous year for the benefit of any such person in any other manner? If so, give

details

2.

3.

4.

5.

6.

7.

8.

No

No

No

No

No

No

No

3. Investment held at any time during the previous year(s) in concerns in which

persons referred to in Section 13(3) have a substantial interest

Name and

address of

the concern

1.

2

3

4 5

6

No.

Ahmedabad

April 24, 2019

Whether the

concern is a

company,

number and

class of

shares held

Nominal

value of the

investment

Income

from the

investment

Whether the

amount in col.(4)

exceeded 5% of the

capital of the

concern during the

previous year say,

yes | no

Not applicable

For B R Shah & Associates

Chartered Accountants

Firm registration number: 129053W

Deval Desai

Partner

Membership number: 132426

27