14 /

Atul Ltd |

Annual Report 2009-10

Investments

The Company invested its operational surplus in its

business. Other investments remained more or less

unchanged at Rs 65 crores.

Inventories

Inventory constituted 34% of current assets as on March

31, 2010. Inventory value marginally increased by 7% from

Rs 197 crores as on March 31, 2009 to Rs 211 crores as on

March 31, 2010. Inventory days stood at 66 days during

the year against 62 days in the previous year.

Debtors

Debtors constituted 43% of the current assets as on March

31, 2010. Debtors increased by 22% from Rs 223 crores as

on March 31, 2009 to Rs 271 crores as on March 31, 2010

due to substantial increase in sales during the last quarter

of the year as compared to the previous year. Debtor days

stood at 81 days during the year against 66 days in the

previous year.

Loans and Advances

Loans and advances increased by 18% from Rs 110 crores

as on March 31, 2009 to Rs 130 crores as on March 31,

2010. The increase was mainly attributable to balance with

Government suppliers | departments.

Current Liabilities

Current liabilities increased by 48% from Rs 178 crores as

on March 31, 2009 to Rs 263 crores as on March 31, 2010

primarily due to our focus on improving working

capital position.

Income

Sales volume on an average grew by 18%. However

operating revenues at Rs 1,198 crores recorded only an

insignificant growth of less than 1% mainly due to a

decline in the prices of raw materials and consequently

those of finished goods. Exports declined by 11% to Rs

513 crores due to the economic slowdown in the USA

and Europe. However, domestic sales at Rs 655 crores

grew by 12% and made up for the lower exports.

15

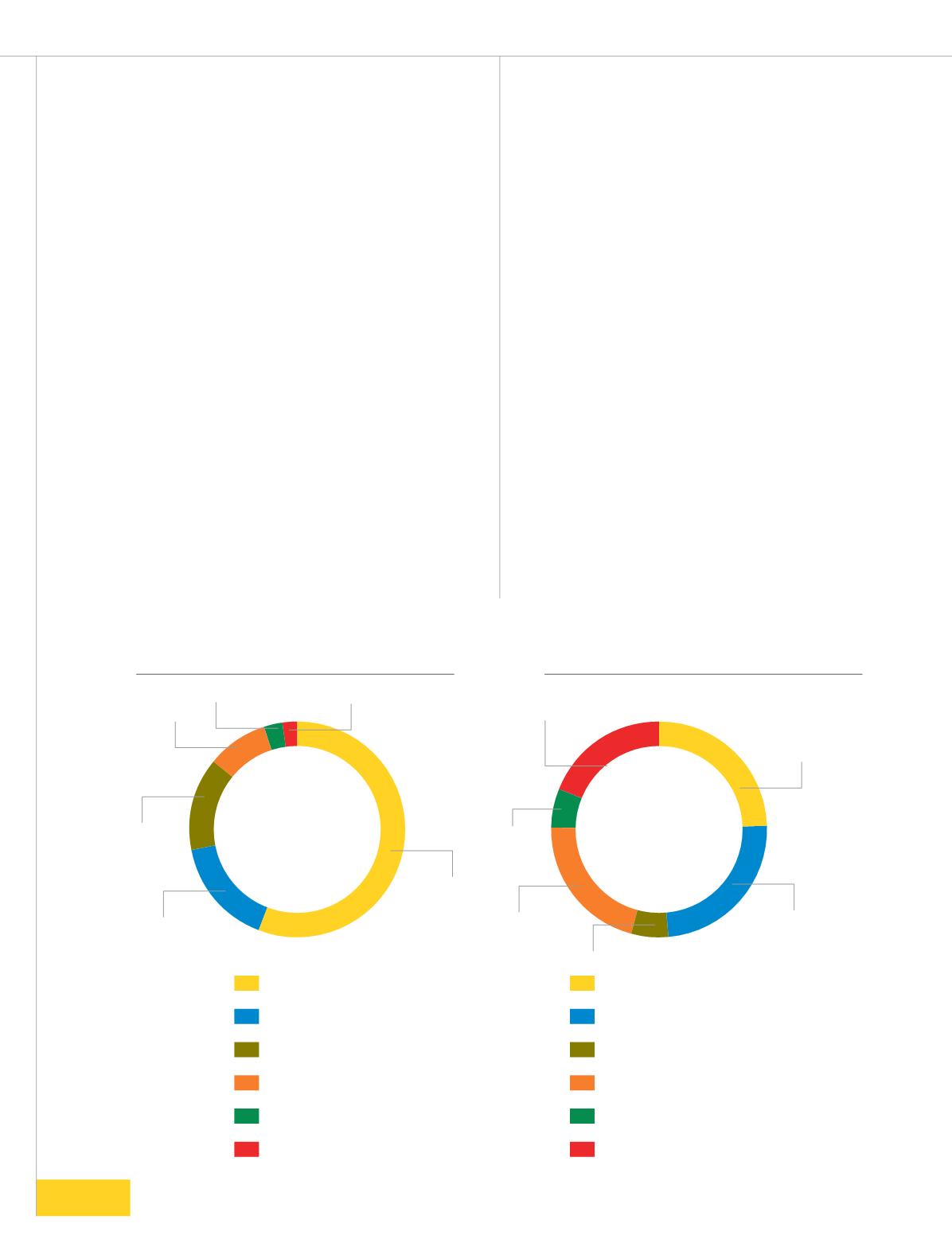

Colors

Aromatics

Bulk Chemicals and Intermediates

Crop Protection

Pharma and Intermediates

Polymers

24

24

21

6

19

6

Revenues by business

India

Asia

Europe

North America

South America

Africa

Sales by geography

56

16

14

9

3

2

(%)

(%)