90 /

Atul Ltd

|

Annual Report 2009-10

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

11 Segment information (Contd)

(b)

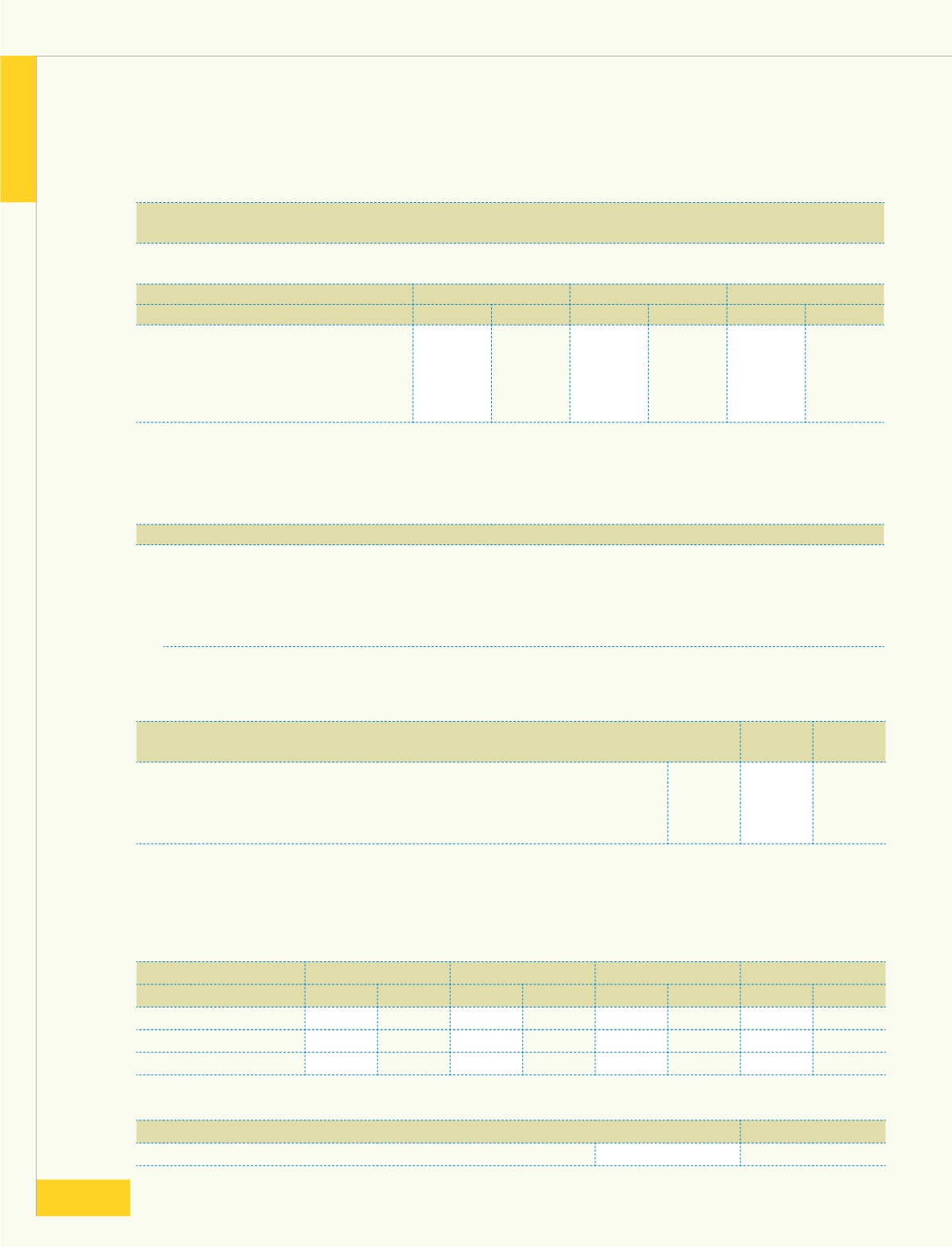

Business secondary - geographical by customers

(Rs crores)

Particulars

In India

Outside India

Total

2009-10 2008-09 2009-10 2008-09 2009-10 2008-09

Segment revenue

712.48 652.58 513.48 576.04 1,225.96 1,228.62

Carrying cost of assets by

location of assets

1,017.16 959.95 98.06 100.69 1,115.22 1,060.64

Addition to assets and

intangible assets

20.68 46.15

-

-

20.68 46.15

Other disclosure

1 Segments have been identified in line with the Accounting Standard - 17 “Segment Reporting” taking into

account the organisation structure as well as the differing risks and returns.

2 Company has disclosed business segment as the primary segment.

3 Composition of business segment:

Name of segment

Comprises

(a) Colors

Dyes and Intermediates

(b) Speciality chemicals and others Agro chemicals, Agro Products, Pharmaceuticals, Polymers, Other

Chemicals and Aromatic Compounds and Cresols

4 The Segment revenue, results, assets and liabilities include respective amounts identifiable to each of the

segment and amounts allocated on reasonable basis.

12 Earning Per Share

Earning per Share (EPS) - The numerators and denominators used to calculate basic and diluted Earning per Share:

Particulars

March

31, 2010

March

31, 2009

Profit for the year attributable to the equity shareholders

Rs crores

56.81 37.87

Basic | weighted average number of equity shares outstanding during the year

29661733 29661733

Nominal value of equity share

Rs

10

10

Basic and diluted Earning per Share

Rs

19.15 12.77

13 Lease

(a) The Company has taken various residential and office premises under operation lease or leave and license

agreements. These are generally cancellable, having a term between 11 months and 3 years and have no specific

obligation for renewal. Payments are recognised in the Profit and Loss Account under "Rent" in Schedule 15.

(b) The Company has given a building and plant and machinery on operating lease, the details of which are as under:

Assets

Gross block

Depreciation fund Written down values Depreciationfortheyear

2009-10 2008-09 2009-10 2008-09 2009-10 2008-09 2009-10 2008-09

Buildings

0.04 0.04 0.04 0.04

-

-

-

Plant andmachinery

1.27

1.27

0.74

0.61

0.53

0.66

0.13

0.13

Total

1.31

1.31

0.78

0.65

0.53

0.66

0.13

0.13

The future minimum lease payments to be received under the non-cancellable leases are as follows:

(Rs crores)

Particulars

As at March 31, 2010 As at March 31, 2009

Not later than one year

-

0.24

Schedule

forming part of the accounts

91