Corporate Identity Serving Diverse Industries Purpose and Values Overview by the Chairman Operational Highlights Financial Analysis Research and Technology

Safety, HealthandEnvironment Serving the Society Directors’ Report Management Discussion andAnalysis Report on Corporate Governance

Financial Statements

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

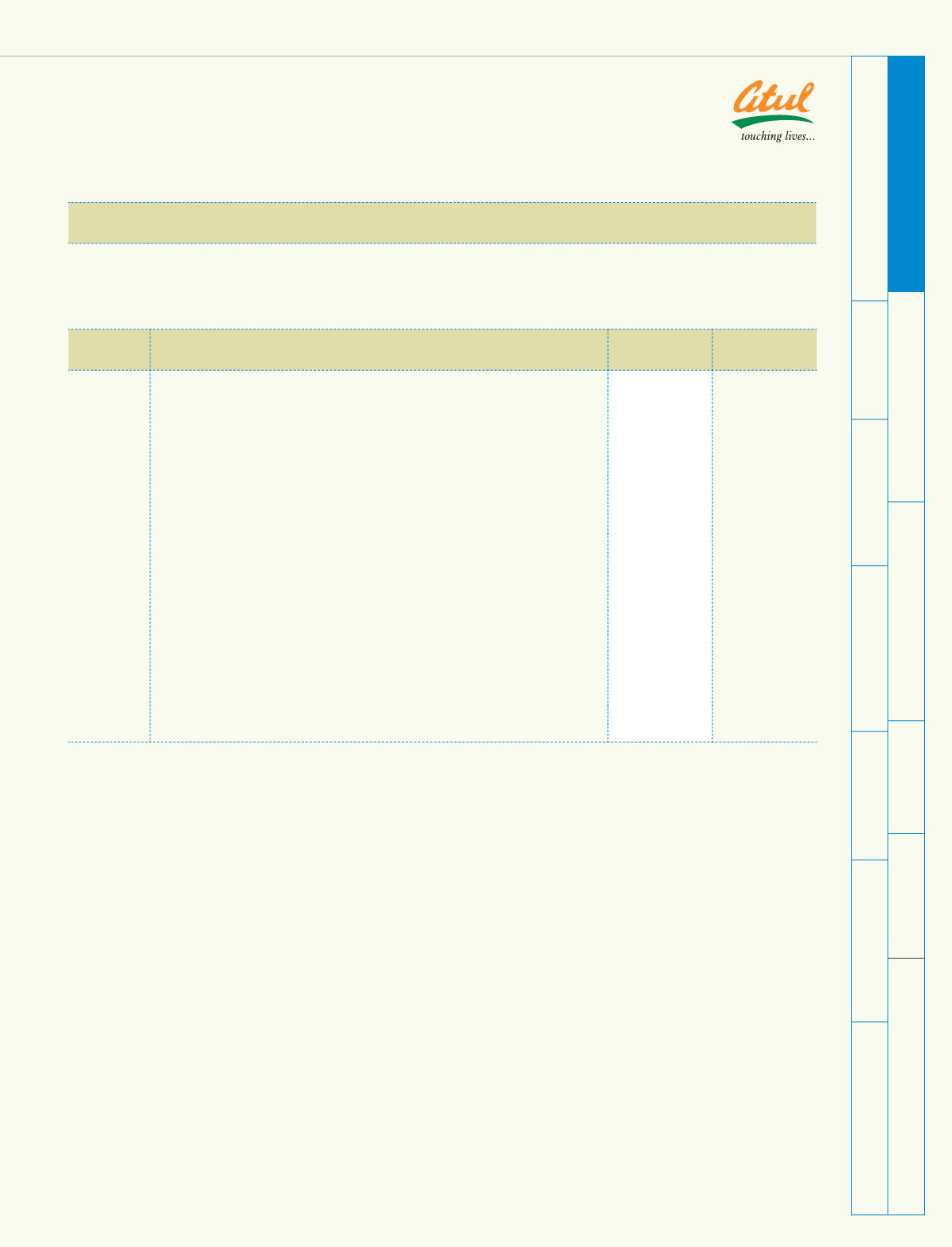

14 Micro, Small and Medium Enterprise dues

Sundry creditors include Rs 0.20 crore due to Micro, Small and Medium Enterprise. Following is the information,

required to be furnished as per Section 22 of the Micro, Small and Medium Enterprise Development Act, 2006.

(Rs crores)

No Particulars

As at

March 31, 2010

As at

March 31, 2009

(a) The principal amount and the interest due thereon remaining unpaid to

any supplier at the end of each accounting year;

Principal

0.20

0.23

Interest

-

0.01

(b) The amount of interest paid by the buyer in terms of section 16 of the

Micro, Small and Medium Enterprise Development Act, 2006, along with

the amounts of the payment made to the suppliers beyond the

appointed day during each accounting year;

-

-

(c) The amount of interest due and payable for the period of delay in making

payment (which have been paid but beyond the appointed day during

the year) but without adding the interest specified under the Micro, Small

and Medium Enterprise Development Act, 2006;

-

0.01

(d) The amount of interest accrued and remaining unpaid at the end of

accounting year; and

-

0.01

(e) The amount of further interest remaining due and payable even in the

succeeding years, until such date when the interest dues as above are

actually paid to the small enterprise, for the purpose of disallowance

as a deductible expenditure under section 23 of the Micro, Small and

Medium Enterprise Development Act, 2006;

-

-

Above disclosures have been made based on information available with the Company, for suppliers who are

registered as Micro, Small and Medium Enterprise under "The Micro, Small and Medium Enterprise Development

Act, 2006" as at March 31, 2010.

15 Provision for Contingency represents provision made for irrecoverable Loans and Advances created by way of

utilisation of Capital Redemption Reserve Account totally and Security PremiumAccount partly in terms of Order dated

February 01, 2005 passed by the Honourable High Court of Gujarat.

16 The use of Derivative instruments is governed by the policies of the Company approved by the board of Directors,

which provide written principles on the use of such financial derivatives consistent with the Company's risk

management strategy.

(a) The Company has entered into the following derivatives:

(1) The Company uses foreign currency forward contracts to hedge its risks associated with foreign currency

fluctuations relating to certain firm commitments and highly probable forecast transactions.

Schedule

forming part of the accounts