Application of Funds

Fixed Assets

During the year, the Company invested

`

22 crores in

fixed assets. The segment-wise spends are outlined

below:

Depreciation

Depreciation increased by 3% over the previous year,

corresponding to the increase in plant, machinery and

building. Cumulative depreciation as a part of total

gross block was 60%.

Investments

The Company invested most of its operational surplus

in its business except for

`

8.30 crores invested for

acquiring strategic shareholding in new businesses.

An amount of

`

10 crores was invested as Promoter’s

contribution in the form of Preference Shares (by

conversion of loans already made) in an associate

company. Other investments remained unchanged at

`

65 crores.

Inventories

Inventories constituted 35% of the current assets as

on March 31, 2011. Inventories increased by 23% to

`

261 crores mainly due to increase in sales of 29%.

Inventories holding days reduced by 3 days to 63

days.

`

crores

Segment

Life Science Chemicals

Performance & Other Chemicals

Unallocable

5

11

6

12 I 13

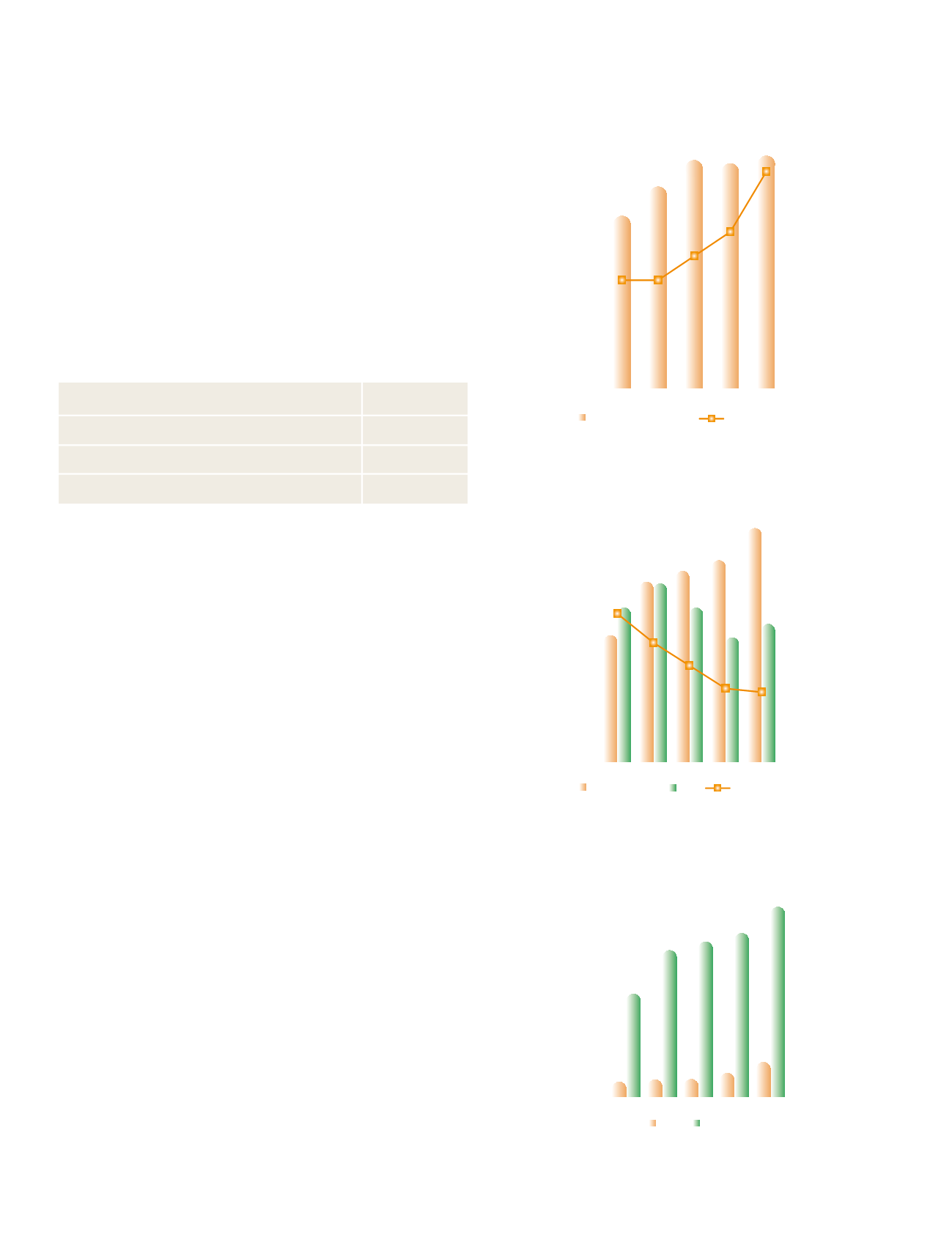

0

100

200

300

400

500

600

700

800

900

2010-11

2009-10

2008-09

2007-08

2006-07

0

2

4

6

8

10

12

14

16

18

20

Return on Average Capital Employed

613

9% 9%

11%

13%

18%

`

crores

%

722

822

810

837

Average Capital Employed+

Return on Average

Capital Employed %+*

+ Excluding capital work in progress

* Excluding exceptional income | expenses

0

100

200

300

400

500

600

2010-11

2009-10

2008-09

2007-08

2006-07

0.0

0.5

1.0

1.5

2.0

Debt-Equity

300

1.23

0.99

0.80

0.61 0.58

`

crores

369

428

368

295

328

433

459

485

567

Debt

Shareholders’Equity

Debt-Equity Ratio

0

50

100

150

200

250

2010-11

2009-10

2008-09

2007-08

2006-07

EPS and Book Value per Share

101

10

12

13

19

30

146

155

164

191

Book value

EPS

CAGR

EPS - 35%

BookValue - 16%

`