Atul Ltd | Annual Report 2010-11

Schedules

forming part of Profit and Loss Account for the

year ended March 31, 2011

(

`

crores)

(

`

crores)

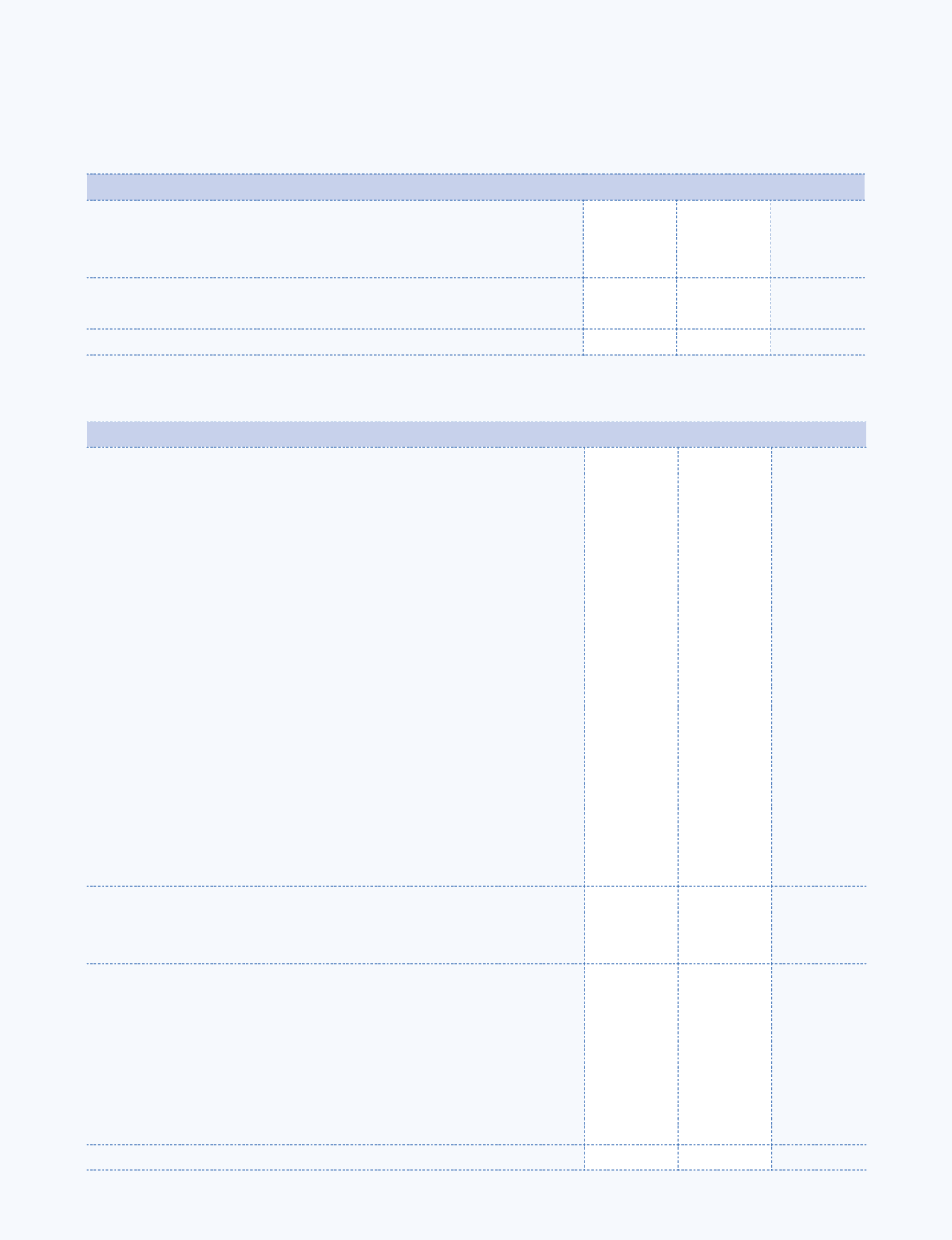

SCHEDULE 15 OTHERS

2010-11

2009-10

Rent

1.25

1.14

Rates and taxes

0.76

1.06

Insurance

2.24

2.33

Freight, cartage and octroi

44.33

30.61

Discount on sales

14.93

10.59

Cash discount

7.90

7.60

Commission to others

11.77

8.15

Brokerage

0.02

0.04

Travelling and conveyance

9.13

7.18

Payments to Statutory Auditors

0.40

0.42

Payments to Cost Auditors

0.02

0.02

Directors’ fees and travelling

0.27

0.22

Directors’ commission (other than Managing and Whole time Director)

0.50

0.27

Charities and donations

0.37

0.31

Bad debts and irrecoverable balances written off

1.47

17.79

Less: Provisions made in earlier years in respect of amounts

written off during the year, adjusted as per contra

–

16.16

1.47

1.63

Irrecoverable loans and advances written off

2.75

–

Less: Adjusted against provision for contingencies

2.75

–

–

–

Provision for diminution in value of investments

–

0.11

Provision for doubtful debts

0.41

–

Miscellaneous expenses

42.87

35.47

Obsolete and unserviceable material written down

0.61

1.87

Loss on assets sold, discarded or demolished

1.96

0.42

Debits relating to earlier years

0.07

0.59

141.28 110.03

SCHEDULE 14 INTEREST AND FINANCE CHARGES

2010-11

2009-10

Interest

On fixed loans*

18.16

21.98

Others

6.60

3.21

24.76

25.19

Discounting charges

0.70

0.50

25.46

25.69

* Includes

`

0.04 crore (Previous year

`

0.03 crore) being the interest paid to Chairman & Managing Director