(

`

crores)

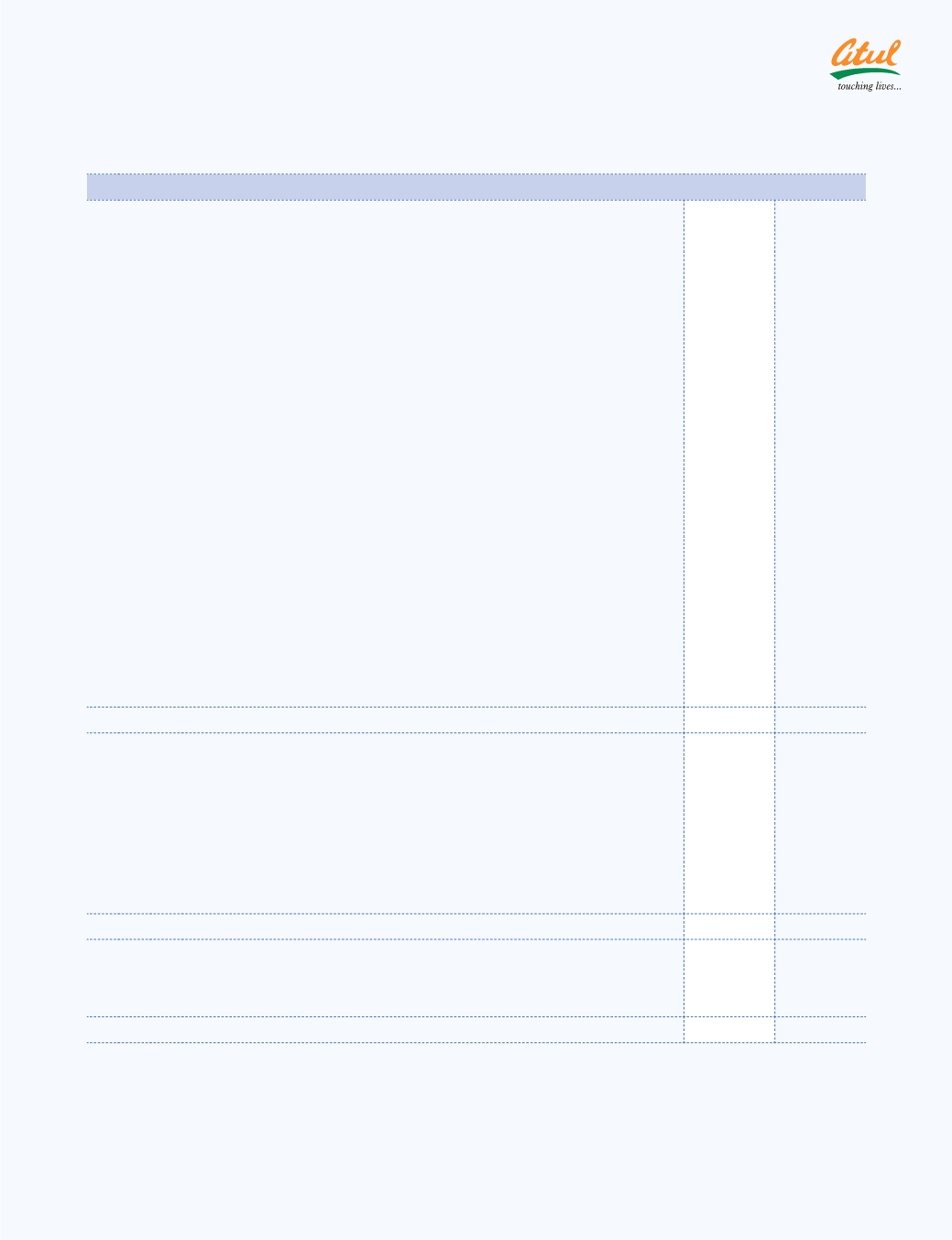

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

2010-11 2009-10

1 Contingent liabilities not provided for in respect of

(a) Disputed excise demands - matter under appeal

21.89

13.92

(b) Disputed customs demands - matter under appeal

16.68

11.99

(c) Disputed water charges - matter under appeal

65.50

61.96

Pursuant to the order passed by Honourable High Court of Gujarat, dated

November 17, 2008 and April 17, 2009 in case of disputed water charges, the

Company has created first charge over its certain land & buildings in favour of

Government of Gujarat.

(d) Claims against the Company not acknowledged as debts

11.96

11.52

(e) Income tax demands (including interest) - matter under appeal

25.50

18.72

(f) Sales tax - matter under appeal

0.74

1.31

(g) Guarantees given by the Company’s bankers (guarantees have been given by

the bankers of the Company in the normal course of business and are not

expected to result in any liability on the Company)

43.11

24.75

Note: Future cash outflows in respect of (a) to (f) above are determinable on

receipt of judgements | decisions pending with various forums | authorities.

2 Estimated amount of contracts remaining to be executed on capital accounts and

not provided for (net of advances)

19.70

2.30

3 Profit and Loss Account includes expenditure on Research & Development as under:

Materials consumed

0.11

0.31

Other expenditure

7.65

8.94

7.76

9.25

4 Payments to Auditors

(a) Statutory Auditors:

(i) As Auditors

0.21

0.21

(ii) In other capacity:

For tax audit

0.06

0.06

For other matters

0.12

0.13

(iii) For expenses

0.01

0.02

0.40

0.42

(b) Cost Auditors:

(i) As Auditors

0.02

0.02

(ii) For expenses

`

11,391 (Previous year

`

7,443)

0.02

0.02

Schedules

forming part of the accounts

72 | 73