129

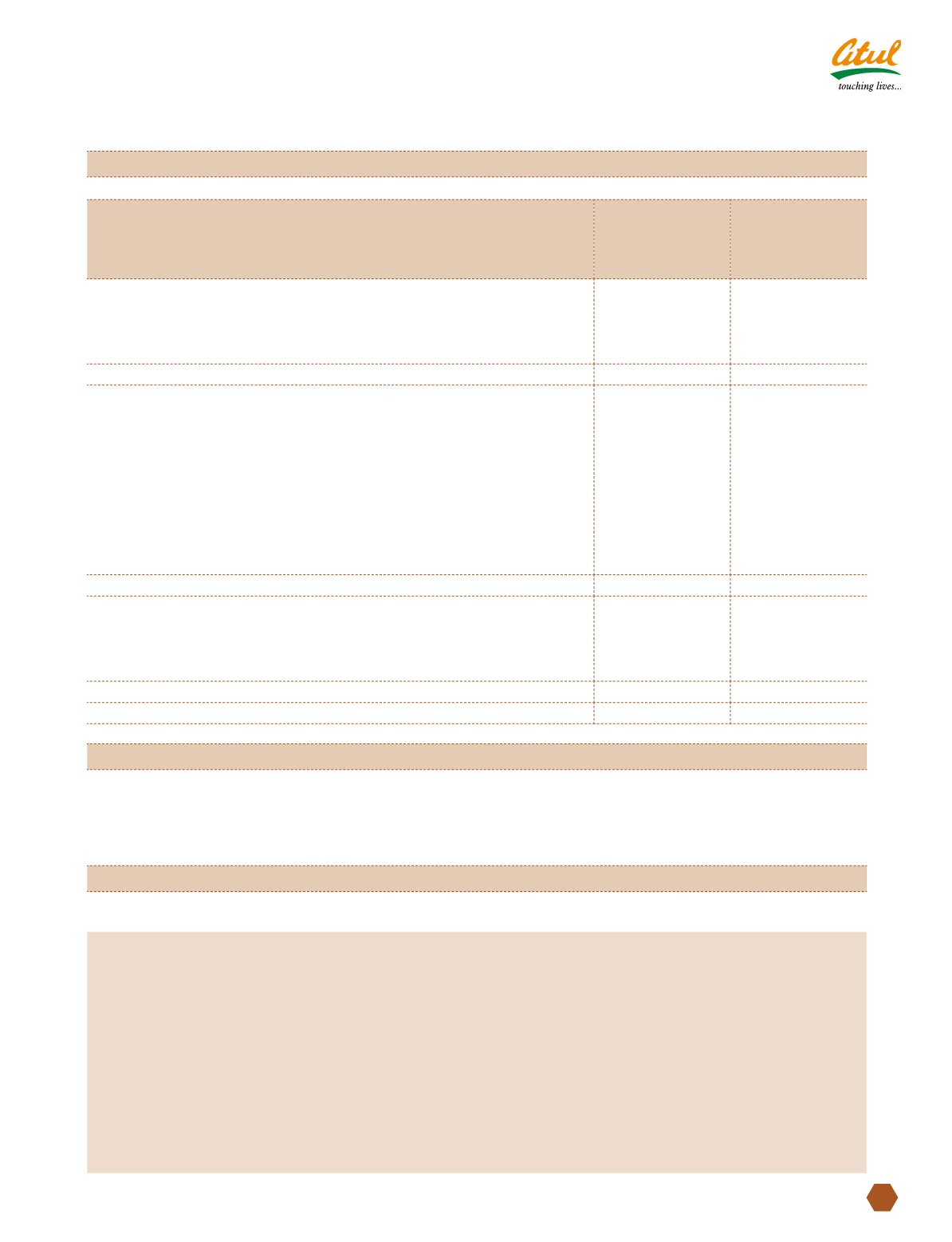

Particulars

For the period

August 18, 2011

to March 31,

2012

As at

March 31, 2011

Statement of Profit and Loss

Revenue

Revenue from operations

2.81

-

Other income

0.01

-

Total revenue

2.82

-

Expenses

Cost of materials consumed

1.67

-

Purchase of stock-in-trade

-

-

Changes in inventories of finished goods, work-in-progress and

stock-in-trade

0.04

-

Employee benefit expenses

0.17

-

Finance costs

0.04

-

Depreciation and amortisation expenses

0.09

-

Other expenses

0.91

-

2.92

-

Profit Before Tax

(0.10)

-

Tax expense

Current tax

0.02

Deferred tax

0.02

0.04

-

Net loss for the period

(0.14)

-

NOTE 27.11 REGROUPED | RECAST | RECLASSIFIED

The financial statements for the year ended March 31, 2011 were prepared as per the applicable, pre-revised

Schedule VI to the Companies Act, 1956. Consequent to the notification of Revised Schedule VI under the Companies

Act, 1956, the financial statements for the year ended March 31, 2012 are prepared as per Revised Schedule VI.

Accordingly, previous year figures have also been restated to conform to this year’s classification.

NOTE 27.12 ROUNDING OFF

Figures less than

`

50,000 has been shown at actual in bracket.

(

`

cr)

As per our attached report of even date

For and on behalf of the Board of Directors

For Dalal & Shah

Firm Registration No. 102020W

Sunil S Lalbhai

Chartered Accountants

Chairman & Managing Director

G S Patel

S S Baijal

B S Mehta

H S Shah

S Venkatesh

S M Datta

Partner

R A Shah

Samveg A Lalbhai

Membership No. F-037942

T R Gopi Kannan

V S Rangan

Managing Director

Mumbai

President, Finance &

B N Mohanan

Mumbai

May 15, 2012

Company Secretary

Directors

May 15, 2012

Notes

to Consolidated financial statements

NOTE 27.10 INTEREST IN JOINT VENTURE COMPANY

(contd)