91

Notes

to financial statements

(

`

cr)

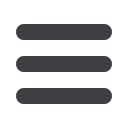

NOTE 27.6 (C) Details of material transactions with related parties

No Name of the related party Subsidiary

companies

Joint

Venture

Company

Associate

companies

Enterprises over

which control

exercised by key

management

personnel

Enterprises

over which

significant

influence

exercised

Key

management

personnel

Relatives

of key

management

personnel

Welfare

funds

2 Receivables

–

–

–

–

–

–

Atul Europe Ltd

30.98

–

–

–

–

–

–

–

(27.75)

–

–

–

–

–

–

–

Atul USA Inc (formerly known

as Atul Americas Inc)

17.79

–

–

–

–

–

–

–

(15.24)

–

–

–

–

–

–

–

Ameer Trading Corporation Ltd

7.69

–

–

–

–

–

–

–

(13.40)

–

–

–

–

–

–

–

Amal Ltd

–

–

19.88

–

–

–

–

–

–

–

(15.26)

–

–

–

–

–

Related party relation is as identified by the company on the basis of information available with the management and relied upon by the Auditors.

* Preference Shares have been issued by Amal Ltd worth

`

10.00 cr in terms of BIFR order.

(contd)

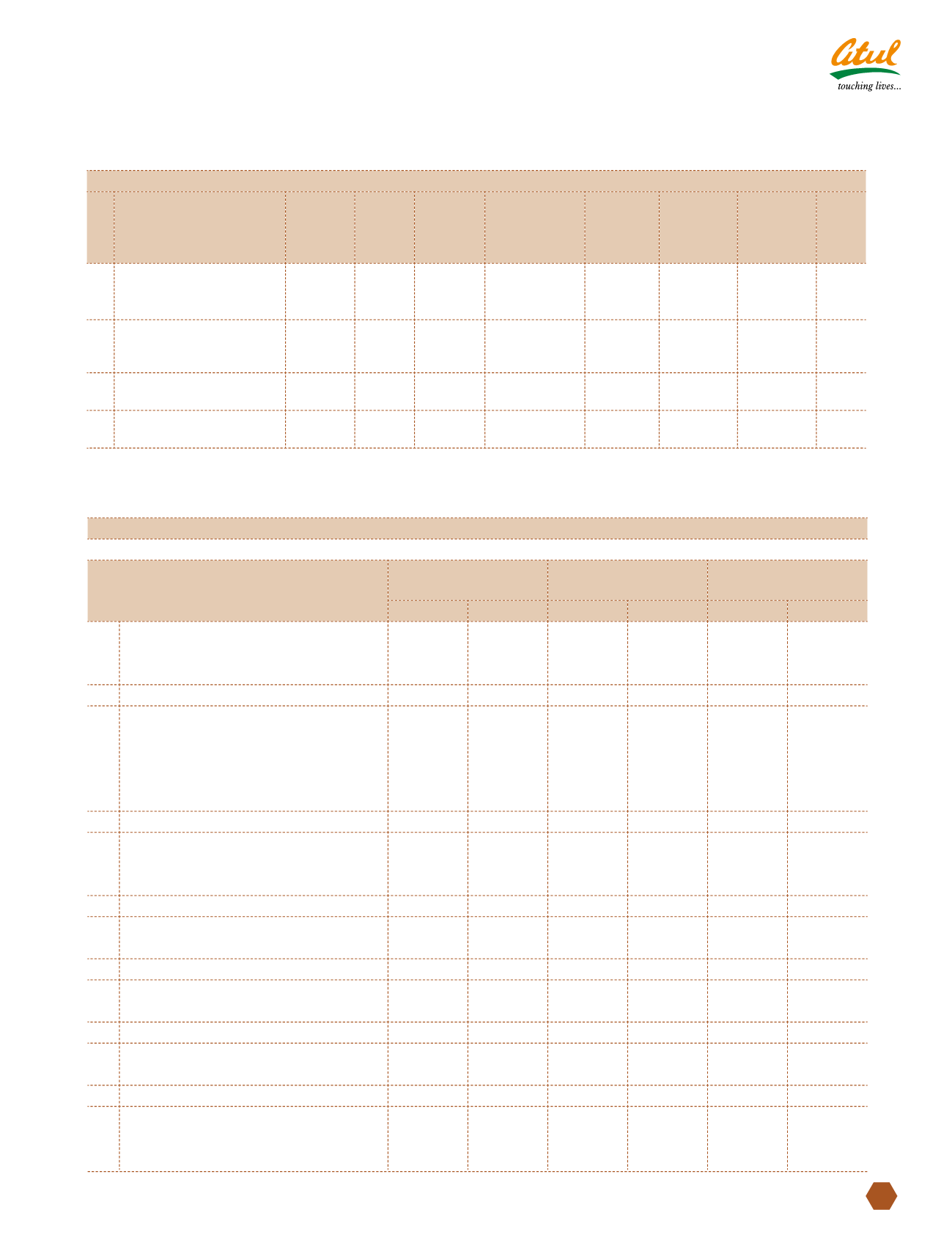

NOTE 27.7 SEGMENT INFORMATION

(a) Primary Segment – Business

(

`

cr)

Particulars

Life Science

Chemicals

Performance &

Other Chemicals

Total

2011-12 2010-11 2011-12 2010-11 2011-12 2010-11

1 Segment revenues

Gross sales

652.87 530.26 1,364.14 1,184.02 2,017.01 1,714.28

Less: Inter segment revenues

-

- 132.46 120.03 132.46 120.03

Net revenues from operations

652.87 530.26 1,231.68 1,063.99 1,884.55 1,594.25

2 Segment results

Profit before finance cost and tax

108.37

90.24

77.57

73.85 185.94 164.09

Finance cost

43.10

26.22

Other unallocable expenditure

20.36

(1.30)

(net of unallocable income)

Profit before tax

122.48 139.17

3 Other information

Segment assets

346.10 266.16 760.10 686.50 1,106.20 952.66

Unallocated common assets

339.86 293.21

Total assets

1,446.06 1,245.87

Segment liabilities

91.50

79.46 258.97 204.87 350.47 284.33

Unallocated common liabilities

65.32

67.24

Total liabilities

415.79 351.57

Capital expenditure

32.90

6.16

65.85

39.20

98.75

45.36

Unallocated capital expenditure

6.58

1.53

Total capital expenditure

105.33

46.89

Depreciation

10.25

9.05

28.95

27.02

39.20

36.07

Unallocated depreciation

4.45

2.47

Total depreciation

43.65

38.54

Significant non-cash expenses

-

-

-

-

-

-

Significant unallocated non-cash expenses

-

-

Total significant non-cash expenses

-

-