Atul Ltd | Annual Report 2013-14

(

`

cr)

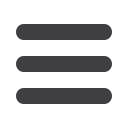

NOTE 27.10 LOANS AND ADVANCES IN THE NATURE OF LOANS

Particulars

Amount outstanding as at

Maximum balance during the year

March 31, 2014 March 31, 2013 2013-14

2012-13

(i) Subsidiary Company:

Ameer Trading Corporation Ltd

4.12

3.76

4.12

7.69

Atul Bioscence Ltd

4.30

4.30

4.30

4.30

(ii) Associate Company:

Amal Ltd

14.88

14.88

14.88

14.88

(iii) Loan to other:

Atul Club

1.42

1.42

1.42

1.42

Notes:

(a) No repayment schedule for (iii)

(b) Loans given to employees as per the policy of the Company are not considered.

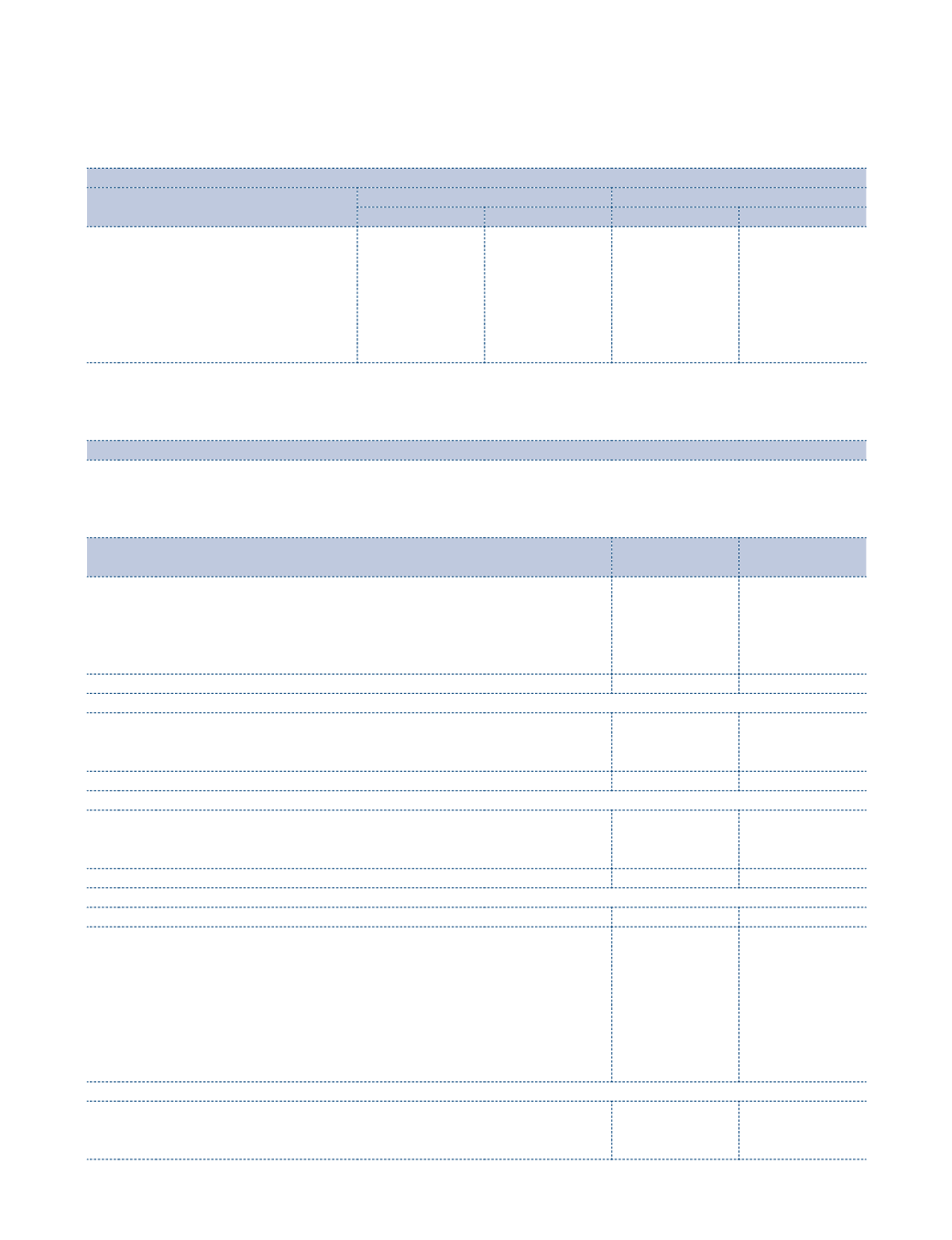

NOTE 27.11 EMPLOYEE BENEFITS

Funded schemes

(a) Defined benefit plans:

Expenses recognised for the year ended on March 31, 2014 (included in Note 24)

(

`

cr)

Particulars

2013-14

2012-13

Gratuity

Gratuity

1 Current service cost

1.92

1.75

2 Interest cost

3.30

3.08

3 Expected return on plan assets

(3.62)

(3.17)

4 Employer contribution (receipt)

–

–

5 Actuarial losses | (gains)

(0.46)

2.94

Expenses recognised in Statement of Profit and Loss

1.14

4.60

Net assets | (liabilities) recognised in the Balance Sheet as at March 31, 2014

1 Present value of defined benefit obligation

41.79

41.32

2 Fair value of plan assets

41.79

41.32

3 Funded status {surplus | (deficits)}

–

–

Net assets | (liabilities)

–

–

Reconciliation of net assets | (liabilities) recognised in the Balance Sheet as at March 31, 2014

1 Net assets | (liabilities) at beginning of the year

–

(0.66)

2 Employer expenses

1.14

4.60

3 Employer contribution

(1.14)

(3.94)

Net assets | (liabilities) at the end of the year

–

–

Actual return on plan assets

3.68

3.46

Actuarial assumptions

1 Discount rates

9.29%

8.00%

2 Expected rate of return on plan assets

8.70%

8.76%

3 Expected rate of salary increase

7.00%

7.00%

4 Mortality post-retirement

Indian Assured

Lives Mortality

(2006-08)

Ultimate

Indian Assured

Lives Mortality

(2006-08)

Ultimate

Major category of plan assets as a % of total plan

1 Unit linked insurance plan of various private insurance companies

approved by IRDA

74.29%

88.98%

2 In approved Government securities

25.71%

11.02%

Notes

to the Financial Statements