101

NOTE 27.11 EMPLOYEE BENEFITS

(contd)

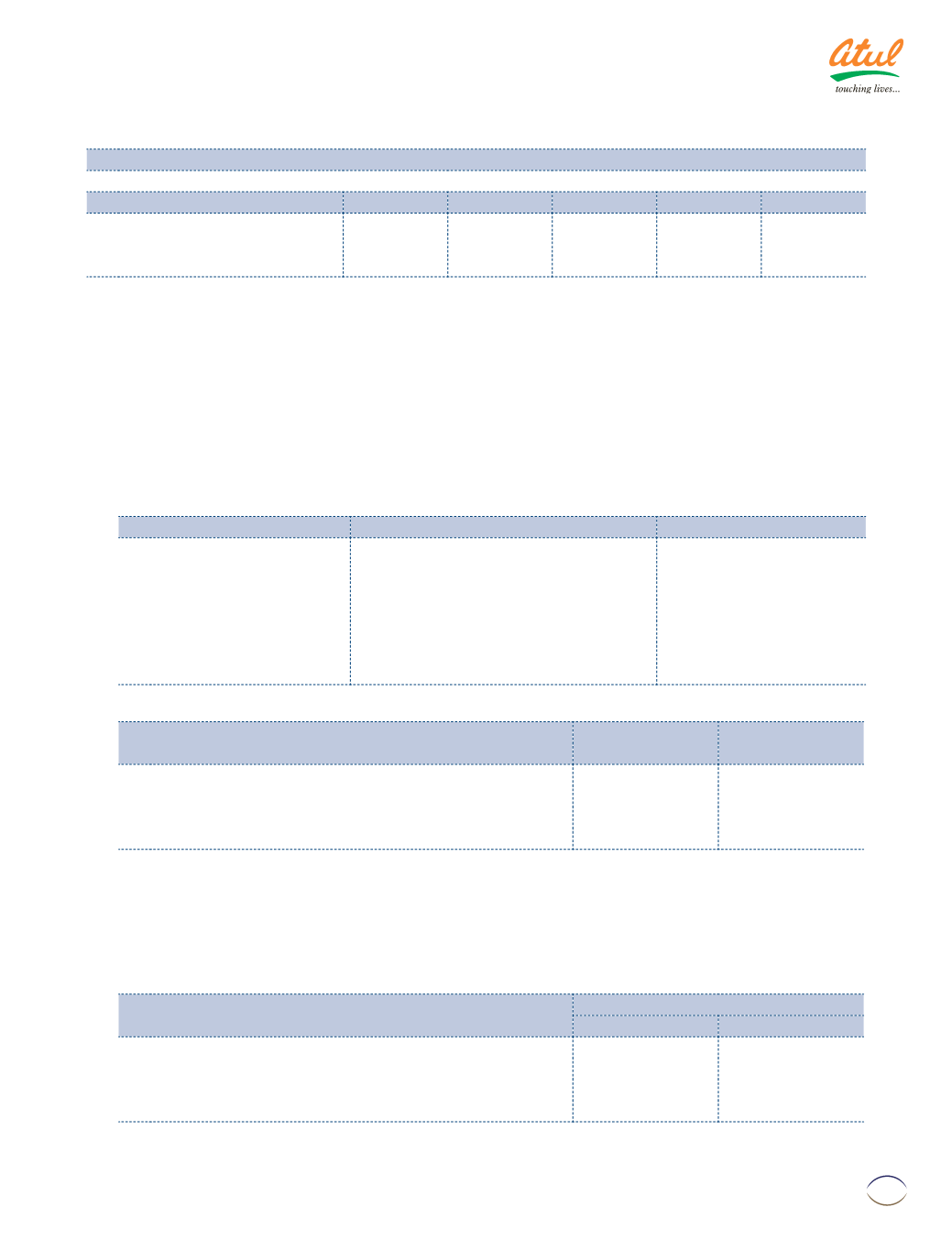

Experience adjustments

(

`

cr)

Particulars

2013-14 2012-13 2011-12 2010-11 2009-10

Experience adjustments on:

1 (Gain) | loss on plan liabilities

0.40

1.35

(0.01)

3.82

2.96

2 (Gain) | loss on plan assets

(0.06)

(0.29)

1.80

0.53

2.63

The Company expects to contribute

`

2.27 cr to Gratuity fund in the year 2014-15.

(b) Defined contribution plan:

Amount of

`

8.53 cr (Previous year:

`

8.24 cr) is recognised as expense and included in the Note 24 ‘Contribution

to Provident and Other Funds’.

(c) Provident Fund Liability:

In case of certain employees, the Provident Fund contribution is made to a trust administered by the Company.

In terms of the guidance note issued by the Institute of Actuaries of India, the actuary has provided a valuation

of Provident Fund liability based on the assumptions listed below and determined that there is no shortfall as

at March 31, 2014.

The assumptions used in determining the present value of obligation of the interest rate guarantee under

deterministic approach are:

Particulars

2013-14

2012-13

1 Mortality rate

Indian Assured Lives Mortality (2006-08)

Ultimate

Indian Assured Lives

Mortality (2006-08) Ultimate

2 Withdrawal rates

5% p.a. for all age groups

5% p.a. for all age groups

3 Rate of discount

9.29%

8.00%

4 Expected rate of interest

8.98%

9.03%

5 Retirement age

60 years

60 years

6 Guaranteed rate of interest 8.75%

8.50%

(

`

cr)

Expenses recognised for the year ended on March 31, 2014

(included in Note 24)

As at

March 31, 2014

As at

March 31, 2013

1 Defined Benefit Obligation

7.44

7.13

2 Fund

7.44

7.13

3 Net liability

-

-

4 Charge to the Statement of Profit and Loss during the year

-

0.21

(d) The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority,

promotion and other relevant factors, such as supply and demand in the employment market. Mortality rates

are obtained from the relevant data.

Unfunded Schemes

(

`

cr)

Particulars

Compensated absences

March 31, 2014 March 31, 2013

1 Present value of Unfunded Obligations

21.24

20.03

2 Expense recognised in the Statement of Profit and Loss

3.23

3.55

3 Discount Rate (p.a.)

9.29%

8.00%

4 Salary escalation rate (p.a.)

7.00%

7.00%

Notes

to the Financial Statements