Atul Ltd | Annual Report 2013-14

(

`

cr)

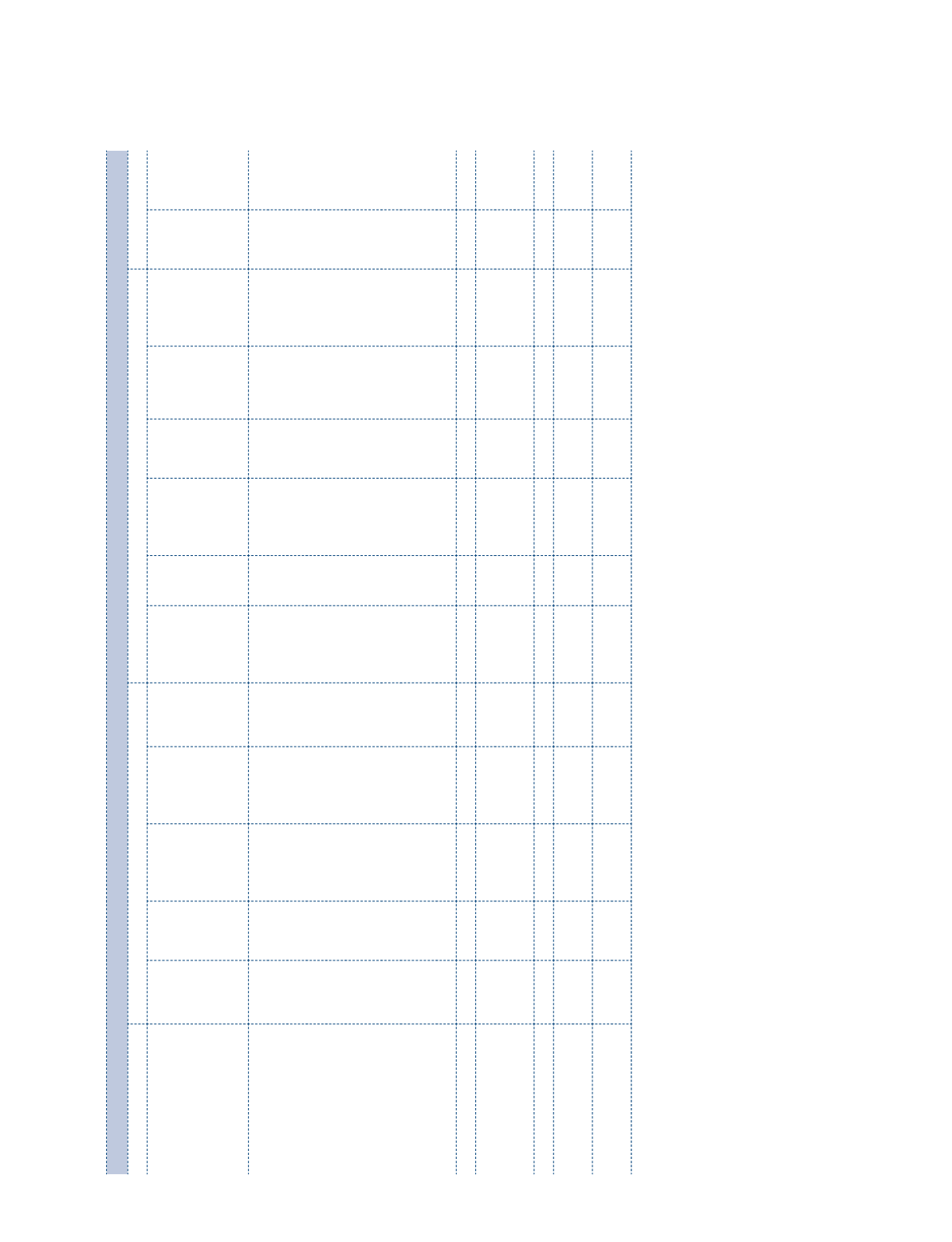

NOTE 12 FIXED ASSETS

ASSET BLOCK

GROSS BLOCK (a)

DEPRECIATION | AMORTISATION | IMPAIRMENT

NET BLOCK

As at

March 31,

2013

Additions

Other

Adjustments

Deductions

and

Adjustments

As at

March 31,

2014

Depreciation

Upto

March 31,

2013

For the

Year

Deductions

and

Adjustments

As at

March 31,

2014

Impairment

Fund

March 31,

2014

Depreciation

and

Impairment

Fund

March 31,

2014

As at

March 31,

2014

As at

March 31,

2013

Tangible assets

Land - Freehold (d)

17.04

4.87

–

0.50

21.41

–

–

–

–

–

– 21.41

17.04

Land - Leasehold (b) and (d)

22.90

–

–

0.55

22.35

–

–

–

–

–

– 22.35

22.90

Buildings (c) and (d)

257.82

15.53

–

9.10

264.25

67.45

7.36

2.15

72.66

–

72.66 191.59 190.37

Roads

3.21

0.10

–

–

3.31

1.30

0.05

–

1.35

–

1.35

1.96

1.91

Plant and equipment (e)

and (f)

833.38

89.04

8.53

11.85

919.10

554.22 48.79

19.80 583.21

21.03

604.24 314.86 258.13

Railway siding

0.08

–

–

–

0.08

0.08

–

–

0.08

–

0.08

–

–

Office equipment and

furniture

28.02

5.55

–

0.17

33.40

19.01

2.37

0.16

21.22

–

21.22

12.18

9.01

Vehicles

14.09

1.45

–

0.62

14.92

8.04

1.69

0.36

9.37

–

9.37

5.55

6.05

Total Tangible assets

1,176.54 116.54

8.53

22.79 1,278.82

650.10 60.26

22.47 687.89

21.03

708.92 569.90 505.41

Intangible assets

Technical know-how

1.10

–

–

–

1.10

0.41

0.35

–

0.76

–

0.76

0.34

0.69

Computer software

12.67

0.27

–

– 12.94

12.64

0.27

– 12.91

–

12.91

0.03

0.03

Total Intangible assets

13.77

0.27

–

– 14.04

13.05 0.62

– 13.67

–

13.67

0.37

0.72

Total as at

March 31, 2014

1,190.31 116.81

8.53

22.79 1,292.86

663.15 60.88

22.47 701.56

21.03

722.59 570.27 506.13

Total as at

March 31, 2013

1,075.37 106.42

11.33

2.81 1,190.31

610.71 53.75

1.31 663.15

21.03

684.18 506.13

Notes:

(a) At cost, except land - freehold, certain leasehold land, building premises and plant and equipment stated at revalued value.

(b) Land - leasehold at cost less amounts written off.

(c) Includes premises on ownership basis

`

1.10 cr (Previous year:

`

1.10 cr) and cost of fully paid share in co-operative society

`

2,000 (Previous year:

`

2,000).

(d) Pursuant to the order passed by Honourable High Court of Gujarat, dated November 17, 2008 and April 17, 2009 in case of water charges, the Company has created first

charge over its certain land and buildings in favour of Government of Gujarat and paid Security Deposit

`

2 cr (Previous year:

`

2 cr).

(e) Exchange rate difference capitalised during the year

`

8.53 cr (Previous year:

`

10.74 cr).

(f) Exchange rate difference which remains unamortised in accordance with the option exercised under Para 46A of Accounting Standard - 11 is

`

16.62 cr (Previous year:

`

11.70 cr).

Notes

to the Consolidated Financial Statements