Atul Ltd | Annual Report 2013-14

Notes

to the Consolidated Financial Statements

(

`

cr)

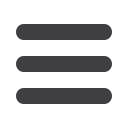

NOTE 13 NON-CURRENT INVESTMENTS

(contd)

As at

March 31, 2014

As at

March 31, 2013

Agrimore Ltd

`

33,000 (Previous year: Nil)

-

Atul Ayurveda Ltd

0.03

0.03

Atul Clean Energy Pvt Ltd

0.01

-

Atul Crop Care Ltd

0.03

0.02

Add: Group share of profit for the year

0.05

0.01

0.08

0.03

Atul Elkay Polymers Ltd

0.03

-

Atul Entertainment Ltd

0.03

0.03

Atul Hospitality Ltd

0.02

0.02

Atul Infotech Pvt Ltd**

0.13

0.01

Add: Group share of profit for the year

-

0.12

Less: Reversal of carrying value on becoming a subsidiary

company

(0.13)

-

-

0.13

Atul Medical Care Ltd

0.03

0.03

Atul (Retail) Brands Pvt Ltd

0.01

-

Atul Seeds Ltd

0.02

0.02

Jayati Infrastructure Ltd

0.03

0.03

Lapox Polymers Pvt Ltd

0.01

-

M. Dohmen S.A.

Cost of acquisition (net of capital reserve of

`

45.72 cr,

Previous year:

`

45.72 cr)

1.21

9.57

Less: Group share of loss for the year

1.21

8.36

-

1.21

Osia Dairy Ltd

0.02

0.02

Osia Infrastructure Ltd

0.02

-

In Others

Nagarjuna Fertilizers and Chemicals Ltd

0.04

0.04

Investments in Preference Shares

In Associate Companies

Amal Ltd (0% Redeemable Preference Shares)

10.00

10.00

Atul Infotech Pvt Ltd**

-

2.75

Investments in Government or Trust Securities

6 Years National Savings Certificates

0.01

0.01

(deposited with Government departments)

62.82

66.71

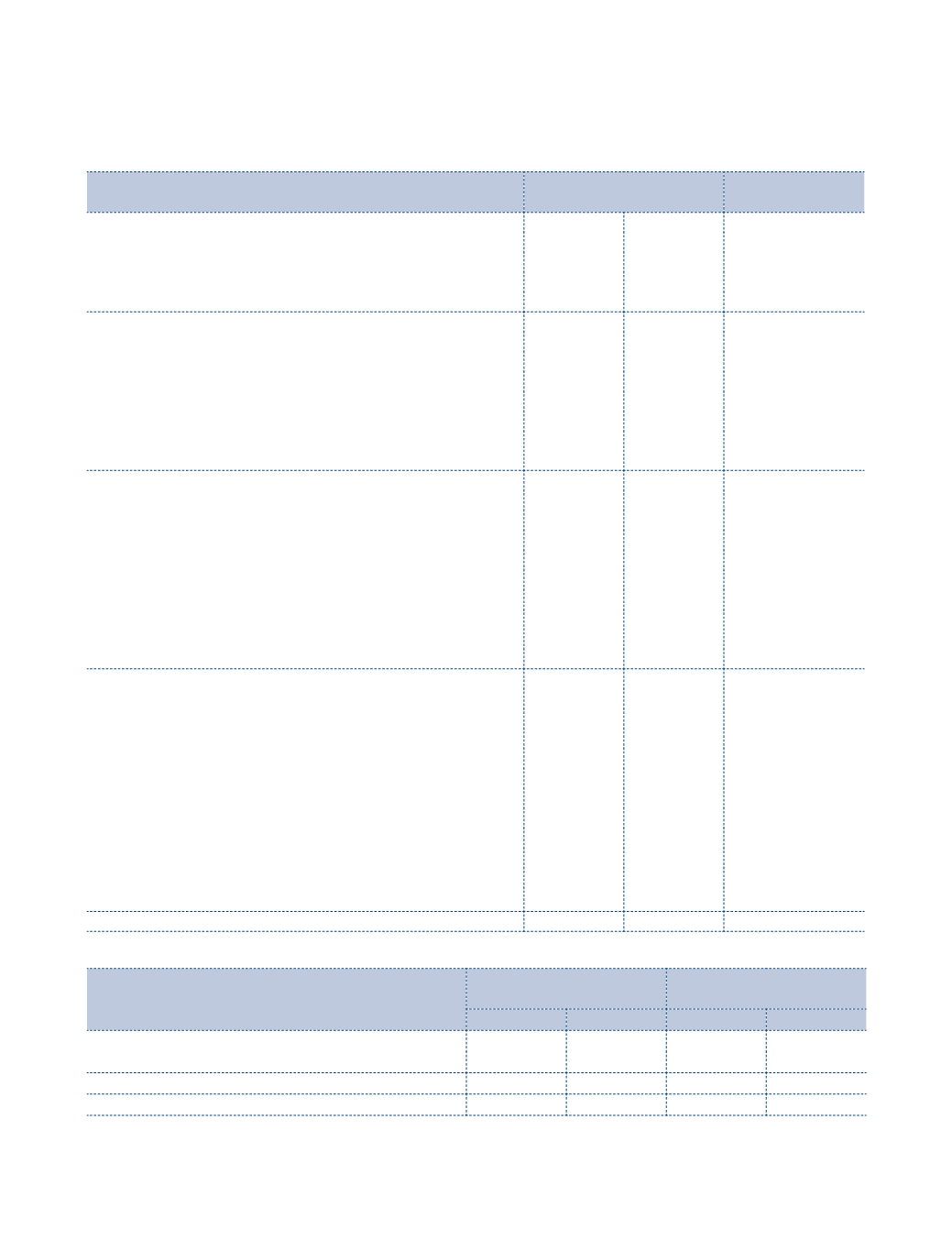

(

`

cr)

Particulars

Book Value

As at March 31,

Market Value

As at March 31,

2014

2013

2014

2013

Quoted

50.16

50.16

236.15

197.27

Unquoted

12.66

16.55

62.82

66.71

Aggregate provision for diminution

1.15

1.15

* Valued at cost unless otherwise stated.

** Became a subsidiary company during the year.