Atul Ltd | Annual Report 2016-17

(

`

cr)

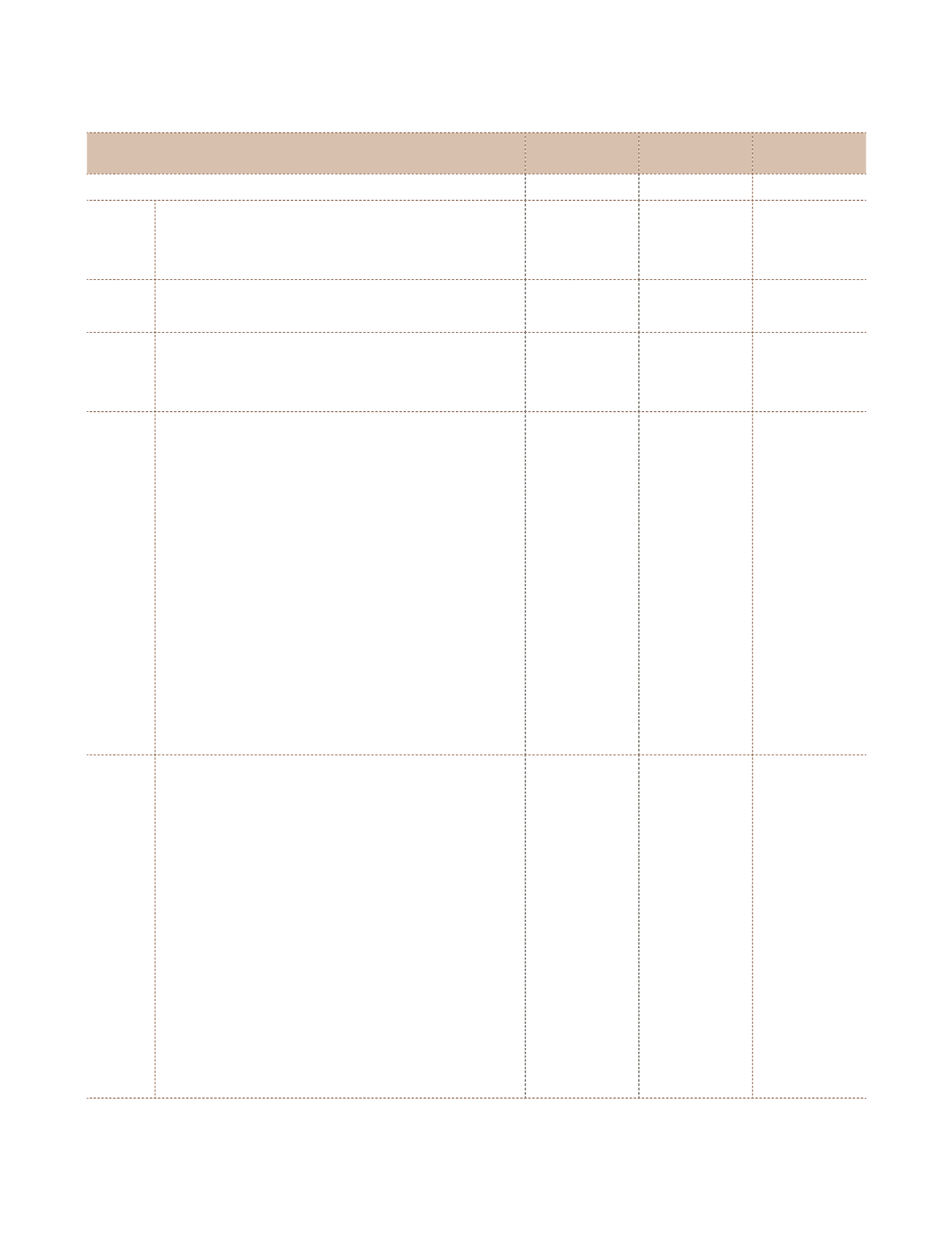

Note 27.4 (H) Outstanding balances as at year end

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

a) With subsidiary companies

01 Loans receivable

15.93

19.18

19.18

Amal Ltd ¹

11.63

14.88

14.88

Atul Bioscience Ltd

2

4.30

4.30

4.30

02 Deposit receivable

2.14

2.14

2.14

Atul Infotech Pvt Ltd

2.14

2.14

2.14

03 Dividend receivable

11.77

–

–

Atul Bioscience Ltd

6.50

–

–

Atul Europe Ltd

5.27

–

–

04 Receivables

92.41

49.37

97.18

Amal Ltd (Current year:

`

49,533)

1.11

5.41

Atul Bioscience Ltd

5.98

6.17

3.30

Atul Biospace Ltd

0.80

0.54

0.03

Atul China Ltd

23.31

1.94

13.31

Atul Crop Care Ltd

0.01

0.01

–

Atul Elkay Polymers Ltd

0.07

0.07

0.10

Atul Europe Ltd

23.34

3.36

27.75

Atul Finserv Ltd

0.01

–

–

Atul Infotech Pvt Ltd (Previous year:

`

43,173)

–

0.05

Atul Middle East FZ-LLC

–

0.88

–

Atul USA Inc

38.89

35.29

47.23

Lapox Polymers Ltd (Previous year:

`

26,390)

–

–

05 Payables

7.66

7.76

7.40

Aasthan Dates Ltd (Current year:

`

20,500)

–

–

Amal Ltd (Previous year:

`

6,384)

3.42

–

Atul Bioscience Ltd

0.03

0.23

0.12

Atul China Ltd

0.17

0.19

0.34

Atul Crop Care Ltd

–

0.71

–

Atul Europe Ltd

2.08

0.96

1.16

Atul Finserv Ltd

3

0.14

2.88

4.23

Atul Infotech Pvt Ltd

0.19

0.07

–

Atul Middle East FZ-LLC

0.01

0.01

–

Atul USA Inc

0.45

1.31

1.52

DPD Ltd

–

0.77

0.03

Lapox Polymers Ltd

1.17

0.63

–

¹ Interest free pursuant to Board for Industrial and Financial Reconstruction Order and including equity component.

2

The Loan to subsidiary is for a periods of 3 years repayable on March, 2018 at interest rate of SBI prevailing market rate.

3

Includes acceptances for bills discounted by third parties.

Notes

to the Financial Statements