Atul Ltd | Annual Report 2016-17

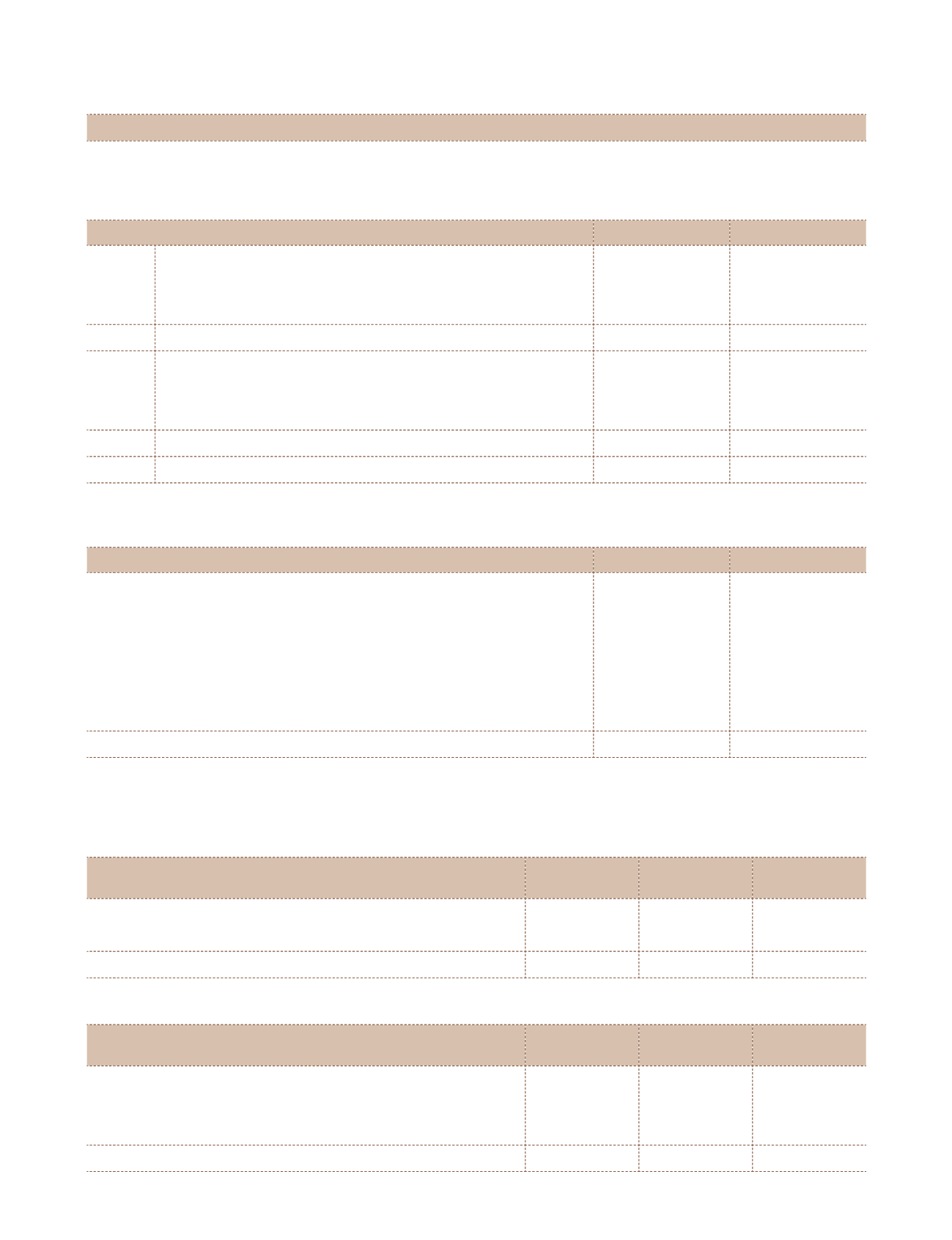

Note 27.5 Current and Deferred tax

The major components of income tax expense for the years ended March 31, 2017 and March 31, 2016 are:

a) Income tax expense

(

`

cr)

Particulars

2016-17

2015-16

i)

Current tax

Current tax on profit for the year

81.80

103.56

Adjustments for current tax of prior periods

(2.07)

–

Total current tax expense

79.73

103.56

ii)

Deferred tax

(Decrease) | Increase in deferred tax liabilities

61.26

22.50

Decrease | (Increase) in deferred tax assets

(25.77)

(0.31)

Total deferred tax expense | (benefit)

35.49

22.19

Income tax expense

115.22

125.75

b) The reconciliation between the statutory income tax rate applicable to the Company and the effective

income tax rate of the Company is as follows:

Particulars

2016-17

2015-16

a) Statutory income tax rate

34.61%

34.61%

b) Differences due to:

i)

Expenses not deductible for tax purposes

0.75%

1.30%

ii)

Income exempt from income tax

(2.17%)

(0.99%)

iii)

Income tax incentives

(3.48%)

(2.94%)

iv)

Others

(0.94%)

(0.55%)

Effective income tax rate

28.77%

31.43%

c) No aggregate amounts of current and deferred tax have arisen in the reporting periods which have been

recognised in equity and not in Statement of Profit and Loss or Other Comprehensive Income.

d) Current tax assets

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Opening balance

3.11

–

–

Add: Tax paid in advance, net of provisions during the year

(3.11)

3.11

–

Closing balance

–

3.11

–

e) Current tax liabilities

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Opening balance

–

5.19

–

Add: Current tax payable for the year

79.73

103.56

80.50

Less: Taxes paid

(77.74)

(108.75)

(75.31)

Closing balance

1.99

–

5.19

Notes

to the Financial Statements