145

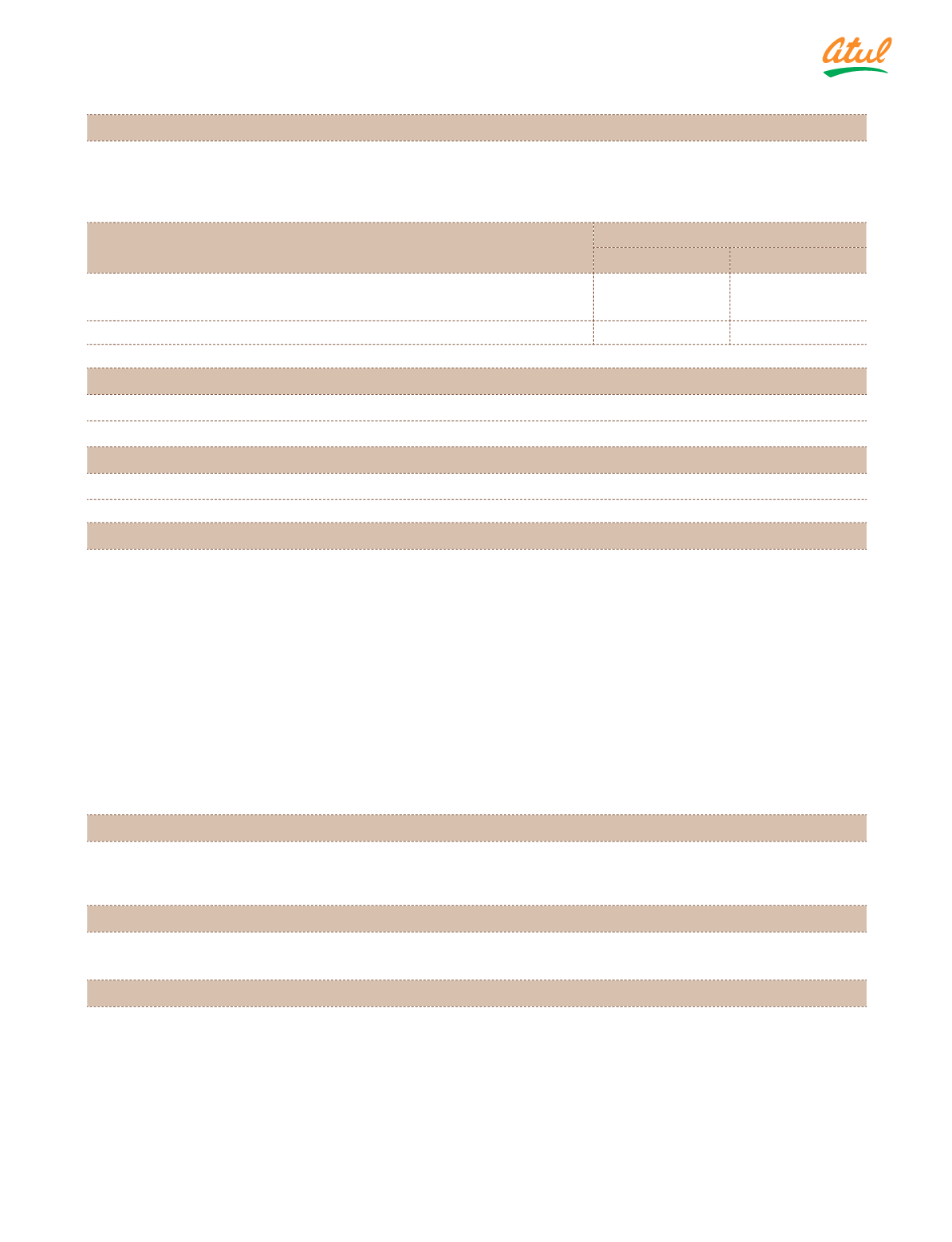

Note 27.17 Exceptional items

Consequent to the capital reduction of £ 1.05 mn in Atul Europe Ltd (AEL), a wholly-owned subsidiary company

of Atul Ltd, following impact has been given to the Financial Statement:

(

`

cr)

Particulars

Income | (Expenses)

2016-17

2015-16

i) Receipt of one-time special dividend (partial redemption of investment)

–

10.38

ii) Reduction in the carrying value of investment in AEL on account of the above

–

(7.71)

Net foreign exchange gain

–

2.67

Note 27.18 Regrouped | Recast | Reclassified

Figures of the earlier year have been reclassified to conform to Ind AS presentation requirements.

Note 27.19 Rounding off

Figures less than

`

50,000 have been shown at actual in brackets.

Note 27.20 Offsetting financial assets and liabilities

The below Note presents the recognised financial instruments that are offset or subject to enforceable master netting

arrangements and other similar Agreements, but not offset as at March 31, 2017, March 31, 2016 and April 01, 2015.

a) Collateral against borrowings

The Company has hypothecated | mortgaged financial instruments as collateral against a number of its borrowings. Refer

to Note 15 for further information on financial and non-financial collateral hypothecated | mortgaged as security against

borrowings.

b) Master netting arrangements – not currently enforceable

Agreements with derivative counterparties are based on an ISDA Master Agreement. Under the terms of these

arrangements, only where certain credit events occur (such as default), the net position owing | receivable to a

single counterparty in the same currency will be taken as owing and all the relevant arrangements terminated. As the

Company does not presently have a legally enforceable right of set-off, these amounts have not been offset in the

Balance Sheet.

Note 27.21 Events occurring after the reporting period

The proposed dividend on Equity shares at

`

10.00 per share is recommended by the Board of Directors which is subject to

the approval of Shareholders in the ensuing Annual General Meeting.

Note 27.22 Authorisation for issue of the Financial Statements

The Financial Statements were authorised for issue by the Board of Directors on May 05, 2017.

Note 27.23 Transition to Ind AS

These are the first Financial Statements of the Company prepared in accordance with Ind AS.

The Accounting Policies set out in Note 1 have been applied in preparing the Financial Statements for the year ended

March 31, 2017, the comparative information presented in these Financial Statements for the year ended March 31, 2016

and in the preparation of an opening Ind AS Balance Sheet as at April 01, 2015 (the date of transition). In preparing its

opening Ind AS Balance Sheet, the Company has adjusted the amounts reported previously in Financial Statements

prepared in accordance with the Accounting Standards notified under Companies (Accounting Standards) Rules, 2006

(as amended) and other relevant provisions of the Act (IGAAP). An explanation of how the transition from IGAAP to Ind AS

has affected the financial position, financial performance and cash flows of the Company is set out in the following tables

and notes:

Notes

to the Financial Statements