149

b)

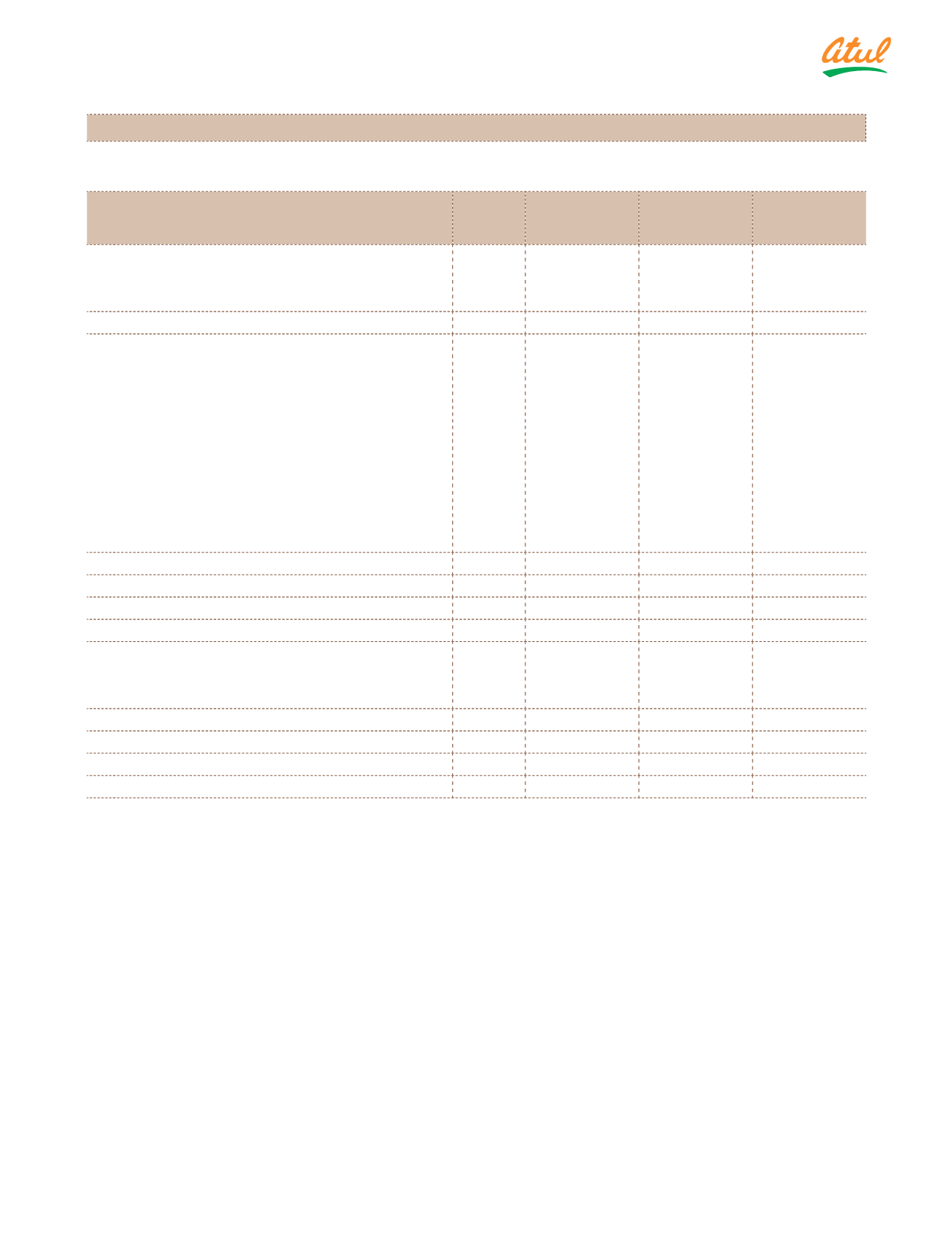

Reconciliation of Total Comprehensive Income for the year ended March 31, 2016

(

`

cr)

Particulars

Note to

first-time

adoption

Regrouped

IGAAP*

Adjustments

Ind AS

INCOME

Revenue from operations

f, j

2,463.99

144.62

2,608.61

Other income

b, h, g

40.65

2.88

43.53

Total income

2,504.64

147.50

2,652.14

Expenses

Cost of materials consumed

1,234.05

–

1,234.05

Purchase of stock-in-trade

19.68

–

19.68

Changes in inventories of finished goods, work-in-

progress and stock-in-trade

(27.66)

–

(27.66)

Excise duty

f

(0.36)

154.47

154.11

Employee benefit expenses

i

172.19

(3.72)

168.47

Finance costs

25.84

–

25.84

Depreciation and amortisation expenses

h

61.69

0.23

61.92

Other expenses

j

628.85

(10.65)

618.20

Total expenses

2,114.28

140.33

2,254.61

Profit before exceptional items and tax

390.36

7.17

397.53

Exceptional items

2.67

–

2.67

Profit before tax from continuing operations

393.03

7.17

400.20

Tax expense

Current tax

i

102.50

1.06

103.56

Deferred tax

e

22.47

(0.28)

22.19

Total tax expense

124.97

0.78

125.75

Profit for the year

268.06

6.39

274.45

Other Comprehensive Income

m

–

(40.97)

(40.97)

Total Comprehensive Income for the year

268.06

(34.58)

233.48

* The IGAAP figures have been reclassified to conform to Ind AS presentation requirements for the purpose of this Note.

c)

Impact of Ind AS adoption on the Standalone Statements of Cash Flows for the year ended March 31,

2016

The transition from IGAAP to Ind AS has not had a material impact on the Statement of Cash Flows.

C) Notes to the reconciliations

a)

Investment property

Under the IGAAP, land, buildings or part thereof were not evaluated for currently determined or undetermined

future use for classification into property, plant and equipment or investment property. Under Ind AS, the Company

has identified certain parcels of freehold land that are held for a currently undetermined future use. These investment

properties are required to be separately presented on the face of the Balance Sheet. There is no impact on the total

equity or profit as a result of this adjustment.

b)

Leases

Under IGAAP, leasehold land was accounted under AS 10 - 'Accounting for fixed assets' . Under Ind AS, leasehold

land is to be evaluated for operating or a finance lease as per the definition and classification criteria under

Ind AS 17.

Accordingly, a combined lease agreement of land and building for 30 years between the Company and its joint

venture that is Rudolf Atul Chemicals Ltd has been assessed for separation into its land and building components.

The building element is recognised as a finance lease while land will remain an operating lease. Present values of

minimum lease payments are allocated between land and building elements based on their relative fair values.

Notes

to the Financial Statements

Transition to Ind AS

(continued)