Atul Ltd | Annual Report 2016-17

The Central Government has, vide notification dated November 28, 2016, notified The Sick Industrial Companies (Special

Provisions) Repeal Act, 2003 effective December 01, 2016. As a result, BIFR and Appellate Authority for Industrial and Financial

Reconstruction (AAIFR) have been abolished and the SICA is repealed by enactment of The Sick Industrial Companies (Special

Provisions) Repeal Act, 2003.

Consequent to the above, the application of SICA which granted BIFR such substantive rights has ceased to be in force

effective December 01, 2016. However, any scheme of revival, which has already been sanctioned by the BIFR in the past and

is under implementation, shall continue to be in force. Since there is no monitoring agency having substantive powers akin to

BIFR preventing Atul Ltd from exercising its unilateral defacto control. Atul Ltd has potential voting rights of 16.11% which will

make its aggregate voting rights to 52.85% (36.74% as at March 31, 2017) in Amal Ltd towards the share application money

which is pending allotment from Amal Ltd. Amal Ltd has applied for in-principle approval from Ahmedabad Stock Exchange

Ltd, Bombay Stock Exchange Ltd and SEBI which is pending as at March 31, 2017. Amal Ltd has been classified as a subsidiary

company as per Ind AS 110 effective December 01, 2016. Ind AS 103 Business Combinations is applicable for accounting

of the event of gaining control. The controlling parties before and after the business combination are different hence, the

business combination is to be performed as per the acquisition method that is the identifiable assets and liabilities acquired

are measured at fair value as on acquisition date.

There is neither any change in the shareholding nor any payment of purchase consideration (including contingent consideration

or indemnification assets) for acquiring control over Amal Ltd. Also there were no costs incurred which were directly

attributable to this business combination. The aggregate effective shareholding of the Group in Amal Ltd continues to be

36.74%. However, the fair value of the previously held equity interests of the Group and fair value of non controlling interests

in Amal Ltd in aggregate exceed the fair value of identifiable assets and liabilities assumed. This has resulted in Goodwill on

the acquisition date that is not deductible for tax purposes.

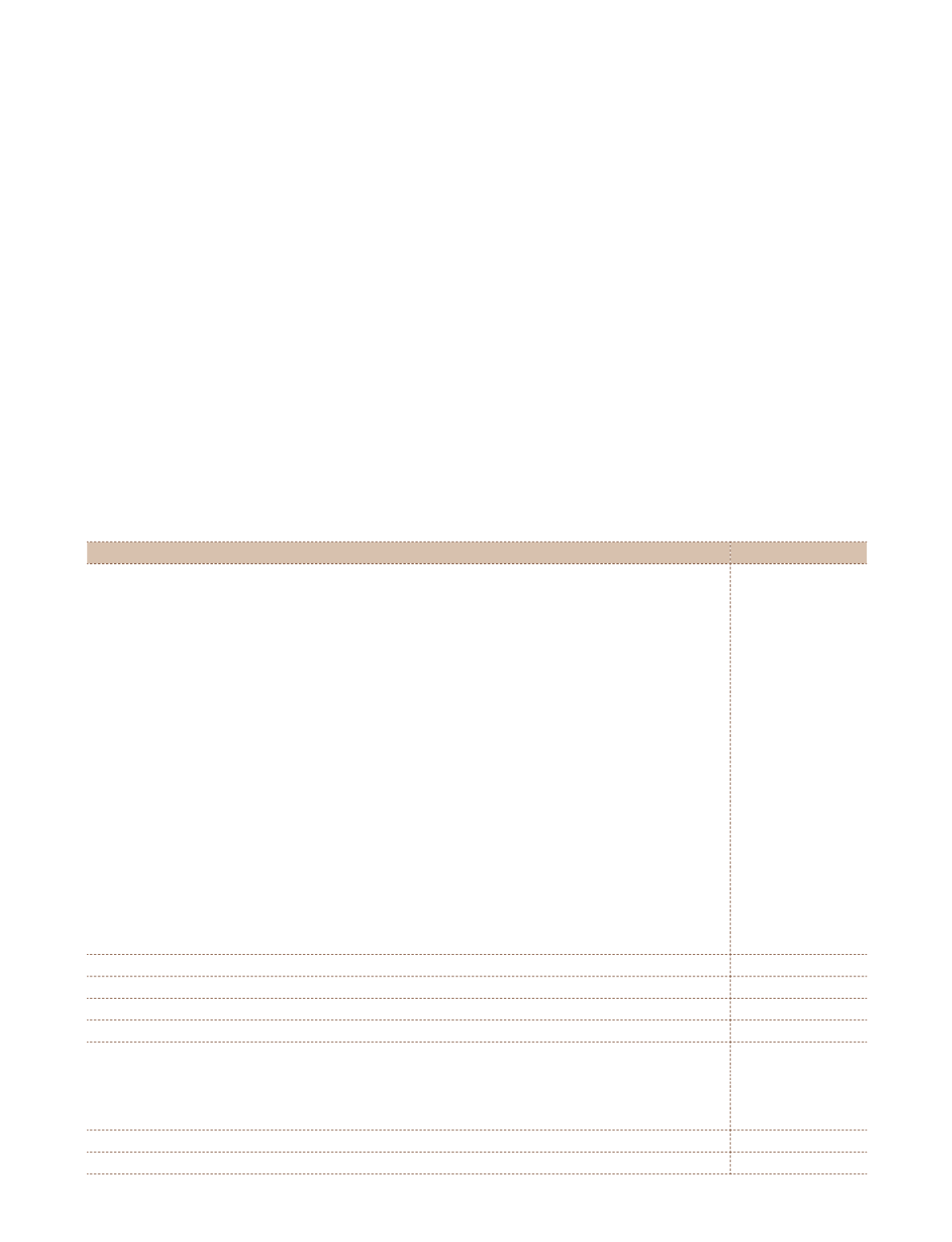

The assets and liabilities recognised as a result of the acquisition are as follows:

(

`

cr)

Particulars

Fair value

Property, plant and equipment

Land - freehold

10.50

Land - leasehold

10.13

Buildings

0.32

Plant and machinery

6.97

Office equipment and furniture

0.01

Investments

0.02

Other financial assets

0.39

Other non-current assets

0.13

Inventories

1.03

Trade receivables

1.33

Cash and cash equivalents

0.75

Other current assets

0.32

Fair value of assets acquired

31.90

Provisions

0.01

Trade payables

1.26

Other financial liabilities

0.60

Other current liabilities

0.59

Fair value of liabilities assumed

2.46

Contingent liabilities

0.41

Net identifiable assets acquired

29.03

Calculation of Goodwill

Consideration transferred

–

Non-controlling interests in Amal Ltd

12.46

Acquisition date fair value of previously held equity interest (including share application money)

30.98

Less: Net identifiable assets acquired

(29.03)

Settlement of pre-existing relationship

9.34

Goodwill

23.75

Notes

to the Consolidated Financial Statements