217

(

`

cr)

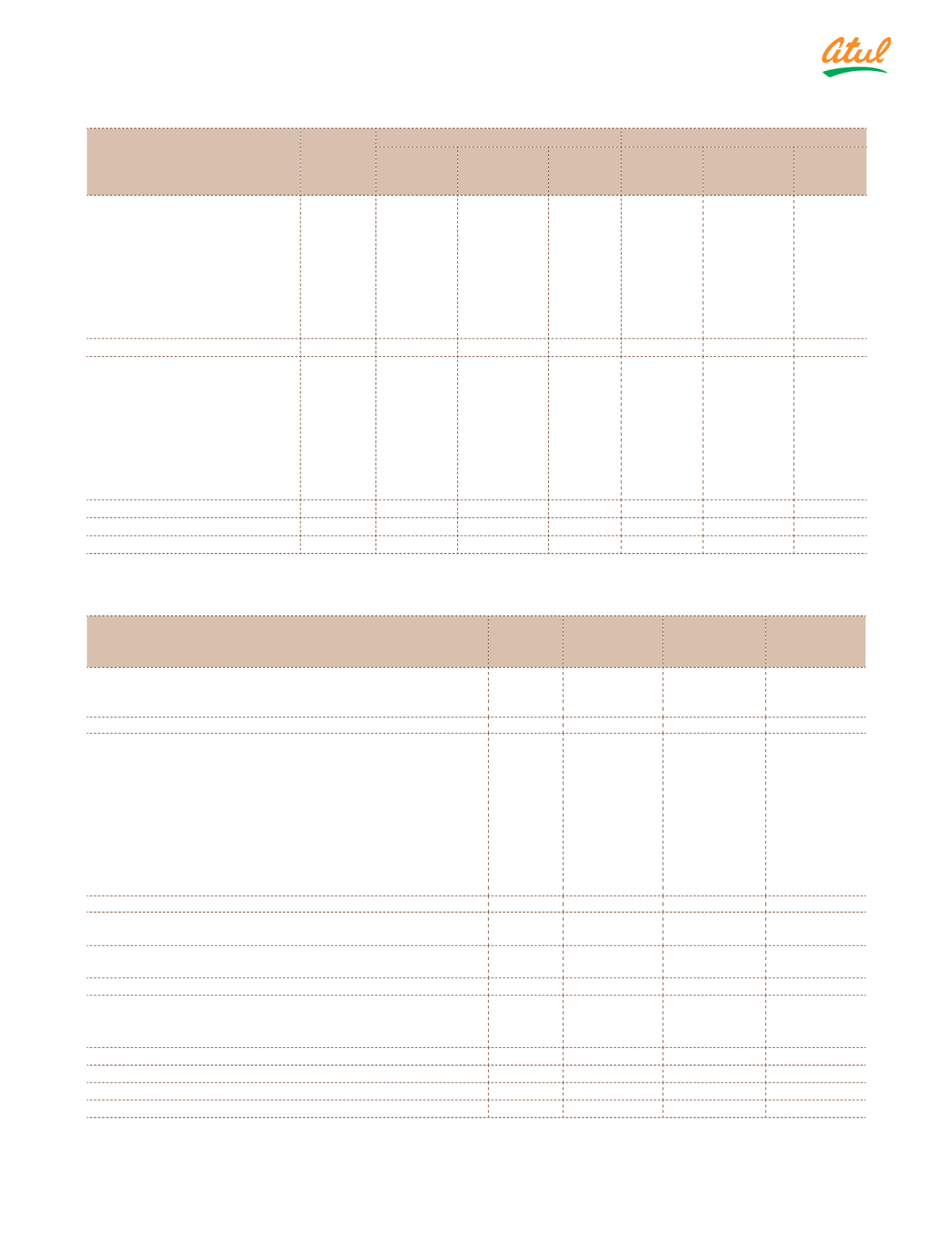

Particulars

Note

to first

time

adoption

As at March 31, 2016

As at April 01, 2015

Regrouped

IGAAP*

Adjustments Ind AS Regrouped

IGAAP*

Adjustments Ind AS

Liabilities

Non-current liabilities

Financial liabilities

i)

Borrowings

23.35

–

23.35

57.46

–

57.46

ii)

Other financial liabilities

24.51

–

24.51

20.14

–

20.14

Provisions

17.31

–

17.31

15.91

–

15.91

Deferred tax liabilities

d

68.60

10.75

79.35

46.09

10.66

56.75

Other non-current liabilities

f

–

11.05

11.05

–

12.46

12.46

Total non-current liabilities

133.77

21.80

155.57

139.60

23.12

162.72

Current liabilities

Financial liabilities

i)

Borrowings

m, q

252.92

3.45

256.37

174.93

–

174.93

ii)

Trade payables

p, q

318.73

(3.61)

315.12

281.05

(2.84)

278.21

iii)

Other financial liabilities

q

65.37

0.51

65.88

86.96

0.38

87.34

Other current liabilities

p, q

78.44

(17.73)

60.71

81.65

(20.65)

61.00

Provisions

p, q

11.64

(4.11)

7.53

8.27

(0.41)

7.86

Current tax liabilities (net)

0.59

–

0.59

5.94

–

5.94

Total current liabilities

727.69

(21.49) 706.20

638.80

(23.52) 615.28

Total liabilities

861.46

0.31

861.77

778.40

(0.40) 778.00

Total equity and liabilities

2,141.80

337.21 2,479.01

1,823.07

356.73 2,179.80

* The IGAAP figures have been reclassified to conform to Ind AS presentation requirements for the purposes of this note.

b) Reconciliation of total comprehensive income for the year ended March 31, 2016

(

`

cr)

Particulars

Note to

first-time

adoption

Regrouped

IGAAP*

Adjustments

Ind AS

Income

Revenue from operations

e, i, p ,q

2,608.13

146.88

2,755.01

Other income

g,l,n,p,q

24.02

10.38

34.40

Total income

2,632.15

157.26

2,789.41

Expenses

Cost of materials consumed

n, o, q

1,324.95

(1.01)

1,323.94

Purchase of stock-in-trade

p

24.89

(1.44)

23.45

Changes in inventories of finished goods, stock-in-trade

and work-in-progress

n, p, q

(23.79)

3.09

(20.70)

Excise duty

e, o, q

(1.22)

161.64

160.42

Employee benefit expenses

h, p

184.66

6.25

190.91

Finance costs

q

27.22

0.31

27.53

Depreciation and amortisation expenses

g, o, q

65.79

0.28

66.07

Other expenses

i, o, p, q

628.75

(10.99)

617.76

Total expenses

2,231.25

158.13

2,389.38

Profit before exceptional items, share of net profits of investments

accounted for using equity method and tax

400.90

(0.87)

400.03

Share of net profit of joint venture company accounted for using the equity

method

p, q

0.04

4.42

4.46

Profit before tax

400.94

(0.87)

404.49

Tax expense

Current tax

h, p, q

109.11

1.08

108.03

Deferred tax

d, p, q

22.51

0.32

22.19

Total tax expense

131.62

1.40

130.22

Profit for the year

269.32

(2.27)

274.27

Other Comprehensive Income

b, h, k

–

31.53

(31.53)

Total comprehensive income for the year

269.32

29.26

242.74

c) Impact of Ind AS adoption on the Consolidated Statements of Cash Flows for the year ended

March 31, 2016

The transition from IGAAP to Ind AS has not had a material impact on the Consolidated Statement of Cash Flows.

Notes

to the Consolidated Financial Statements