221

(

`

cr)

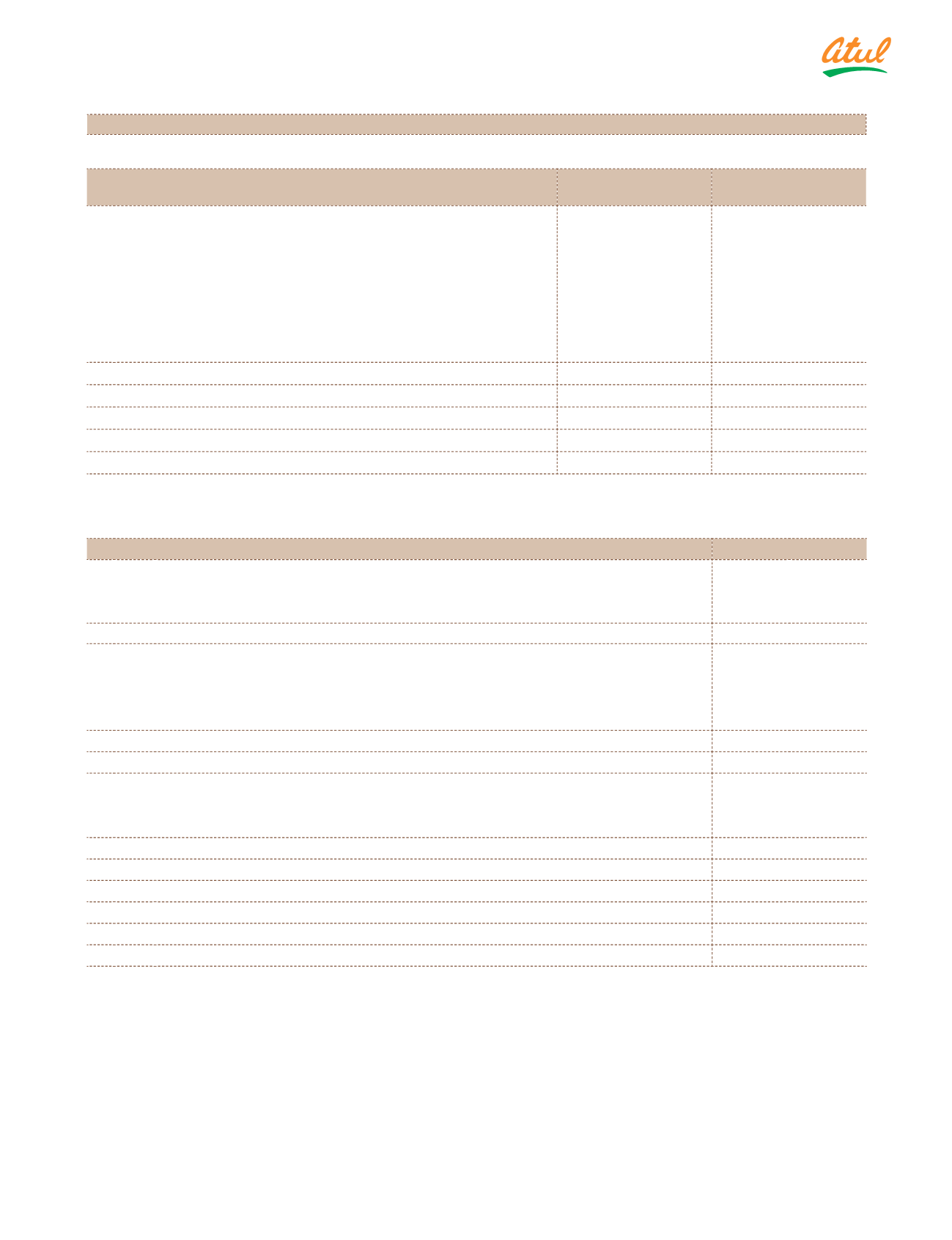

Particulars

As at

March 31, 2016

As at

April 01, 2015

LIABILITIES

Current liabilities

Financial liabilities

ii.

Trade payables

0.51

0.57

iii. Other financial liabilities

0.47

0.38

Other current liabilities

0.74

0.22

Provisions

0.38

0.32

Total current liabilities

2.10

1.49

Total liabilities

2.10

1.49

Net assets recognised

1.98

1.29

Non-controlling interests recognised

–

–

Investments in associate companies de-recognised

1.98

1.29

ii)

The Statement of profit and loss of the above entities for the year ended March 31, 2016 is as follows:

(

`

cr)

Particulars

2015-16

INCOME

Revenue from operations

12.31

Other income

0.20

Total Income

12.51

Expenses

Changes in inventories of finished goods, stock-in-trade and work-in progress

0.10

Employee benefit expense

11.38

Other expenses

0.21

Total expenses

11.69

Profit before tax

0.82

Tax expense

Current tax

0.26

Deferred tax

(0.01)

Total tax expense

0.25

Profit for the year

0.57

Other Comprehensive Income

0.05

Total comprehensive income for the year (A)

0.62

Share of profit of equity accounted investments de-recognised (B)

0.17

Impact on profit (A-B) *

0.45

* Consequent impact on account of discontinuation of equity accounting of Atul Ltd under IGAAP on total

comprehensive income.

q)

Joint venture company

Under IGAAP, Rudolf Atul Chemicals Ltd (RACL) was classified as a joint venture company and accounted for using the

proportionate consolidation method. Under Ind AS, a joint venture company is accounted for using the equity method.

For the purposes of applying the equity method, the investment in RACL of

`

6.13 cr, as at the date of transition,

has been measured as the aggregate of the carrying amounts of the assets and liabilities that the Group had

previously proportionately consolidated. An impairment assessment has been performed as at April 01, 2015,

and no impairment provision is considered necessary.

Transition to Ind AS

(continued)

Notes

to the Consolidated Financial Statements