Atul Ltd | Annual Report 2017-18

(

`

cr)

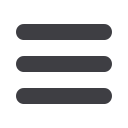

Note 3 Investment properties

As at

March 31, 2018

As at

March 31, 2017

Land – freehold

Gross carrying amount

3.22

3.22

Net carrying amount

3.22

3.22

a) Amount recognised in the Statement of Profit and Loss for investment properties:

The Company has classified parcels of freehold land held for a currently undeterminable future use as investment

properties. There are no amounts pertaining to these investment properties recognised in the Statement of Profit and

Loss, since the Company does not receive any rental income, incur any depreciation or other operating expenses.

b) The Company does not have any contractual obligations to purchase, construct or develop, for maintenance or

enhancements of investment property.

c) Fair value:

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Investment properties

141.00

134.00

141.00

134.00

Estimation of fair value

The Company obtains valuations from independent valuer for its investment properties at least annually. The best

evidence of fair value is current prices in an active market for similar properties. Where such information is not available,

the valuer considers information from a variety of sources including current prices in an active market for investment

properties of different nature or recent prices of similar investment properties in less active markets, adjusted to reflect

those differences.

All resulting fair value estimates for investment properties are included in level 3.

(

`

cr)

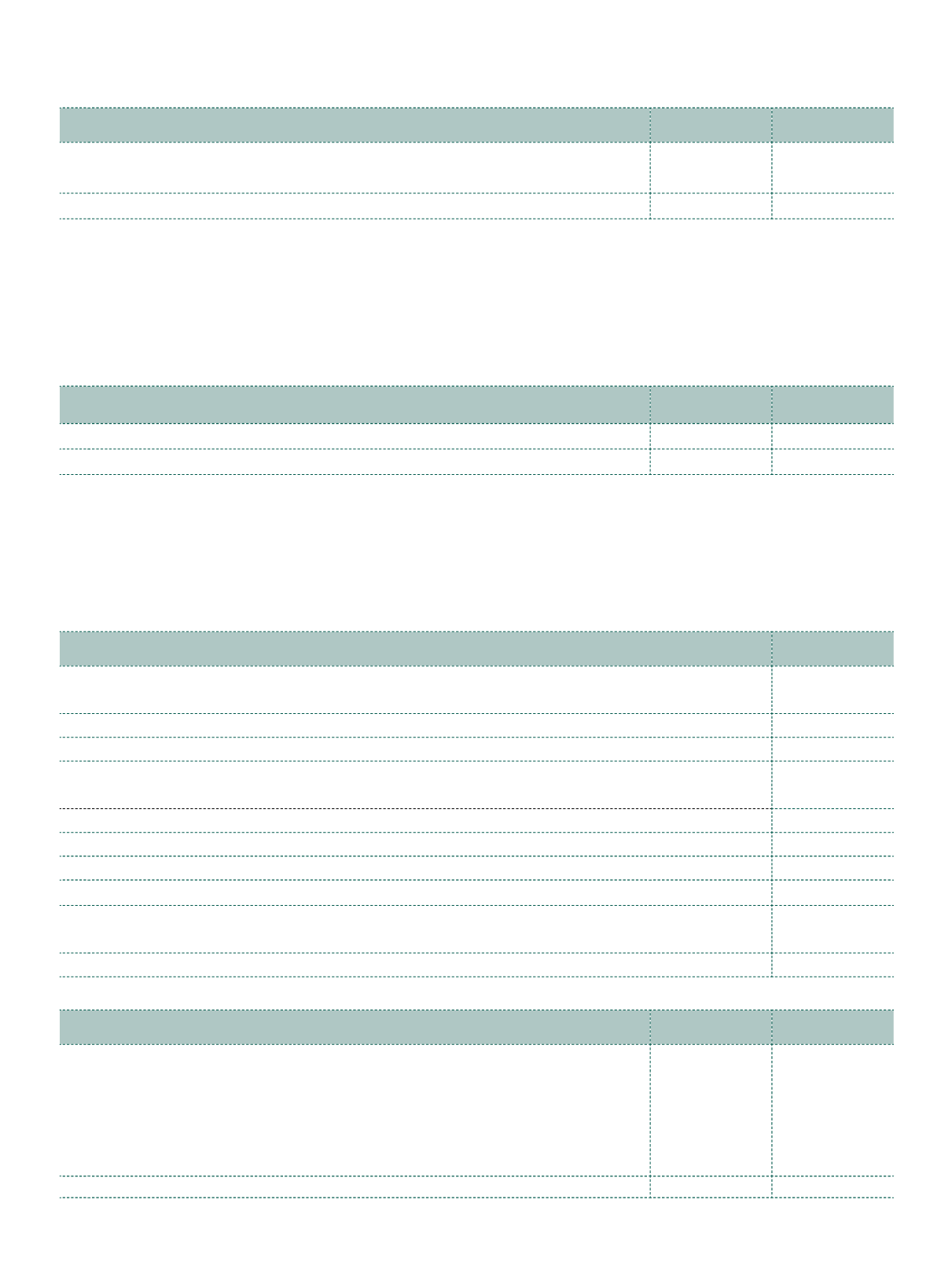

Note 4 Intangible assets

Computer

software

Gross carrying amount

As at March 31, 2016

0.21

As at March 31, 2017

0.21

As at March 31, 2018

0.21

Amortisation

Up to March 31, 2016

0.09

Amortisation charged for the year

0.10

Up to March 31, 2017

0.19

Amortisation charged for the year

0.01

Up to March 31, 2018

0.20

Net carrying amount

As at March 31, 2017

0.02

As at March 31, 2018

0.01

(

`

cr)

Note 5 Non-current investments

As at

March 31, 2018

As at

March 31, 2017

a) Investment in equity instruments of subsidiary companies measured at cost

1

130.63

103.27

b) Investment in equity instruments of joint venture company measured at cost

6.13

6.13

c) Investment in equity instruments of other companies measured at FVOCI

452.32

415.06

d) Investment in preference shares of subsidiary companies at amortised cost

5.72

7.10

e) Investments in Government or Trust securities measured at amortised cost

0.01

0.01

594.81

531.57

¹ Includes share application money

Notes

to the Financial Statements