117

(

`

cr)

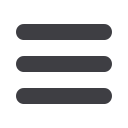

Note 7 Other financial assets

As at

March 31, 2018

As at

March 31, 2017

Current

Non-

current

Current

Non-

current

a)

Security deposits for utilities and premises

0.37

0.73

0.41

2.86

b)

Derivative financial assets – foreign exchange forward contracts

0.05

–

1.31

–

c)

Finance lease receivable

–

1.25

–

1.38

d)

Balance with banks in fixed deposits, with maturity beyond

12 months

–

0.50

–

0.41

e)

Dividends receivable

17.38

–

15.93

–

f)

Other receivables (including discount receivable, insurance

receivable, etc)

14.14

–

7.47

–

31.94

2.48

25.12

4.65

(

`

cr)

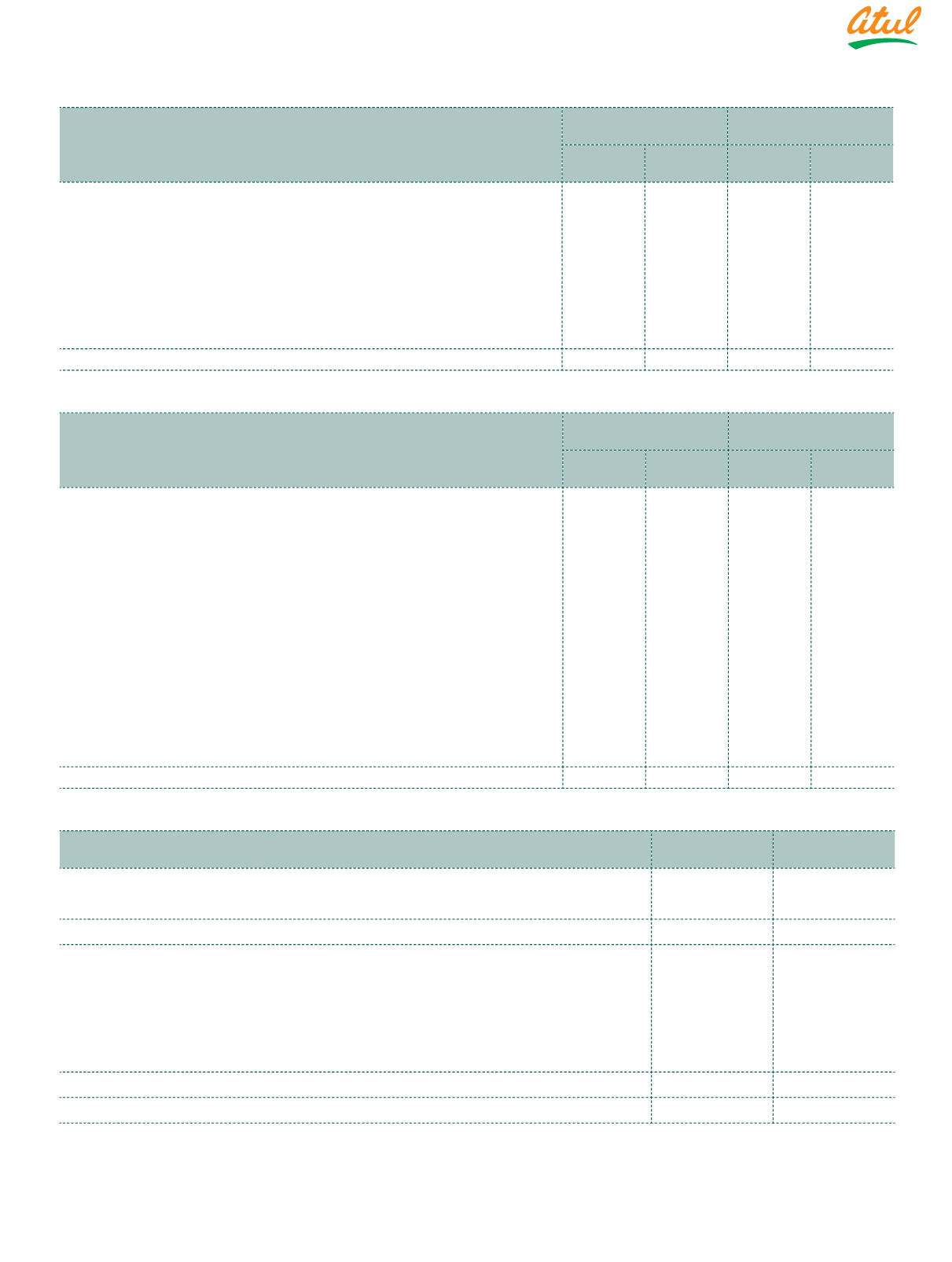

Note 8 Other assets

As at

March 31, 2018

As at

March 31, 2017

Current

Non-

current

Current

Non-

current

a) Balances with the Government authorities

i) Taxes paid under protest

–

18.82

–

16.46

ii) VAT receivable

–

19.07

6.33

34.99

iii) GST receivable

76.89

–

–

–

iv) Balances with the statutory authorities

0.14

–

59.00

–

v) Deposit paid under protest

–

0.24

–

3.41

vi) Security deposit

–

2.00

–

2.00

b) Export incentive receivable

24.09

–

30.37

–

c) Capital advances

–

3.91

–

17.77

d) Advances

i) Related Parties (refer Note 27.4)

0.55

–

–

–

ii) Others

25.03

–

25.02

–

e) Other receivables

0.98

–

0.78

–

127.68

44.04

121.50

74.63

(

`

cr)

Note 9 Inventories*

As at

March 31, 2018

As at

March 31, 2017

a) Raw materials and packing materials

107.27

82.22

Add: Goods-in-transit

31.58

18.01

138.85

100.23

b) Work-in-progress

99.11

112.76

c) Finished goods

97.54

112.03

d) Stock-in-trade

1.93

5.55

e) Stores, spares and fuel

31.69

30.27

Add: Goods-in-transit

9.83

7.05

41.52

37.32

378.95

367.89

* Valued at cost or net realisable value, whichever is lower.

Amounts recognised in the Statement of Profit and Loss:

Written-down value of inventories to net realisable value amounted to

`

6.85 cr (March 31, 2017:

`

6.21 cr). These were recognised as an

expense during the year and included in cost of materials consumed, and changes in value of inventories of work-in-progress, stock-in-trade

and finished goods in the Statement of Profit and Loss.

Notes

to the Financial Statements