175

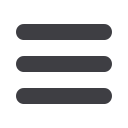

Note 6 Non-current investments

(continued)

(

`

cr)

Particulars

Book value

as at

Market value

as at

March 31,

2018

March 31,

2017

March 31,

2018

March 31,

2017

Quoted

453.30

415.91

453.30

415.91

Unquoted

0.12

0.11

–

–

453.42

416.02

453.30

415.91

1

Carrying value of

`

12,700 (March 31, 2017:

`

12,400) |

2

Under liquidation

(

`

cr)

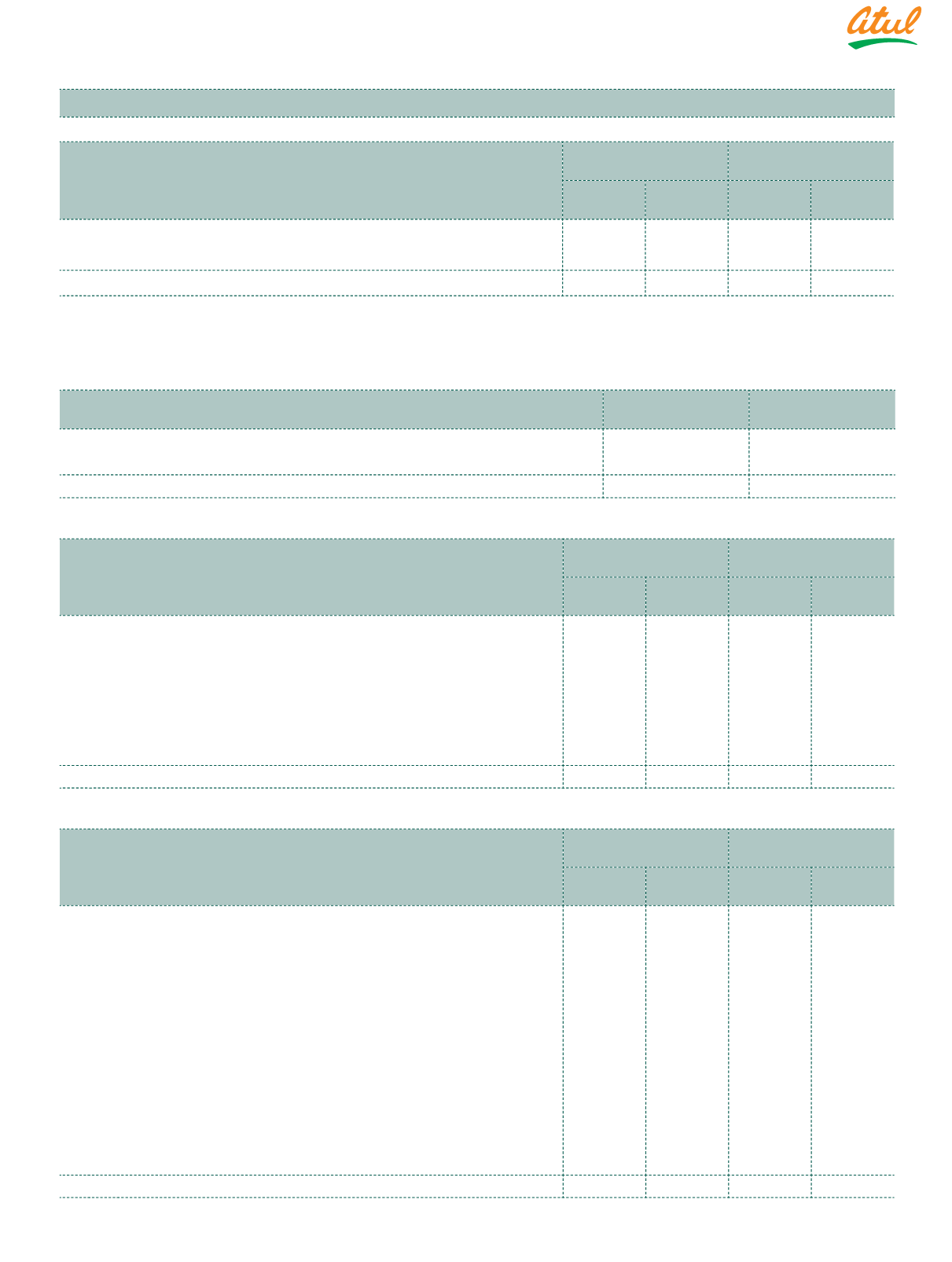

Note 7 Non-current loans

As at

March 31, 2018

As at

March 31, 2017

Loan to others

Unsecured, considered good

0.20

–

0.20

–

(

`

cr)

Note 8 Other financial assets

As at

March 31, 2018

As at

March 31, 2017

Current

Non-

current

Current

Non-

current

a) Security deposits for utilities and premises

0.47

1.01

0.86

0.73

b) Derivative financial assets - foreign exchange forward contracts

0.05

–

1.31

–

c) Balance with banks in fixed deposits, with maturity beyond

12 months

–

0.51

–

0.41

d) Dividends receivable

3.51

–

9.40

–

e) Other receivables (including discount receivable, insurance

receivable, etc.)

16.87

–

8.41

–

20.90

1.52

19.98

1.14

(

`

cr)

Note 9 Other assets

As at

March 31, 2018

As at

March 31, 2017

Current

Non-

current

Current

Non-

current

a) Balances with the Government authorities

i) Taxes paid under protest

–

18.83

–

16.47

ii) VAT receivable

0.78

19.07

6.93

34.99

iii) GST receivable

79.13

–

–

–

iv) Balances with the statutory authorities

0.15

–

60.45

–

v) Deposit paid under protest

–

0.24

–

3.41

vi) Security deposit

–

2.00

–

2.00

b) Export incentive receivable

24.26

–

30.52

–

c) Capital advances

–

9.53

–

17.77

d) Prepayment

Others

26.66

–

26.40

–

e) Other receivables

2.49

–

1.62

0.02

133.47

49.67

125.92

74.66

Notes

to the Consolidated Financial Statements