Atul Ltd | Annual Report 2017-18

Note 17 Borrowings

(continued)

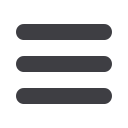

g) Net debt reconciliation:

(

`

cr)

Particulars

Liabilities from financing activities

Current

borrowings

Non-current

borrowings

Total

Net debt as at March 31, 2017

144.59

23.10

167.69

Repayments

(128.68)

(23.10)

(151.78)

Interest expense

7.38

–

7.38

Interest paid

(7.38)

–

(7.38)

Net debt as at March 31, 2018

15.91

–

15.91

(

`

cr)

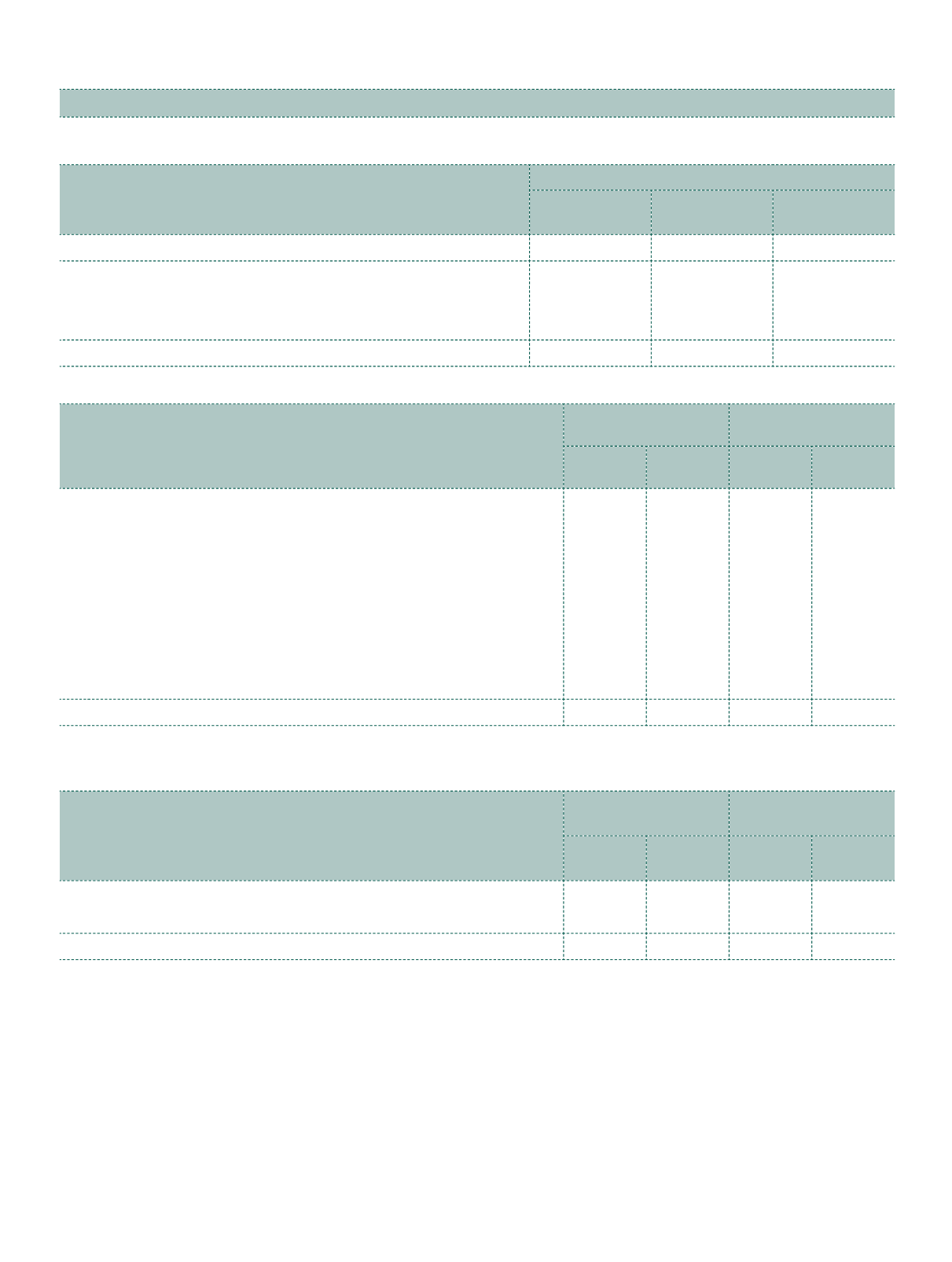

Note 18 Other financial liabilities

As at

March 31, 2018

As at

March 31, 2017

Current

Non-

current

Current

Non-

current

a) Current maturities of long-term debt (refer Note 17)

–

–

22.72

–

b) Employee benefits payable

23.93

–

21.71

–

c) Security deposits

–

22.46

–

21.92

d) Interest accrued, but not due

–

–

0.20

–

e) Unclaimed dividend*

1.95

–

1.71

–

f) Unclaimed matured deposits and interest thereon*

0.01

–

0.01

–

g) Creditor for capital goods

19.64

–

20.52

–

h) Other liabilities (includes discount payable)

12.13

2.77

7.76

2.13

57.66

25.23

74.63

24.05

* There is no amount due and outstanding to be credited to Investor Education and Protection Fund as at March 31, 2018.

(

`

cr)

Note 19 Provisions

As at

March 31, 2018

As at

March 31, 2017

Current

Non-

current

Current

Non-

current

a) Provision for compensated absences

7.69

17.84

6.74

20.15

b) Others {refer a(ii) and (b) below}

3.18

–

2.86

–

10.87

17.84

9.60

20.15

a) Information about individual provisions and significant estimates

i)

Compensated absences:

The Compensated absences cover the liability for sick and earned absences. Out of the total amount disclosed

above, the amount of

`

7.69 cr (March 31, 2017:

`

6.08 cr) is presented as current, since the Group does not have

an unconditional right to defer settlement for any of these obligations. However, based on past experience, the

Group does not expect all employees to take the full amount of accrued leave or require payment within the next

12 months.

ii) Effluent disposal:

The Group has provided for expenses it estimates to be incurred for safe disposal of waste in line with the regulatory

framework it operates in. The provision represents the unpaid amount the entity expects to incur for which the

obligating event has already arisen as on the reporting date.

Notes

to the Consolidated Financial Statements