a) Rights, preferences and restrictions:

The Company has one class of shares referred to as equity shares having a par value of

`

10 each.

i)

Equity shares:

In the event of liquidation of the Company, the holders of equity shares will be entitled to receive any of the remaining

assets of the Company, after distribution of all preferential amounts and preference shares, if any. The distribution

will be in proportion to the number of equity shares held by the shareholders.

Each holder of equity shares is entitled to one vote per share.

ii) Dividend:

The Company declares and pays dividend in Indian rupees. The dividend proposed by the Board is subject to the

approval of shareholders in the ensuing Annual General Meeting, except in case of interim dividend.

b) Shares reserved for allotment at a later date:

56 equity shares are held in abeyance due to disputes at the time of earlier rights issues.

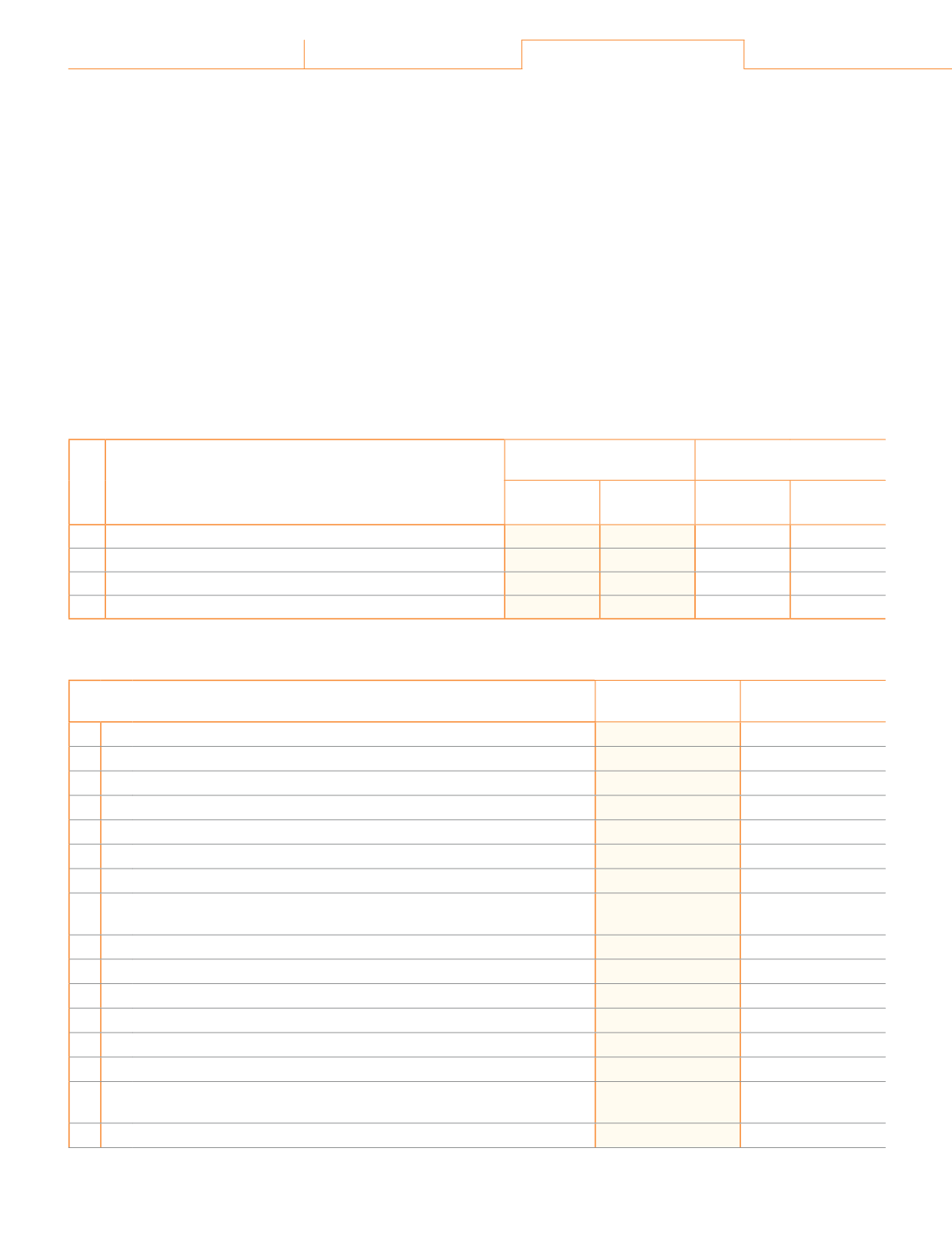

c) Details of shareholders holding more than 5% of equity shares:

(

`

cr)

No. Name of the shareholder

As at

March 31, 2019

As at

March 31, 2018

Holding % Number of

shares

Holding % Number of

shares

1 Aagam Holdings Pvt Ltd

ǨǨȦǪǨɼ

66,50,700

ǨǨȦǪǧɼ

66,50,000

2 Aeon Investments Pvt Ltd

1

-

-

ǬȦǯǪɼ

20,60,817

3 Arvind Farms Pvt Ltd

2

9.35%

ǨǭȡǭǨȡǬǪǨ

-

-

Ǫ

HDFC Trustee Company Ltd

6.01% 17,82,336

-

-

1

Amalgamated with Arvind Farms Pvt Ltd |

2

Pursuant to amalgamation of Aeon Investments Pvt Ltd and other shareholders

(

`

cr)

Note 14 Other equity

As at

March 31, 2019

As at

March 31, 2018

a) Securities premium

ǩǪȦǬǬ

ǩǪȦǬǬ

b) General reserve

95.80

95.80

c) Retained earnings

Balance as at the beginning of the year

ǧȡǬǩǭȦǪǮ

ǧȡǩǯǭȦǦǪ

ēēȠ ¡ƑūǛƥ ljūƑ ƥĺĚ NjĚîƑ

ǪǨǮȦǬǪ

ǨǭǦȦǪǧ

ēēȠ ¤ĚŞĚîƙƭƑĚŞĚŠƥ ijîĿŠ ʈ ȳŕūƙƙȴ ūŠ ēĚǛŠĚē ċĚŠĚǛƥ ƎŕîŠƙȡ ŠĚƥ ūlj ƥîNJ

ȳǦȦǨǪȴ

1.78

Add: Transfer from OCI on disposal of FVOCI equity instruments

-

ǧȦǫǪ

Less: Dividend on equity shares, including dividend distribution tax

{2017-18:

`

12 per share, (2016-17:

`

10 per share)}

ȳǩǯȦǯǪȴ

(33.29)

Balance as at the end of the year

ǨȡǦǨǫȦǯǪ

ǧȡǬǩǭȦǪǮ

d) Other reserves

i)

FVOCI equity instruments

Balance as at the beginning of the year

399.89

ǩǬǪȦǧǧ

Add: Equity instruments through other comprehensive income (FVOCI)

73.80

37.32

Less: Deferred tax liability on above

(11.00)

-

Less: Transfer to retained earnings on disposal of FVOCI equity

instruments

-

ȳǧȦǫǪȴ

Balance as at the end of the year

ǪǬǨȦǬǯ

399.89

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250

ǧǪǦ

Atul Ltd | Annual Report 2018-19