(

`

cr)

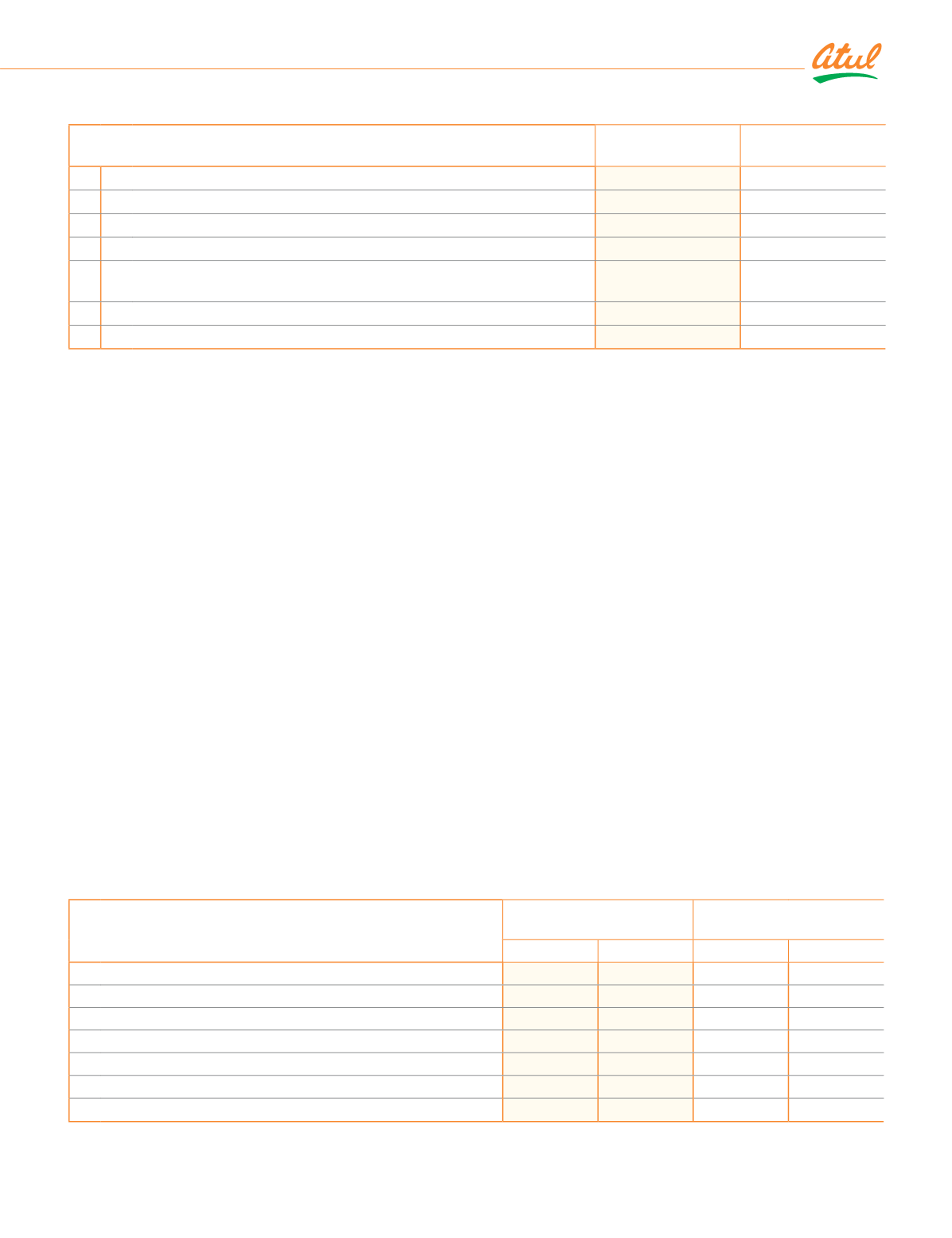

Note 14 Other equity (continued)

As at

March 31, 2019

As at

March 31, 2018

ii)

/ljljĚČƥĿDŽĚ ƎūƑƥĿūŠ ūlj Čîƙĺ ǜūDž ĺĚēijĚƙ

Balance as at the beginning of the year

0.03

ȳǦȦǪǭȴ

ēēȠ /ljljĚČƥĿDŽĚ ƎūƑƥĿūŠ ūlj ijîĿŠ ʈ ȳŕūƙƙȴ ūŠ Čîƙĺ ǜūDž ĺĚēijĚƙ

1.22

0.05

Less: Deferred tax liability on above

ȳǦȦǪǩȴ

(0.02)

gĚƙƙȠ OĚēijĿŠij ijîĿŠ ʈ ȳŕūƙƙȴ ƑĚČŕîƙƙĿǛĚē ƥū ƥĺĚ ¬ƥîƥĚŞĚŠƥ ūlj ¡ƑūǛƥ îŠē

Loss

(0.03)

ǦȦǪǭ

Balance as at the end of the year

0.79

0.03

2,619.88

2,167.86

Nature and purpose of other reserves

a) Securities premium

Securities premium is used to record the premium on issue of shares. The reserve is utilised in accordance with the

provisions of the Companies Act, 2013.

b) General reserve

General reserve represents the amount appropriated out of retained earnings pursuant to the earlier provisions of

Companies Act, 1956. Mandatory transfer to general reserve is not required under the Companies Act, 2013.

c) Retained earnings

¤ĚƥîĿŠĚē ĚîƑŠĿŠijƙ îƑĚ ƥĺĚ ƎƑūǛƥƙ ƥĺîƥ ƥĺĚ ūŞƎîŠNj ĺîƙ ĚîƑŠĚē ƥĿŕŕ ēîƥĚȡ ŕĚƙƙ îŠNj ƥƑîŠƙljĚƑƙ ƥū ijĚŠĚƑîŕ ƑĚƙĚƑDŽĚȡ îŠNj ƥƑîŠƙljĚƑƙ

from or to OCI, dividends or other distributions paid to shareholders.

d) FVOCI - equity instruments

The Company has elected to recognise changes in the fair value of certain investments in equity securities in other

comprehensive income. These changes are accumulated within the FVOCI equity instruments reserve within equity. The

Company transfers amounts from this reserve to retained earnings when the relevant equity securities are de-recognised.

Ěȴ îƙĺ ǜūDž ĺĚēijĿŠij ƑĚƙĚƑDŽĚ

The Company uses hedging instruments as part of its management of foreign currency risk associated with its highly

probable forecast sale and inventory purchases and interest rate risk associated with variable interest rate borrowings.

For hedging foreign currency risk, the Company uses foreign currency forward contracts, foreign currency option contracts

îŠē ĿŠƥĚƑĚƙƥ ƑîƥĚ ƙDžîƎƙȦ ¹ĺĚNj îƑĚ ēĚƙĿijŠîƥĚē îƙ Čîƙĺ ǜūDž ĺĚēijĚƙ ƥū ƥĺĚ ĚNJƥĚŠƥ ƥĺĚƙĚ ĺĚēijĚƙ îƑĚ ĚljljĚČƥĿDŽĚȡ ƥĺĚ ČĺîŠijĚ ĿŠ

ljîĿƑ DŽîŕƭĚ ūlj ƥĺĚ ĺĚēijĿŠij ĿŠƙƥƑƭŞĚŠƥ Ŀƙ ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ Čîƙĺ ǜūDž ĺĚēijĿŠij ƑĚƙĚƑDŽĚȦ ŞūƭŠƥƙ ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ Čîƙĺ ǜūDž

ĺĚēijĿŠij ƑĚƙĚƑDŽĚ Ŀƙ ƑĚČŕîƙƙĿǛĚē ƥū ƎƑūǛƥ ūƑ ŕūƙƙ DžĺĚŠ ƥĺĚ ĺĚēijĚē ĿƥĚŞ îljljĚČƥƙ ƎƑūǛƥ ūƑ ŕūƙƙ ȳljūƑ ĚNJîŞƎŕĚȡ ƙîŕĚƙ îŠē ĿŠƥĚƑĚƙƥ

ƎîNjŞĚŠƥƙȴȦ ØĺĚŠ ƥĺĚ ljūƑĚČîƙƥ ƥƑîŠƙîČƥĿūŠ ƑĚƙƭŕƥƙ ĿŠ ƥĺĚ ƑĚČūijŠĿƥĿūŠ ūlj î ŠūŠȹǛŠîŠČĿîŕ îƙƙĚƥ ȳljūƑ ĚNJîŞƎŕĚȡ ĿŠDŽĚŠƥūƑNjȴȡ ƥĺĚ

îŞūƭŠƥ ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ Čîƙĺ ǜūDž ĺĚēijĿŠij ƑĚƙĚƑDŽĚ Ŀƙ îēŏƭƙƥĚē îijîĿŠƙƥ ƥĺĚ ČîƑƑNjĿŠij îŞūƭŠƥ ūlj ƥĺĚ ŠūŠȹǛŠîŠČĿîŕ îƙƙĚƥȦ

(

`

cr)

sūƥĚ ǧǫ ~ƥĺĚƑ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙ

As at

March 31, 2019

As at

March 31, 2018

Current

Non-current

Current

Non-current

a)

/ŞƎŕūNjĚĚ ċĚŠĚǛƥƙ ƎîNjîċŕĚ

ǪǭȦǭǦ

-

ǨǪȦǨǮ

-

b) Security deposits

-

22.39

-

19.80

c)

ÀŠČŕîĿŞĚē ēĿDŽĿēĚŠēƙȜ

ǨȦǧǪ

-

1.95

-

d)

ÀŠČŕîĿŞĚē ŞîƥƭƑĚē ēĚƎūƙĿƥƙ îŠē ĿŠƥĚƑĚƙƥ ƥĺĚƑĚūŠȜ

0.01

-

0.01

-

e) Creditor for capital goods

ǧǬȦǪǫ

-

18.81

-

f) Other liabilities (includes discount payable)

1.79

2.61

10.13

2.77

68.09

25.00

55.18

22.57

*There is no amount due and outstanding to be credited to Investor Education and Protection Fund as at March 31, 2019.

ǧǪǧ

Standalone

|

Notes to the Financial Statements