sūƥĚ ǨǮȦǧǬ ~ljljƙĚƥƥĿŠij ǛŠîŠČĿîŕ îƙƙĚƥƙ îŠē ŕĿîċĿŕĿƥĿĚƙ

The below Note presents the recognised assets that are offset, or subject to enforceable master netting arrangements and

other similar agreements but not offset, as at March 31, 2019 and March 31, 2018.

a) Collateral against borrowings

The Company has hypothecated | mortgaged assets as collateral against a number of its sanctioned line of credit. Refer

to Note 17 for further information on assets hypothecated | mortgaged as security.

b) Master netting arrangements – not currently enforceable

ijƑĚĚŞĚŠƥƙ DžĿƥĺ ēĚƑĿDŽîƥĿDŽĚ ČūƭŠƥĚƑƎîƑƥĿĚƙ îƑĚ ċîƙĚē ūŠ îŠ T¬' qîƙƥĚƑ ijƑĚĚŞĚŠƥȦ ÀŠēĚƑ ƥĺĚ ƥĚƑŞƙ ūlj ƥĺĚƙĚ

arrangements, only where certain credit events occur (such as default), the net position owing | receivable to a single

counterparty in the same currency will be taken as owing and all the relevant arrangements terminated. As the Company

does not presently have a legally enforceable right of set-off, these amounts have not been offset in the Balance Sheet.

Note 28.17 Changes in accounting policies

¹ĺĚ ūŞƎîŠNj îēūƎƥĚē TŠē ¬ ǧǧǫ ċNj ƭƙĿŠij ƥĺĚ ŞūēĿǛĚē ƑĚƥƑūƙƎĚČƥĿDŽĚ ƥƑîŠƙĿƥĿūŠ ŞĚƥĺūē ĚljljĚČƥĿDŽĚ ƎƑĿŕ Ǧǧȡ ǨǦǧǮȦ ÀŠēĚƑ

this method, the Company recognised the cumulative effect of initially applying Ind AS 115 as an adjustment to the opening

balance of retained earnings as at April 01, 2018. Comparative prior period has not been adjusted.

/ŠƥĿƥĿĚƙ îƎƎŕNjĿŠij ƥĺĚ ŞūēĿǛĚē ƑĚƥƑūƙƎĚČƥĿDŽĚ ŞĚƥĺūē ČîŠ ĚŕĚČƥ ƥū îƎƎŕNj ƥĺĚ ƑĚDŽĚŠƭĚ ƙƥîŠēîƑē ūŠŕNj ƥū ČūŠƥƑîČƥƙ ƥĺîƥ îƑĚ Šūƥ

completed as at the date of initial application (that is, they would ignore the effects of applying the revenue standard to

contracts that were completed prior to the date of initial application). However, the Company elected to apply the standard to

all contracts as at April 01, 2018.

There is no impact on the retained earnings as at April 01, 2018.

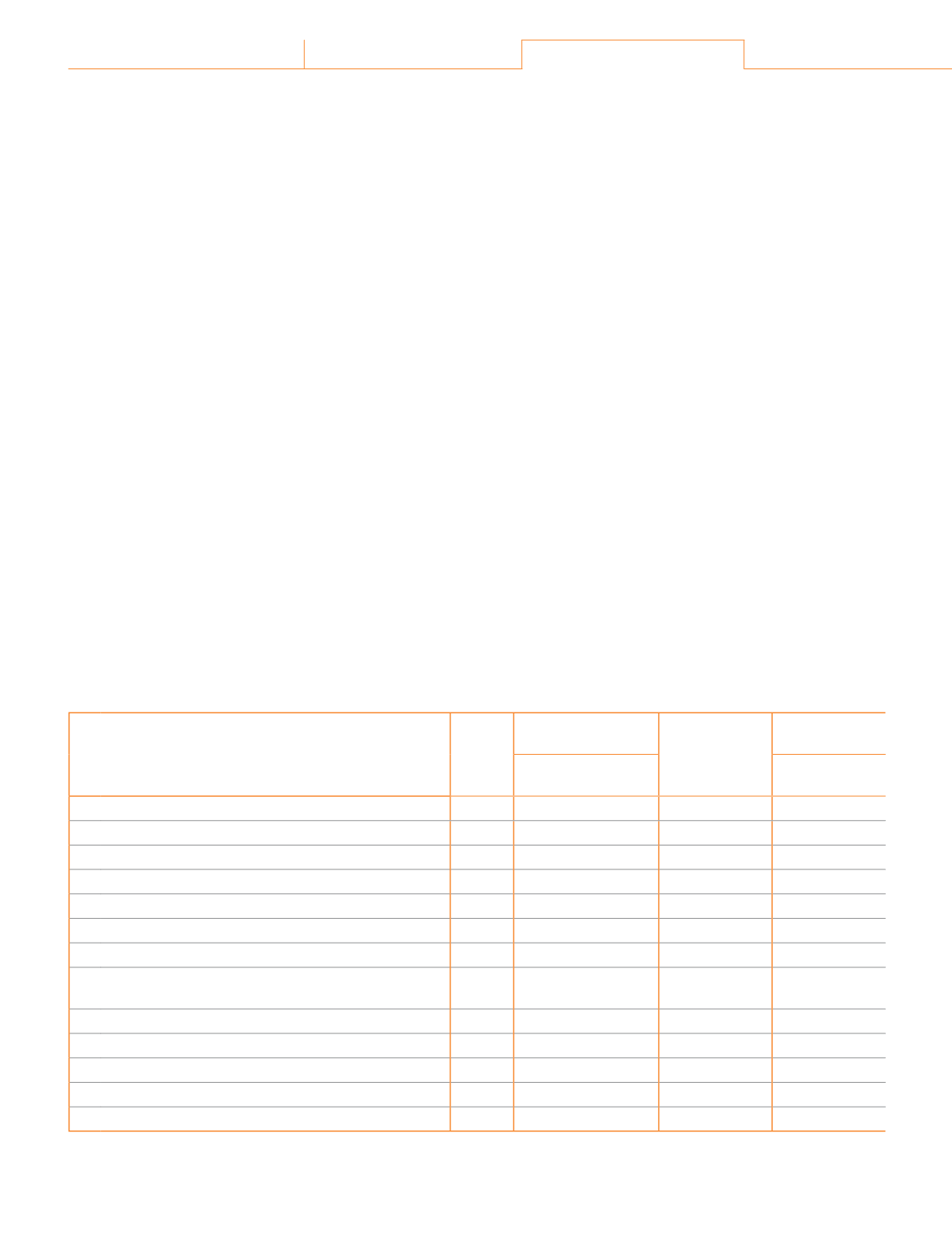

¹ĺĚ ljūŕŕūDžĿŠij ƥîċŕĚ ƎƑĚƙĚŠƥƙ ƥĺĚ îŞūƭŠƥƙ ċNj DžĺĿČĺ ĚîČĺ ǛŠîŠČĿîŕ ƙƥîƥĚŞĚŠƥ ŕĿŠĚ ĿƥĚŞ Ŀƙ îljljĚČƥĚē ĿŠ ƥĺĚ ČƭƑƑĚŠƥ NjĚîƑ ĚŠēĚē

March 31, 2019 by the application of Ind AS 115 as compared with the Ind AS 18 revenue recognition requirements. Line items

that were affected by the changes have been included.

As a result, the sub-totals and totals disclosed cannot be recalculated from the numbers provided. The adjustments are

explained as below:

(

`

cr)

Balance sheet (extract)

Note

As at

March 31, 2019

Increase |

(decrease)

As at

March 31, 2019

without adoption

of Ind AS 115

as reported

Current assets

Trade receivables

i

768.30

(6.12)

762.18

Total current assets

768.30

(6.12)

762.18

Total assets

768.30

(6.12)

762.18

Current liabilities

a) Trade payables

Creditors other than micro enterprises and small

enterprises

ii

ǪǧǭȦǦǪ

(6.12)

ǪǧǦȦǯǧ

b)

~ƥĺĚƑ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙ

iii

72.01

(3.92)

68.09

c) Contract liabilities

iii

-

8.15

8.15

d) Other current liabilities

iii

ǧǦȦǫǪ

ȳǪȦǨǩȴ

6.31

Total current liabilities

499.58

(6.12)

493.46

Total liabilities

499.58

(6.12)

493.46

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250

172

Atul Ltd | Annual Report 2018-19