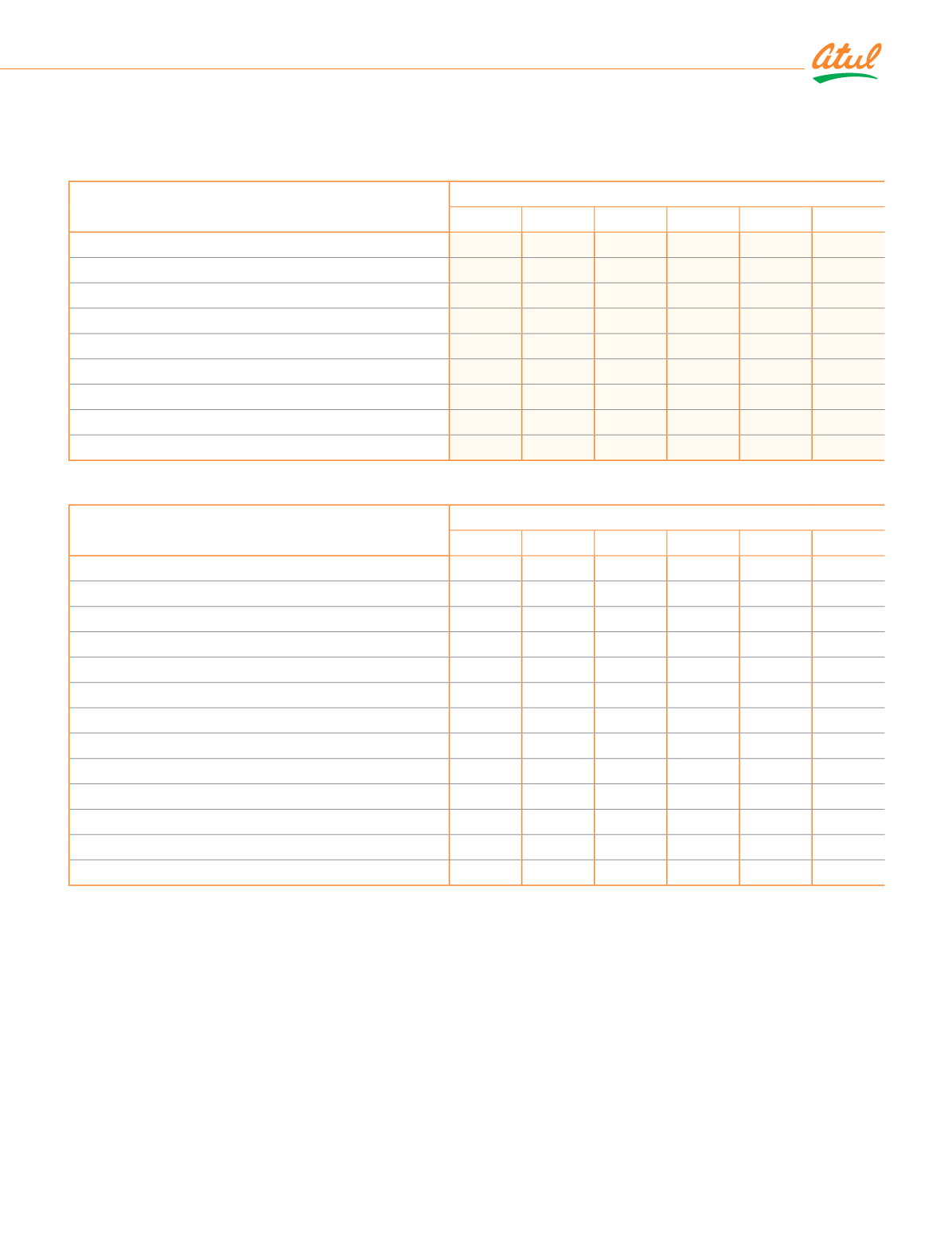

Note 28.8 Financial risk management (continued)

Foreign currency risk exposure:

The exposure to foreign currency risk of the Company at the end of the reporting period expressed are as follows:

Particulars

As at March 31, 2019

US$ mn

`

cr

€ mn

`

cr

£ mn

`

cr

Financial assets

Trade receivables

ǫǮȦǪǦ ǪǦǩȦǯǬ

3.39

ǨǬȦǩǪ

ǦȦǪǯ

ǪȦǪǩ

Less:

Hedged through derivatives

1

Currency range options

ǧǨȦǪǫ

86.12

0.13

0.97

-

-

Net exposure to foreign currency risk (assets)

45.95 317.84

3.26

25.37

0.49

4.43

Financial liabilities

Trade payables

13.67

ǯǪȦǫǬ

0.20

ǧȦǫǪ

0.03

0.28

Net exposure to foreign currency risk (liabilities)

13.67

94.56

0.20

1.54

0.03

0.28

1

Includes hedges for highly probable transactions up to next 12 months

Particulars

As at March 31, 2018

US$ mn

`

cr

€ mn

`

cr

£ mn

`

cr

Financial assets

Trade receivables

ǫǪȦǮǦ ǩǫǬȦǪǩ

2.75

22.17

0.03

0.27

Dividends receivable

0.16

ǧȦǦǪ

-

-

0.57

5.21

Less:

Hedged through derivatives

1

Foreign exchange forward contracts

0.92

6.01

-

-

-

-

Net exposure to foreign currency risk (assets)

54.04 351.46

2.75

22.17

0.60

5.48

Financial liabilities

Trade payables

16.09

ǧǦǪȦǬǪ

ǦȦǧǪ

1.09

0.03

ǦȦǨǪ

Less:

Hedged through derivatives

1

Currency range option

3.72

ǨǪȦǨǨ

-

-

-

-

Net exposure to foreign currency risk (liabilities)

12.37

80.42

0.14

1.09

0.03

0.24

1

Includes hedges for highly probable transactions up to next 12 months

c) Management of credit risk

ƑĚēĿƥ ƑĿƙŒ Ŀƙ ƥĺĚ ƑĿƙŒ ūlj ǛŠîŠČĿîŕ ŕūƙƙ ƥū ƥĺĚ ūŞƎîŠNj Ŀlj î ČƭƙƥūŞĚƑ ūƑ ČūƭŠƥĚƑƎîƑƥNj ljîĿŕƙ ƥū ŞĚĚƥ Ŀƥƙ ČūŠƥƑîČƥƭîŕ ūċŕĿijîƥĿūŠƙȦ

Trade receivables

Concentrations of credit risk with respect to trade receivables are limited, due to the customer base being large, diverse and

îČƑūƙƙ ƙĚČƥūƑƙ îŠē ČūƭŠƥƑĿĚƙȦ ¬ĿijŠĿǛČîŠƥ ƎūƑƥĿūŠ ūlj ƥƑîēĚ ƑĚČĚĿDŽîċŕĚ îƑĚ ƙĚČƭƑĚē ċNj ĿŠƙƭƑîŠČĚ ƎūŕĿČĿĚƙ ūƑ /¡ H ƙČĺĚŞĚƙȦ

All trade receivables are reviewed and assessed for default on a quarterly basis.

Historical experience of collecting receivables of the Company is supported by low level of past default and hence the

credit risk is perceived to be low.

167

Standalone

|

Notes to the Financial Statements