f) Foreign currency translation reserve

/NJČĺîŠijĚ ēĿljljĚƑĚŠČĚƙ îƑĿƙĿŠij ūŠ ƥƑîŠƙŕîƥĿūŠ ūlj ƥĺĚ ljūƑĚĿijŠ ūƎĚƑîƥĿūŠƙ îƑĚ ƑĚČūijŠĿƙĚē ĿŠ ūƥĺĚƑ ČūŞƎƑĚĺĚŠƙĿDŽĚ ĿŠČūŞĚ îƙ

ēĚƙČƑĿċĚē ĿŠ îČČūƭŠƥĿŠij ƎūŕĿČNj îŠē îČČƭŞƭŕîƥĚē ĿŠ î ƙĚƎîƑîƥĚ ƑĚƙĚƑDŽĚ DžĿƥĺĿŠ ĚƐƭĿƥNjȦ ¹ĺĚ ČƭŞƭŕîƥĿDŽĚ îŞūƭŠƥ Ŀƙ ƑĚČŕîƙƙĿǛĚē

ƥū ƥĺĚ ūŠƙūŕĿēîƥĚē ¬ƥîƥĚŞĚŠƥƙ ūlj ¡ƑūǛƥ îŠē gūƙƙ DžĺĚŠ ƥĺĚ ŠĚƥ ĿŠDŽĚƙƥŞĚŠƥ Ŀƙ ēĿƙƎūƙĚēȹūljljȦ

(

`

cr)

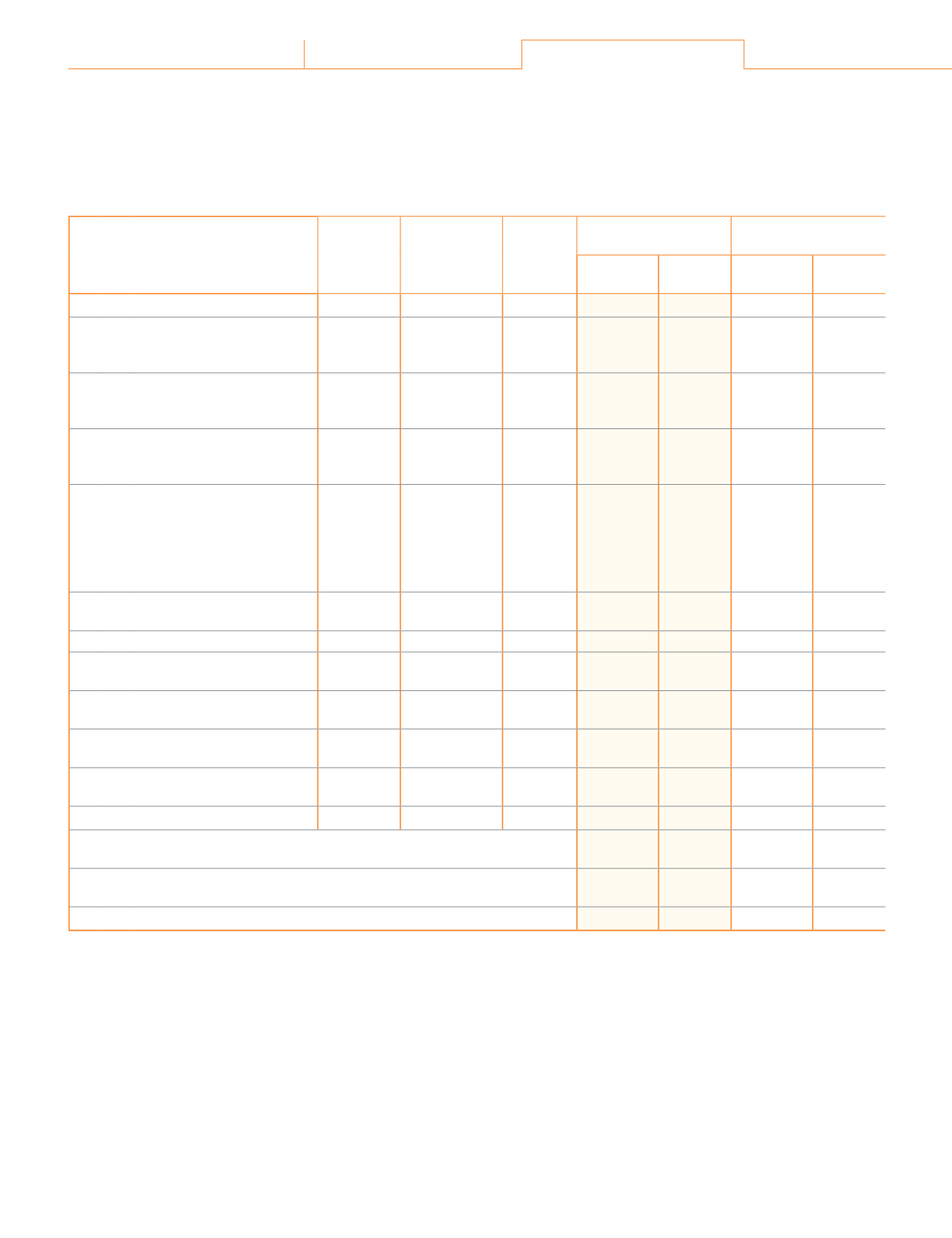

Note 16 Borrowings

Maturity Terms of

repayment

Interest

rate p.a.

As at

March 31, 2019

As at

March 31, 2018

Current

Non-

current

Current

Non-

current

a) Secured

i)

Rupee term loan from

banks (refer Note a)

July, 2025 20 equal

quarterly

installments

8.90%

-

27.82

-

-

December,

2025

22 equal

quarterly

installments

9%

-

2.00

-

-

ii) Foreign currency term loan

from banks (refer Note b)

May, 2023 50 equal

monthly

installments

5.25%

-

0.99

-

-

August,

2023

ǪǮ ĚƐƭîŕ

monthly

installments

starting from

September

2019

2.75%

(Base rate

+ 2%)

-

10.37

-

-

iii) Working capital loans from

banks (refer Note c)

1 - 12

months

Repayable on

demand

9.75% -

10.15%

ǪȦǩǨ

-

3.38

-

b)

ÀŠƙĚČƭƑĚē

i)

Rupee term loan from a

bank

March,

2021

8 quarterly

installments

9.70%

-

ǪȦǧǭ

-

-

ii) Loan from banks including

foreign banks

1 - 6

months

1 - 6 months 1.00% -

5.00%

-

-

1.00

-

iii) Loan from Related Parties 1 - 6

months

1 - 6 months

9.25% 5.08

-

11.52

-

iv) Deposit from the Directors 1 - 12

months

1 - 12 months 6.50%

-

-

0.01

-

9.40

45.35

15.91

-

Amount of current maturities of long-term debt disclosed under the

ĺĚîē Ȫ~ƥĺĚƑ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙȪ ȳƑĚljĚƑ sūƥĚ ǧǭȴ

-

(2.21)

-

-

TŠƥĚƑĚƙƥ îČČƑƭĚē ēĿƙČŕūƙĚē ƭŠēĚƑ ƥĺĚ ĺĚîē Ƀ~ƥĺĚƑ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙɄȳƑĚljĚƑ

Note 17)

(0.08)

-

-

-

9.32

43.14

15.91

-

sūƥĚƙȠ

îȴ ¤ƭƎĚĚ ƥĚƑŞ ŕūîŠƙ ljƑūŞ ċƙ îƑĚ ƙĚČƭƑĚē ċNj ĚNJČŕƭƙĿDŽĚ ČĺîƑijĚ ūŠ ƥĺĚ ƎƑūƎĚƑƥNjȡ ƎŕîŠƥ îŠē ĚƐƭĿƎŞĚŠƥ ūlj ƑĚƙƎĚČƥĿDŽĚ

subsidiary companies, both present and future.

ċȴ GūƑĚĿijŠ ČƭƑƑĚŠČNj ƥĚƑŞ ŕūîŠƙ ljƑūŞċƙ îƑĚ ƙĚČƭƑĚē ċNj ĚNJČŕƭƙĿDŽĚ ČĺîƑijĚ ūŠ ƥĺĚ ċƭĿŕēĿŠij ūlj ƑĚƙƎĚČƥĿDŽĚ ƙƭċƙĿēĿîƑNj ČūŞƎîŠĿĚƙȡ

both present and future.

c) Working capital loans repayable on demand from banks are secured by hypothecation of tangible current assets, namely,

inventories and book debts and secured by second and subservient charge on immovable and movable assets of the

ūŞƎîŠNj îŠē ČĚƑƥîĿŠ ƙƭċƙĿēĿîƑNj ČūŞƎîŠĿĚƙ ƥū ƥĺĚ ĚNJƥĚŠƥ ūlj ĿŠēĿDŽĿēƭîŕ ċ ŕĿŞĿƥ îƙ ŞĚŠƥĿūŠĚē ĿŠ ŏūĿŠƥ ČūŠƙūƑƥĿƭŞ

ēūČƭŞĚŠƥƙȦ ¹ĺĿƙ îŕƙū ĚNJƥĚŠēƙ ƥū ijƭîƑîŠƥĚĚƙ îŠē ŕĚƥƥĚƑƙ ūlj ČƑĚēĿƥ ijĿDŽĚŠ ċNj ƥĺĚ ċĚƑƙ îijijƑĚijîƥĿŠij ƥū

`

102.31 cr (March

31, 2018:

`

88.30 cr).

210

Atul Ltd | Annual Report 2018-19

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250