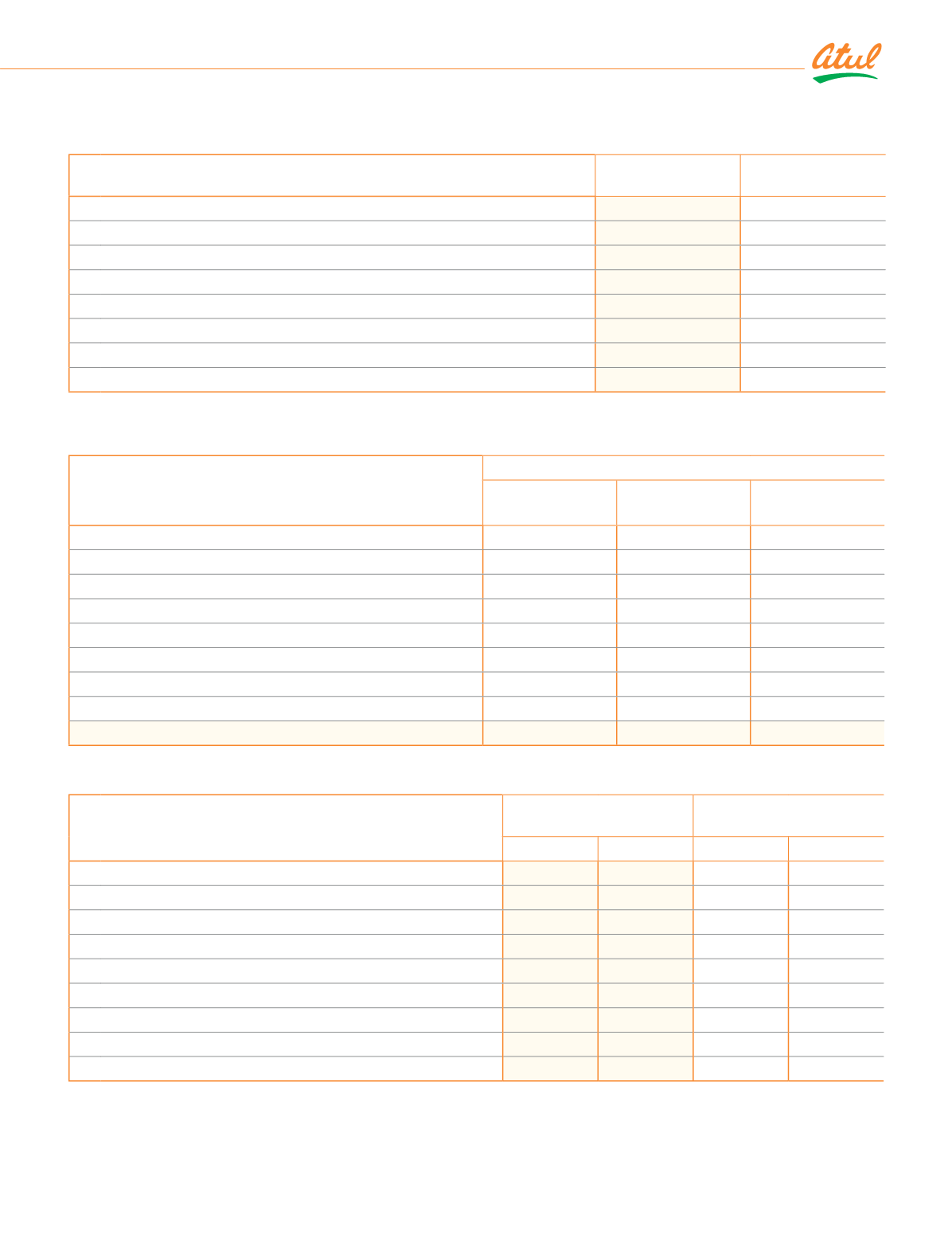

d) The carrying amount of assets hypothecated | mortgaged as security for current and non-current borrowing limits are:

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

First charge for current and second charge for non-current borrowings

i)

Inventories

ǪǫǪȦǨǫ

378.95

ii) Trade receivables

799.82

717.68

iii) Current assets other than inventories and trade receivables

193.60

ǧǮǪȦǬǦ

1,447.67

1,281.23

First charge for non-current and second charge for current borrowings

¡ƑūƎĚƑƥNj ƎŕîŠƥ îŠē ĚƐƭĿƎŞĚŠƥ ĚNJČŕƭēĿŠij ŕĚîƙĚĺūŕē ŕîŠē

1,082.57

937.06

Total assets as security

2,530.24

2,218.29

e) Net debt reconciliation:

(

`

cr)

Particulars

gĿîċĿŕĿƥĿĚƙ ljƑūŞ ǛŠîŠČĿŠij îČƥĿDŽĿƥĿĚƙ

Current

borrowings

Non-current

borrowings

Total

Net debt as at March 31, 2017

144.59

23.10

167.69

Repayments

(128.68)

(23.10)

(151.78)

TŠƥĚƑĚƙƥ ĚNJƎĚŠƙĚ

7.38

-

7.38

Interest paid

(7.38)

-

(7.38)

Net debt as at March 31, 2018

15.91

-

15.91

(Repayments) | Disbursements

(6.50)

ǪǫȦǩǫ

38.85

TŠƥĚƑĚƙƥ ĚNJƎĚŠƙĚ

0.67

0.87

ǧȦǫǪ

Interest paid

(0.67)

(0.87)

ȳǧȦǫǪ

Net debt as at March 31, 2019

9.40

45.35

54.75

(

`

cr)

sūƥĚ ǧǭ ~ƥĺĚƑ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙ

As at

March 31, 2019

As at

March 31, 2018

Current

Non-current

Current

Non-current

a) Current maturities of long-term debt (refer Note 16)

2.21

-

0.01

-

b)

/ŞƎŕūNjĚĚ ċĚŠĚǛƥƙ ƎîNjîċŕĚ

ǪǯȦǫǩ

-

23.93

-

c) Security deposits

-

ǨǫȦǪǨ

-

ǨǨȦǪǬ

d) Interest accrued but not due (refer Note 16)

0.08

-

-

-

e)

ÀŠČŕîĿŞĚē ēĿDŽĿēĚŠēƙȜ

ǨȦǧǪ

-

1.95

-

f)

ÀŠČŕîĿŞĚē ŞîƥƭƑĚē ēĚƎūƙĿƥƙ îŠē ĿŠƥĚƑĚƙƥ ƥĺĚƑĚūŠȜ

0.01

-

0.01

-

g) Creditor for capital goods

81.78

-

ǧǯȦǬǪ

-

h) Other liabilities (includes discount payable)

2.86

2.61

12.12

2.77

138.61

28.03

57.66

25.23

*There is no amount due and outstanding to be credited to Investor Education and Protection Fund as at March 31, 2019.

Consolidated

|

Notes to the Financial Statements

211