Corporate Identity Serving Diverse Industries Purpose and Values Overview by the Chairman Operational Highlights Financial Analysis Research and Technology

Safety, HealthandEnvironment Serving the Society Directors’ Report Management Discussion andAnalysis Report on Corporate Governance

Financial Statements

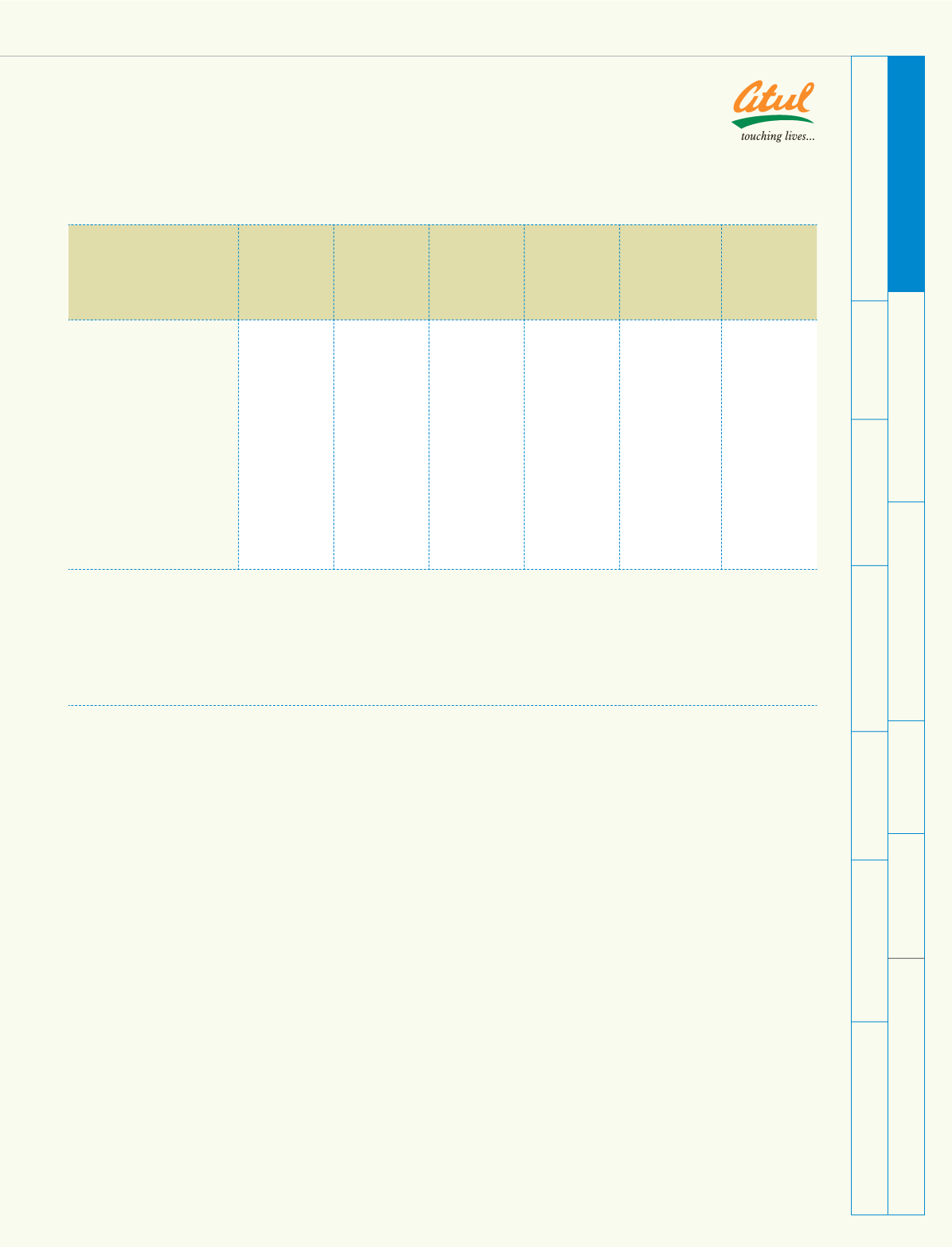

(Rs crores)

Subsidiary

Ameer

Trading

Corporation

Ltd

Atul

Americas Inc

Atul Europe

Ltd

Atul

Deutschland

GmbH

Atul

International

Trading

(Shanghai) Co

Ltd

Atul

Rajasthan

Date Palms

Ltd

Capital

0.35

9.03

6.80

0.61

2.24

2.02

Reserves and Surplus

4.42

1.42

(5.61)

(0.03)

(1.37)

10.32

Total Assets

5.95

13.15

33.13

3.28

4.01

12.34

Total Liabilities

5.77

2.70

31.94

2.70

3.14

-

Investments

4.59

-

-

-

-

-

Turnover

0.68

61.00

69.00

13.94

10.19

0.87

Profit Before Tax

0.03

1.69

(0.28)

(0.21)

0.57

Provision for Taxation

(0.04)

-

0.12

-

(0.26)

Profit After Taxation

0.07

1.69

(0.44)

(0.21)

0.30

Proposed dividend

-

-

-

-

-

-

Note:

1 The Annual Accounts of the Subsidiary Companies and other related information shall be made available to the

Shareholders of the Company on request to the Company Secretary at the registered office of the Company.

2 As per Government of India, Ministry of Company Affairs approval no 47/59/2010-CL-III dated April 28, 2010 all the

figures of Foreign Subsidiaries have been converted at the exchange rate prevailing at March 31, 2010.

3 Rate of exchange considered as on March 31, 2010 are 1 US$ = Rs 45.14, 1 GBP = Rs 68.03, 1 Euro = Rs 60.56

and 1 Chinese Yuan = Rs 6.60.

Additional Information on Subsidiary Companies

for the year ended March 31, 2010