124 /

Atul Ltd

|

Annual Report 2009-10

SCHEDULE 16 NOTES FORMING PART OF THE CONSOLIDATED ACCOUNTS

(contd)

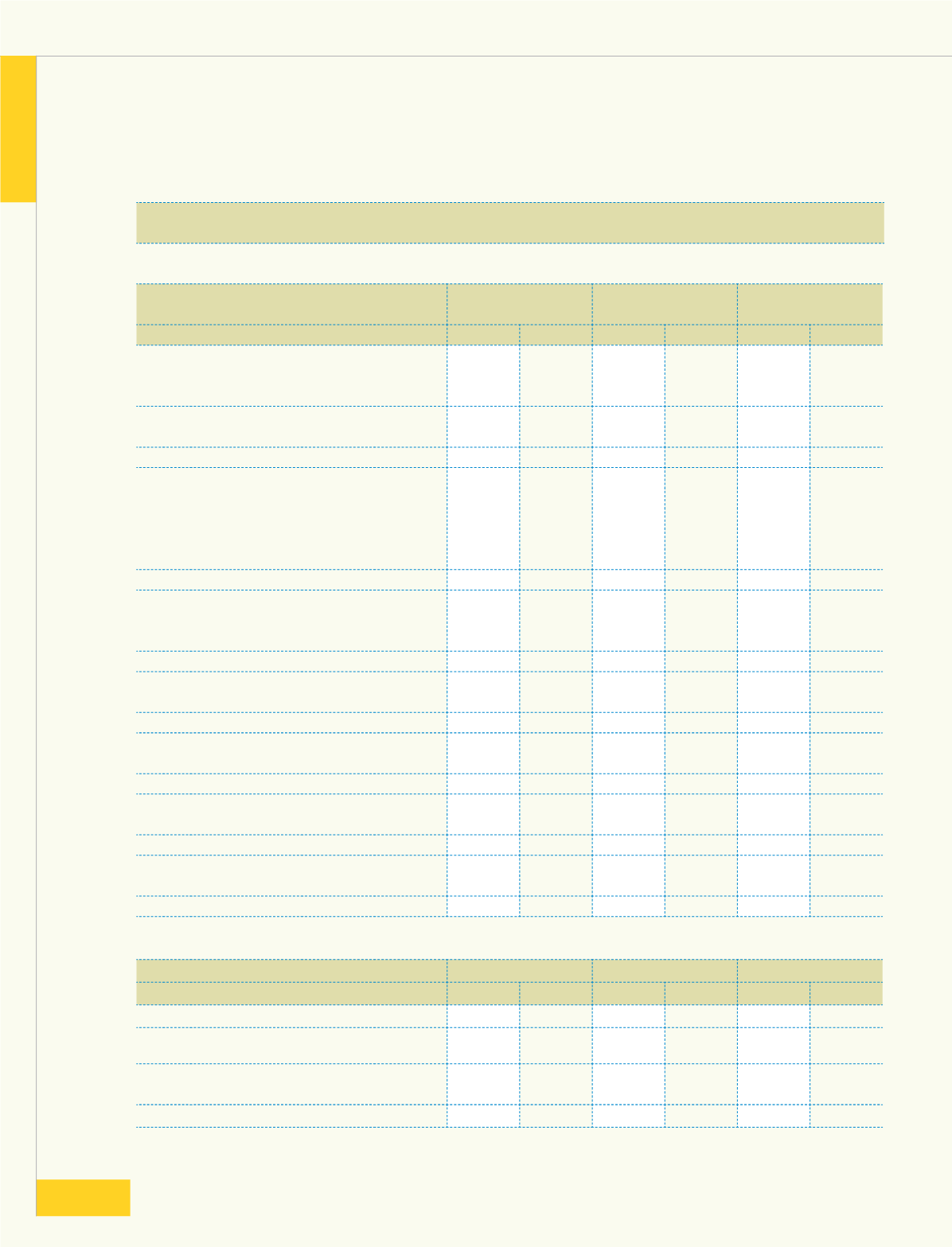

8 Segment information:

(a) Information about business segment - primary:

(Rs crores)

Particulars

Colors

Speciality Chemicals

and others

Total

2009-10 2008-09 2009-10 2008-09 2009-10 2008-09

1 Segment revenue

External sales

304.83 319.76 944.99 951.68 1249.82 1271.44

Inter segment sales

0.85

0.24 11.80 25.05 12.65 25.29

Total segment revenue

305.68 320.00 956.79 976.73 1262.47 1296.73

Less: Inter segment revenue

0.85

0.24 11.80 25.05 12.65 25.29

Net revenue from operations

304.83 319.76 944.99 951.68 1249.82 1271.44

2 Segment results

Profit before interest and tax

7.80

7.84 114.90 140.56 122.70 148.40

Interest

25.63 41.41

Other unallocable expenditure

(net of unallocable income)

18.17 56.70

Profit before tax

78.90 50.29

3 Other Information

Segment assets

228.23 183.88 670.70 612.53 898.93 796.41

Unallocated common assets

232.08 265.70

Total assets

1131.01 1062.11

4 Segment liabilities

70.79 38.25 188.10 114.21 258.89 152.46

Unallocated common liabilities

75.36 83.50

Total liabilities

334.25 235.96

5 Capital expenditure

2.05

5.21 17.53 36.50 19.58 41.71

Unallocated capital expenditure

2.86

4.50

Total capital expenditure

22.44 46.21

6 Depreciation

5.73

5.98 29.87 25.09 35.60 31.07

Unallocated depreciation

1.82

0.80

Total depreciation

37.42 31.87

7 Non cash expenses

-

-

Unallocated non cash expenses

-

-

Total non cash expenses

-

-

(b) Business secondary - geographical by customers:

(Rs crores)

Particulars

In India

Outside India

Total

2009-10 2008-09 2009-10 2008-09 2009-10 2008-09

Segment revenue

713.38 652.58 536.44 618.86 1249.82 1271.44

Carrying cost of assets by

location of assets

1031.31 959.95 99.70 102.16 1131.01 1062.11

Addition to assets and

intangible assets

22.44 46.15

-

0.06 22.44 46.21

Schedule

forming part of the Consolidated accounts

125