27

Dear Members,

The Board of Directors presents the Annual Report of Atul together with the audited statement of accounts for the year ended

March 31, 2012.

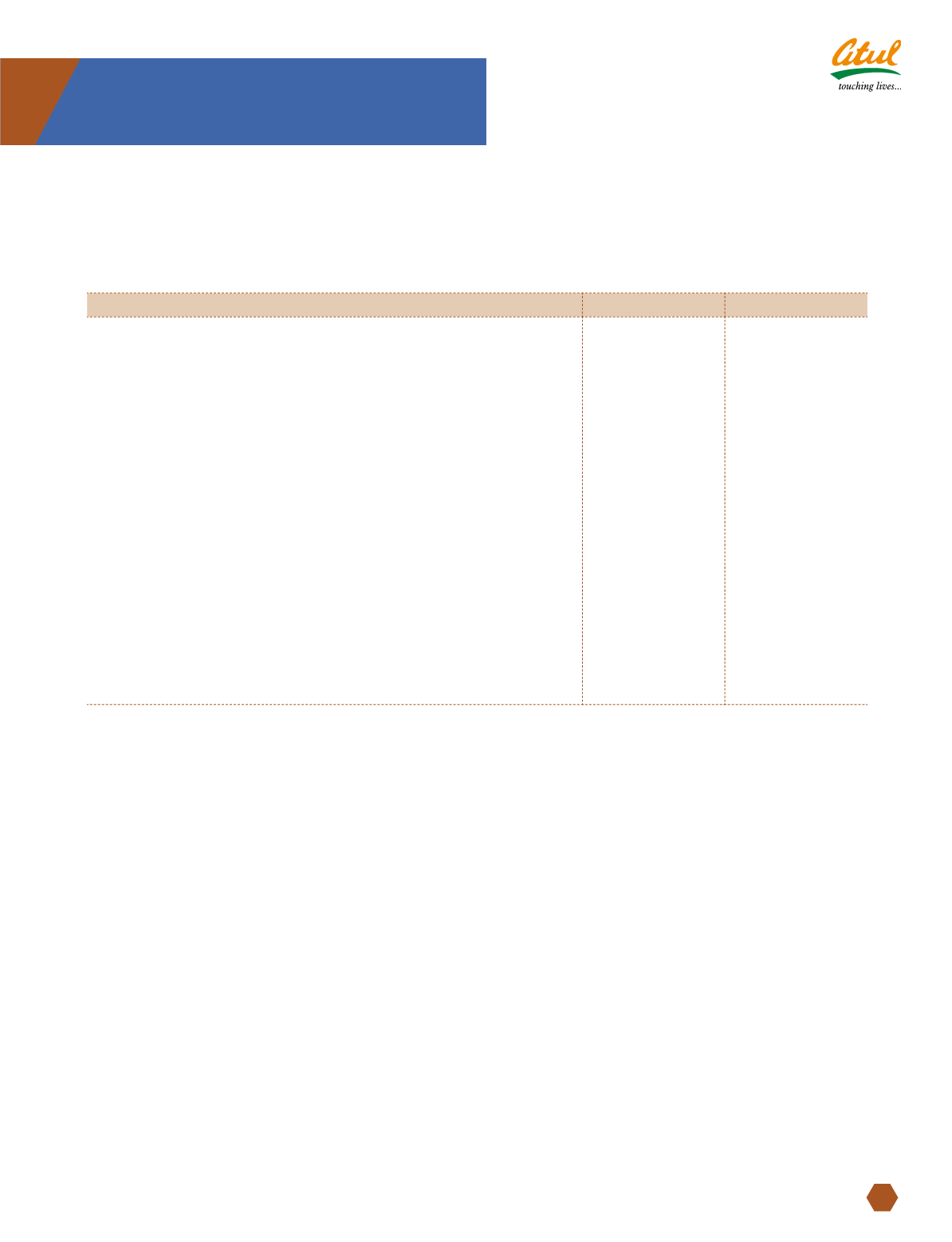

Financial results

(

`

cr)

2011-12

2010-11

Revenue from operations

1795

1534

Other income

12

19

Total revenues

1807

1553

Profit before tax and exchange rate difference

134

148

Exchange rate difference - expense

12

9

Profit before tax

122

139

Provision for tax

34

43

Profit for the year

88

96

Tax adjustments for the earlier years

-

(6)

Profit available for appropriation

88

90

Balance brought forward

334

265

Disposable surplus

422

355

Appropriations

General reserve

9

5

Proposed dividend

14

14

Dividend distribution tax

2

2

Balance carried forward

397

334

Dividend

The Board recommends payment of dividend of

`

4.50 per

share on 2,96,61,733 Equity Shares of

`

10 each fully paid-up.

The dividend will entail an outflow of

`

15.52 cr (including

dividend distribution tax) on the paid-up Equity Share capital

of

`

29.66 cr.

Financial Performance

Net sales grew by 17% to

`

1761 cr including a growth of

21% in exports and 14% in domestic market. However, the

margins were under pressure and reduced slightly; the PBT

before exceptional items reduced from

`

129 cr to

`

116 cr. The

reduction in profitability was mainly on account of increase in

input prices, fixed costs, exchange loss and interest. During the

year, CARE assigned CARE A1+ rating to the proposed CP issue.

CARE also upgraded credit rating to CARE A+ (from CARE A in

the Previous year) for long-term debts, while maintaining top

notch CARE A1+ for short-term debts.

Insurance

The Company has taken adequate insurance to cover the

risks to its people, plant and machineries, buildings and other

assets, profits and third parties.

Directors

According to Article 134 of the Articles of Association of the

Company, Mr G S Patel, Mr B S Mehta and Mr B N Mohanan

retire by rotation and being eligible offer themselves for

reappointment at the forthcoming Annual General Meeting

scheduled on July 27, 2012.

Corporate Governance

A Report on Corporate Governance along with a certificate

from the Statutory Auditors regarding compliance of the

conditions of Corporate Governance pursuant to Clause 49 of

the Listing Agreement is annexed.

Directors’ Report