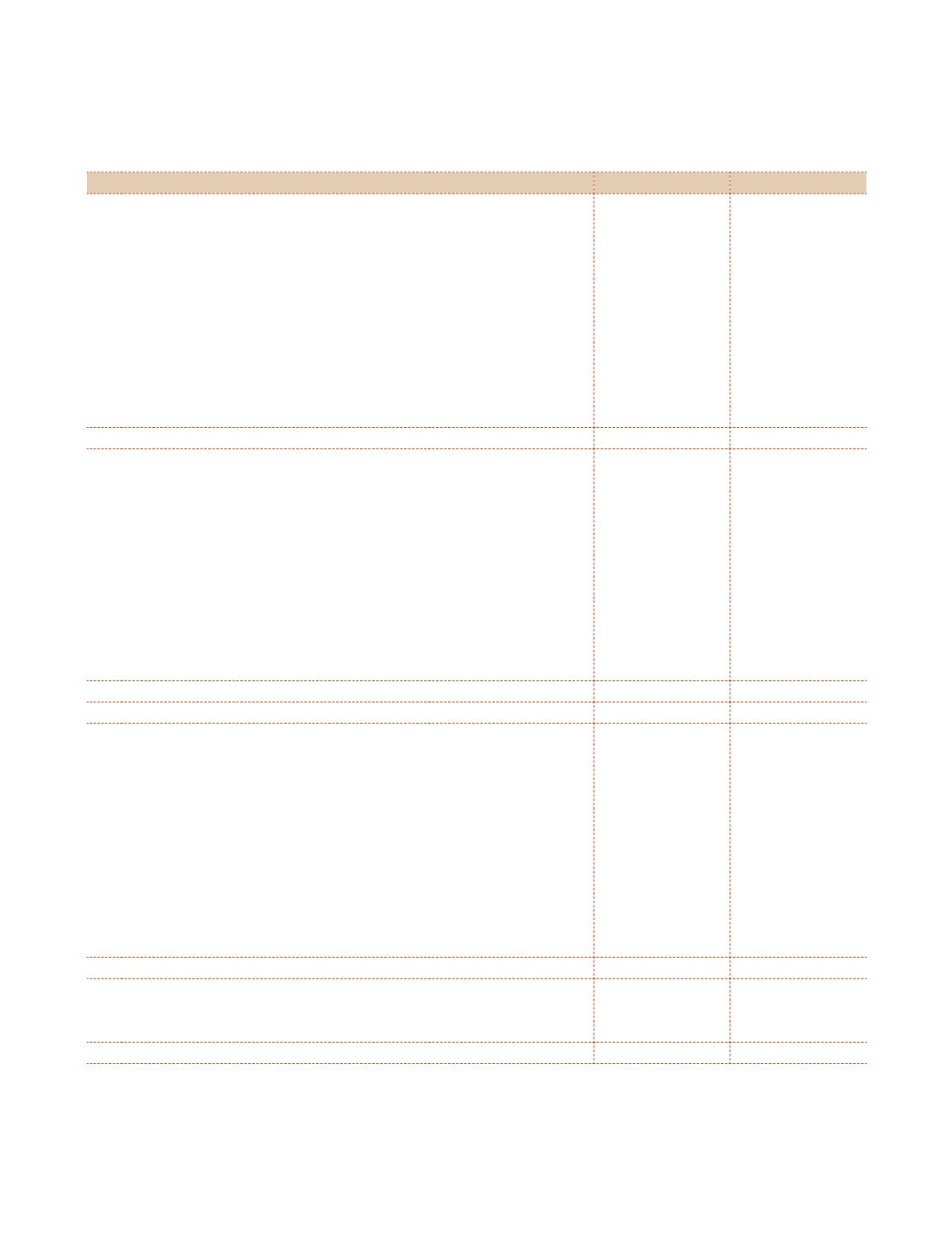

Atul Ltd | Annual Report 2011-12

Cash Flow Statement

for the year ended March 31, 2012

(

`

cr)

Particulars

2011-12

2010-11

(A) CASH FLOW FROM OPERATING ACTIVITIES

Profit before tax

122.48

139.17

Adjustments for:

Add:

Depreciation and amortisation expenses

43.65

38.54

Finance costs

43.10

26.22

Loss on assets sold or discarded

0.06

1.96

Unrealised exchange rate difference (net)

(3.43)

2.00

Bad debts and irrecoverable balances written off

3.01

1.47

Provision for doubtful debts

0.79

0.41

Obsolete material written off

-

0.60

87.18

71.20

209.66

210.37

Less:

Dividend received

1.59

5.42

Interest received

2.35

1.55

Impairment written back

-

0.89

Provisions no longer required

3.69

7.01

Gain on settlement of long-term export advance

-

8.20

Reversal of provision for diminution in value of long-term investment

in a subsidiary company

6.51

-

Sale of technical know-how

1.63

-

Surplus on sale of fixed assets

0.28

0.03

16.05

23.10

Operating profit before working capital changes

193.61

187.27

Adjustments for:

Inventories

(31.86)

(50.70)

Trade receivables

(73.72)

(38.19)

Short-term loans and advances

4.80

1.15

Other current assets

(4.51)

(5.17)

Non-current assets

(3.98)

(21.00)

Long-term loans and advances

(1.94)

6.02

Long-term provisions

0.73

2.60

Trade payables

55.46

61.61

Other current liabilities

19.00

(27.86)

Short-term provisions

1.21

(10.21)

(34.81)

(81.75)

Cash generated from operations

158.80

105.52

Less:

Direct taxes (refund) | paid

38.30

45.32

Net cash flow from operating activities

A

120.50

60.20