63

Cash Flow Statement

for the year ended March 31, 2012 (contd)

(

`

cr)

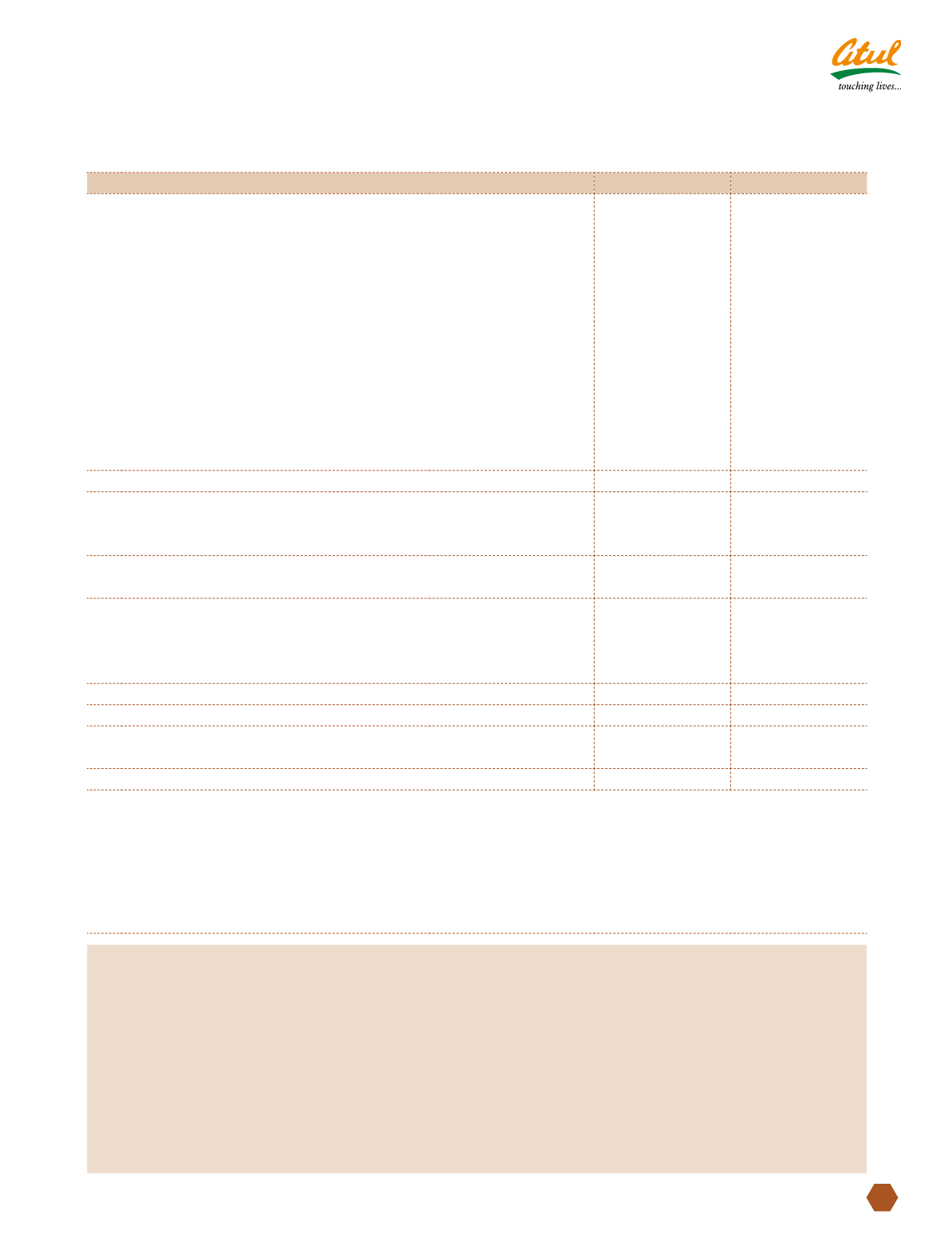

Particulars

2011-12

2010-11

(B) CASH FLOW FROM INVESTING ACTIVITIES

Purchase of tangible assets

(102.36)

(44.43)

Purchase of intangible assets

(1.86)

-

Capital advances

0.49

(2.47)

Investments in subsidiary companies

(29.04)

(6.83)

Investments in associate companies

-

(1.47)

Investments in joint venture companies

(3.00)

-

Repayments | (disbursements) of loans

4.72

(7.47)

Long-term bank deposits

0.88

(1.17)

Short-term bank deposits

(0.39)

2.96

Sale of fixed assets

6.42

2.72

Interest received

3.31

1.22

Dividend received

1.59

5.42

Net cash used in investing activities

B

(119.24)

(51.52)

(C) CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from long-term borrowings

20.84

(61.37)

Add: Exchange rate difference

(6.08)

0.94

Proceeds from long-term borrowings (adjusted)

14.76

(60.43)

Proceeds from short-term borrowings

38.36

94.82

Total proceeds from borrowings

53.12

34.39

Payment of Unclaimed dividend

(0.08)

-

Interest paid

(37.04)

(25.98)

Dividend on Equity Shares (including dividend distribution tax)

(15.42)

(13.79)

Net cash used in financing activities

C

0.58

(5.38)

Net change in cash and cash equivalents

A+B+C

1.84

3.30

Opening balance - cash and cash equivalents

13.41

10.11

Closing balance - cash and cash equivalents

15.25

13.41

1.84

3.30

Notes to the Cash Flow Statement for the year ended March 31, 2012:

1. The Cash Flow Statement has been prepared under the ‘Indirect Method’ set out in Accounting Standard-3

‘Cash Flow Statement’ referred to in The Companies Accounting Standard Rules, 2006.

2. In terms of Joint Venture Agreement with IB Industriechemie Beteiligungs GmbH, the Company has subscribed

2918750 shares at price of

`

21 each, by transferring technical know-how (

`

1.63 cr), inventories (

`

0.26 cr),

trade receivables (

`

1.24 cr) being non-cash consideration not considered in the above Cash Flow Statement.

The remaining amount (

`

3.00 cr) was paid in cash.

As per our attached report of even date

For and on behalf of the Board of Directors

For Dalal & Shah

Firm Registration No. 102020W

Sunil S Lalbhai

Chartered Accountants

Chairman & Managing Director

G S Patel

S S Baijal

B S Mehta

H S Shah

S Venkatesh

S M Datta

Partner

R A Shah

Samveg A Lalbhai

Membership No. F-037942

T R Gopi Kannan

V S Rangan

Managing Director

Mumbai

President, Finance &

B N Mohanan

Mumbai

May 15, 2012

Company Secretary

Directors

May 15, 2012