69

Notes

to financial statements

(

`

cr)

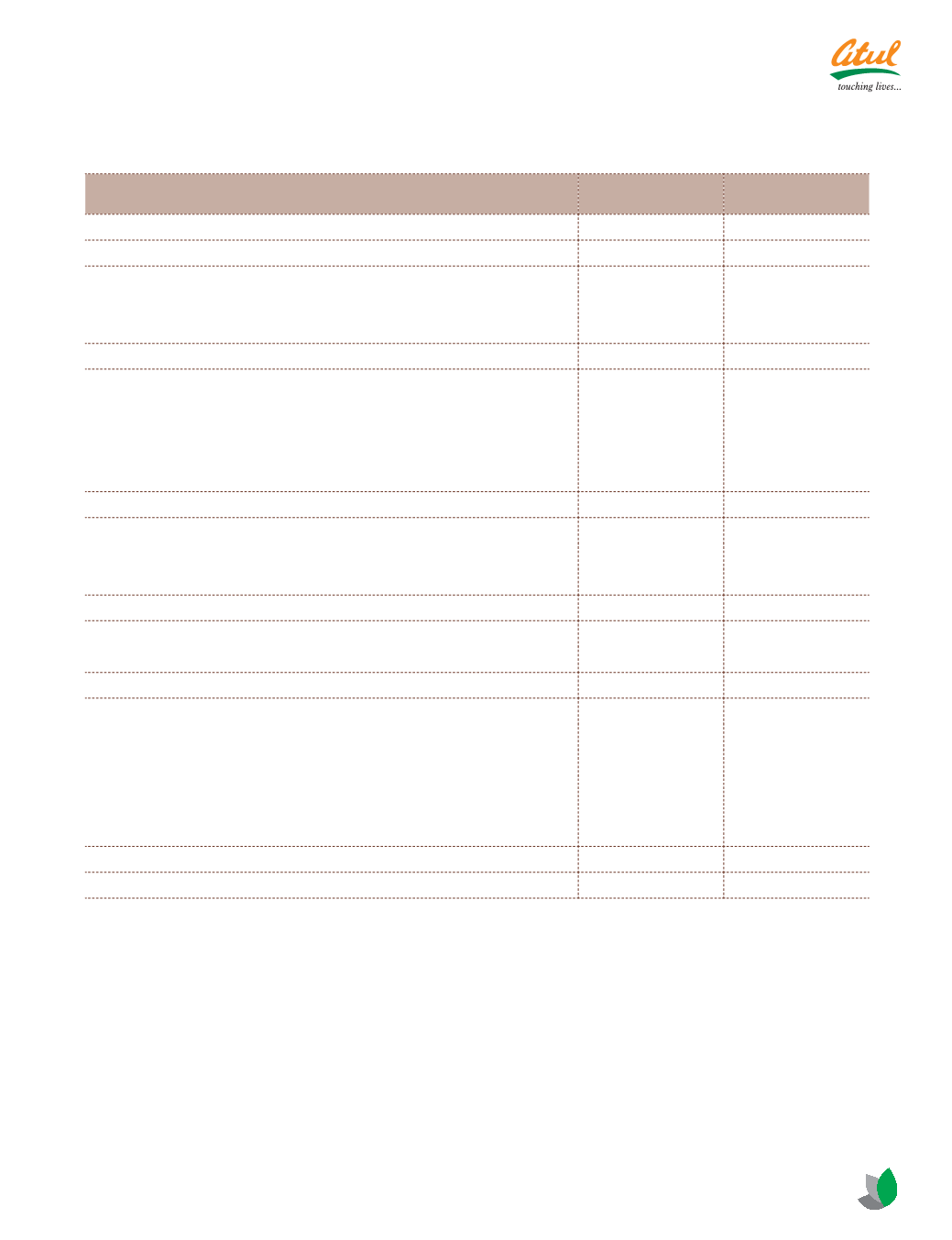

NOTE 3 RESERVES AND SURPLUS

As at

March 31, 2013

As at

March 31, 2012

(a) Capital reserve

6.68

6.68

(b) Securities premium account

34.66

34.66

(c) Revaluation reserve:

Balance as at the beginning of the year

106.52

108.58

/HVV 7UDQVIHUUHG WR 6WDWHPHQW RI 3URÀW DQG /RVV

2.06

2.06

Balance as at the end of the year

104.46

106.52

(d) Hedging reserve {see Note 27.9 (c)}:

Balance as at the beginning of the year

(0.78)

(5.09)

$GG 7UDQVIHUUHG WR 6WDWHPHQW RI 3URÀW DQG /RVV

0.78

5.09

Less:Effect of foreign exchange rate variation on hedging

instruments outstanding at the end of the year

(0.74)

0.78

Balance as at the end of the year

0.74

(0.78)

(e) General reserve:

Balance as at the beginning of the year

67.87

59.06

$GG 7UDQVIHUUHG IURP 6WDWHPHQW RI 3URÀW DQG /RVV

13.55

8.81

Balance as at the end of the year

81.42

67.87

I 6XUSOXV LQ 6WDWHPHQW RI 3URÀW DQG /RVV

Balance as at the beginning of the year

397.30

333.52

$GG 3URÀW IRU WKH \HDU

135.52

88.11

Amount available for appropriation

532.82

421.63

Less : Appropriations

General reserve

13.55

8.81

Proposed dividend on Equity Shares for the year

{at

`

6.00 per share (March 31, 2012

`

4.50 per share)}

17.80

13.35

Dividend distribution tax on proposed dividend

3.02

2.17

Balance as at the end of the year

498.45

397.30

726.41

612.25