Atul Ltd | Annual Report 2012-13

Notes

to financial statements

(

`

cr)

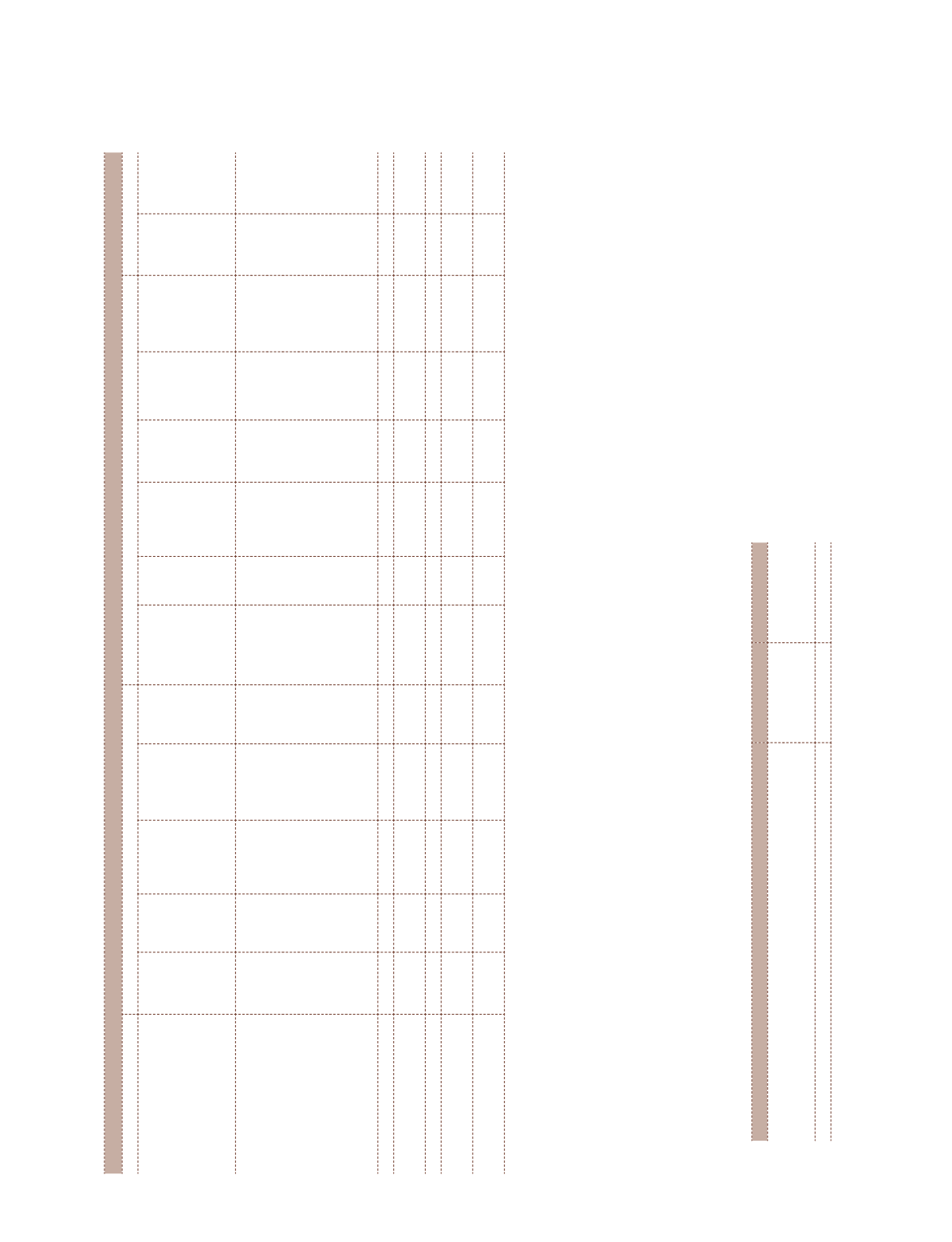

NOTE 11 FIXED ASSETS

ASSET BLOCK

GROSS BLOCK (a)

DEPRECIATION | AMORTISATION | IMPAIRMENT

NET BLOCK

As at

March 31,

2012

Additions

Other

Adjustments

Deductions

and

Adjustments

As at

March 31,

2013

Depreciation

Upto

March 31,

2012

For the

Year

Deductions

and

Adjustments

As at

March 31,

2013

Impairment

Fund

March 31,

2013

Depreciation

and

Impairment

Fund

March 31,

2013

As at

March 31,

2013

As at

March 31,

2012

Tangible assets

Land - Freehold (d) and (e)

14.37

2.67

-

-

17.04

-

-

-

-

-

-

17.04

14.37

Land - Leasehold (b),(d) and (e)

23.17

-

-

0.27

22.90

-

-

-

-

-

-

22.90

23.17

Buildings (c), (d) and (e)

235.65

14.30

-

0.02 249.93

60.64

6.22

-

66.86

-

66.86 183.07 175.11

Roads

3.10

0.11

-

-

3.21

1.24

0.06

-

1.30

-

1.30

1.91

1.86

Plant and equipment (f)

719.80

79.01

11.33

0.23 809.91

509.24 38.58

0.13

547.69

21.03

568.72 241.19 189.43

Railway siding

0.08

-

-

-

0.08

0.08

-

-

0.08

-

0.08

-

-

2IÀFH HTXLSPHQW IXUQLWXUH

24.37

2.48

-

0.02

26.83

16.99

1.41

0.01

18.39

-

18.39

8.44

7.38

Vehicles

13.37

1.83

-

1.40

13.80

7.14

1.83

1.07

7.90

-

7.90

5.90

6.23

Total Tangible assets

1,033.91 100.40

11.33

1.94 1,143.70

595.33 48.10

1.21 642.22

21.03

663.25 480.45 417.55

Intangible assets

Computer software

10.08

2.53

-

-

12.61

9.86

2.75

-

12.61

-

12.61

-

0.22

Total Intangible assets

10.08

2.53

-

-

12.61

9.86 2.75

-

12.61

-

12.61

-

0.22

Total as at

1,043.99 102.93

11.33

1.94 1,156.31

605.19 50.85

1.21 654.83

21.03

675.86 480.45 417.77

March 31, 2013

Total as at

972.24

77.75

1.59

7.59 1,043.99

561.14 45.43

1.38

605.19

21.03

626.22 417.77

March 31, 2012

Notes:

(a) At cost, except land - freehold, certain leasehold land, building premises which are stated at revalued value.

(b) Land - Leasehold at cost less amounts written off.

(c) Includes premises on ownership basis

`

1.10 cr (Previous year

`

1.10 cr) and cost of fully paid share in co-operative society

`

2,000 (Previous year

`

2,000).

(d) The Company has revalued (i) Leasehold land (

`

20.02 cr) and (ii) Commercial land & building at Ahmedabad, Mumbai and Delhi (

`

87.45 cr) as at March 31, 2008 at fair market value as

determined by an independent valuer appointed for the purpose. Resultant increase of

`

107.47 cr in book value has been transferred to Revaluation Reserve.

H 3XUVXDQW WR WKH RUGHU SDVVHG E\ +RQRXUDEOH +LJK &RXUW RI *XMDUDW GDWHG 1RYHPEHU

DQG $SULO

LQ FDVH RI ZDWHU FKDUJHV WKH &RPSDQ\ KDV FUHDWHG ÀUVW FKDUJH RYHU LWV

certain land & buildings in favour of Government of Gujarat and paid Security Deposit

`

2 cr (Previous year

`

2 cr).

(f) Exchange rate difference capitalised during the year

`

10.74 cr (Previous year

`

1.89 cr).

J 3XUVXDQW WR WKH FODULÀFDWLRQ UHJDUGLQJ DSSOLFDELOLW\ RI 3DUD RI $FFRXQWLQJ 6WDQGDUG DQG 3DUD H RI $FFRXQWLQJ 6WDQGDUG YLGH FLUFXODU QXPEHU _

GDWHG $XJXVW

IURP 0&$ ÀQDQFH FRVWV DPRXQWLQJ WR

`

FU GHELWHG WR WKH 6WDWHPHQW RI 3URÀW DQG /RVV GXULQJ WKH SUHYLRXV ÀQDQFLDO \HDU KDYH EHHQ DGGHG WR WKH FRVW RI À[HG DVVHWV LQ FXUUHQW \HDU

Further for current year an amount of

`

FU KDV EHHQ DGGHG WR WKH FRVW RI À[HG DVVHWV $V D UHVXOW RI WKLV FKDQJH GHSUHFLDWLRQ IRU WKH FXUUHQW SHULRG LV KLJKHU E\

`

FU ÀQDQFH

cost is lower by

`

FU DQG SURÀW IRU WKH \HDU LV KLJKHU E\

`

9.70 cr.

(h) Break-up of depreciation for the year

(

`

cr)

Particulars

2012-13

2011-12

Depreciation | Amortisation for the year

50.85

45.43

Add: Amortisation of Leasehold land

0.27

0.28

Less: Amount withdrawn from Revaluation reserve (see Note 3)

2.06

2.06

'HSUHFLDWLRQ _ $PRUWLVDWLRQ DV SHU 6WDWHPHQW RI 3URÀW DQG /RVV

49.06

43.65