119

(

`

cr)

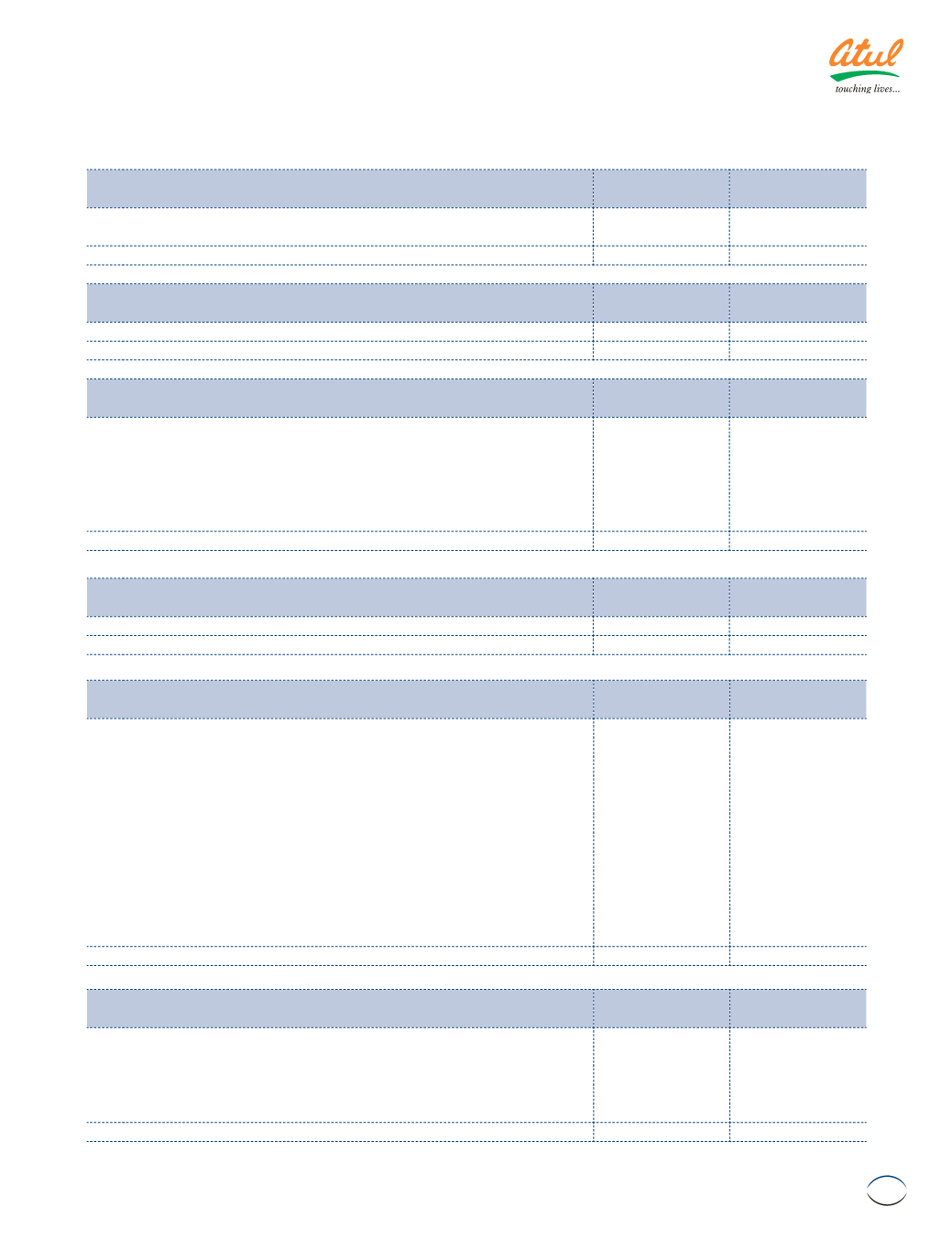

NOTE 6 LONG-TERM PROVISIONS

As at

March 31, 2014

As at

March 31, 2013

Provision for leave entitlement

5.28

5.07

Gratuity

0.05

0.06

5.33

5.13

(

`

cr)

NOTE 7 OTHER NON-CURRENT LIABILITIES

As at

March 31, 2014

As at

March 31, 2013

Deferred liabilities - capital goods

1.00

–

1.00

–

(

`

cr)

NOTE 8 SHORT-TERM BORROWINGS

As at

March 31, 2014

As at

March 31, 2013

(a) Secured

Working capital loans repayable on demand from banks

132.88

152.21

(b) Unsecured

Loans from banks including foreign banks

55.00

–

Loan from related parties

5.00

–

(c) Buyers’ credit arrangement

–

9.36

192.88

161.57

(

`

cr)

NOTE 9 TRADE PAYABLES

As at

March 31, 2014

As at

March 31, 2013

Trade payables including acceptances

322.96

291.61

322.96

291.61

(

`

cr)

NOTE 10 OTHER CURRENT LIABILITIES

As at

March 31, 2014

As at

March 31, 2013

(a) Current maturities of long-term borrowings (see Note 4)

54.71

44.09

(b) Interest accrued but not due on borrowings

1.25

1.50

(c) Unclaimed dividends

1.12

0.97

(d) Unclaimed matured deposits and interest thereon

0.05

0.12

(e) Security deposits

17.80

14.38

(f) Advances received from customers

6.51

3.99

(g) Employee benefits payable

24.41

21.23

(h) Creditors for capital goods

3.02

5.95

(i) Commission and discount payable

10.05

10.39

(j) Statutory dues

14.74

9.36

(k) Provision for Mark-to-Market losses on derivatives

–

0.10

(l) Others

5.23

5.53

138.89

117.61

(

`

cr)

NOTE 11 SHORT-TERM PROVISIONS

As at

March 31, 2014

As at

March 31, 2013

(a) Provision for leave entitlement

16.12

15.06

(b) Others:

Proposed dividend (see Note 3 (g))

22.25

17.80

Dividend distribution tax on proposed dividend

3.85

3.02

Other provisions

1.25

0.36

43.47

36.24

Notes

to the Consolidated Financial Statements